As part of the Secure Act, most adults who inherit a 401(k) from a parent must take the money in 10 years. Depending on your financial position and life stage, this could complicate your tax situation. After inheriting a 401(k) from a parent, consider ways to balance the benefits of extending tax-deferred investment growth with the tax impact of distributions. A central factor in determining the best distribution strategy is your current tax bracket and expectations going forward.

You have 10 years to take the money from an inherited 401(k) – maybe less!

After inheriting a 401(k) from a parent, your primary decision is when to take the money. As a non-spouse beneficiary, funds from an inherited 401(k) plan must be distributed by the end of the 10th year following the year of death[1]. This is called the 10-year rule.

If you’ve inherited an IRA too, note the options for an inherited IRA differ somewhat from an inherited 401(k). When you inherit an IRA outright, you usually have full control over the timing of withdrawals within the 10-year window.

When inheriting a 401(k), particularly from a parent, you may be subject to plan specific rules. Are there any other beneficiaries? What are the plan rules? Work with the executor of the estate and 401(k) plan sponsor to discuss your payout options.

What to Do When a Parent Dies and You’re the Executor

IRS proposes changes, certain beneficiaries may need to take distributions during 10 year window

In early 2022, the IRS issued proposed guidance that stunned the financial community. As drafted, the changes would impact non-eligible designated beneficiaries by requiring distributions in years one through nine in addition to withdrawing all the funds in year 10, but only if the decedent was subject to RMDs when they died.

Distributions during the 10-year window would generally be based on the beneficiary’s own single life expectancy according to the IRS’ Uniform Lifetime Table, reduced by one each year.

What the initial IRS proposal did not seek to change:

- Existing post-Secure Act guidance for beneficiaries who inherited a retirement account from a non-spouse who died before reaching their required beginning date (also called RMD age). As of the writing of this article, those beneficiaries would still refer to the widely accepted guidance section above.

- Changes wouldn’t apply to individuals who died (at any age) before 2020 or between spouses.

- Post Secure Act distribution rules for beneficiaries of Roth IRAs, as Roth IRAs don’t have RMDs (Roth 401(k)s do until 2024). However, non-eligible designated beneficiaries would still need to take all the funds within the 10-year window.

UPDATE: In April 2024, the IRS again announced final regulations will be forthcoming and will apply (at earliest) to the 2025 distribution year. Individuals affected by the new rules who ‘failed’ to take RMDs prior to 2025 will not be subject to the ordinary penalties.

How money from an inherited 401(k) is taxed

When you inherit a retirement account like a 401(k), distributions generally follow the same tax treatment as would apply to the original account holder.

Most often, distributions from an inherited 401(k) are included in a beneficiary’s regular taxable income. This would be the case if your parent made pre-tax contributions to a 401(k), as most do. Large withdrawals can push you into a higher marginal tax bracket, trigger the 3.8% Medicare surtax, or cause the loss of other income-driven tax deductions.

If you inherit a Roth 401(k), distributions may be tax-free if your parent first began making contributions to their “designated Roth account” at least five years before you begin your own withdrawals.

When should you take money from an inherited 401(k)?

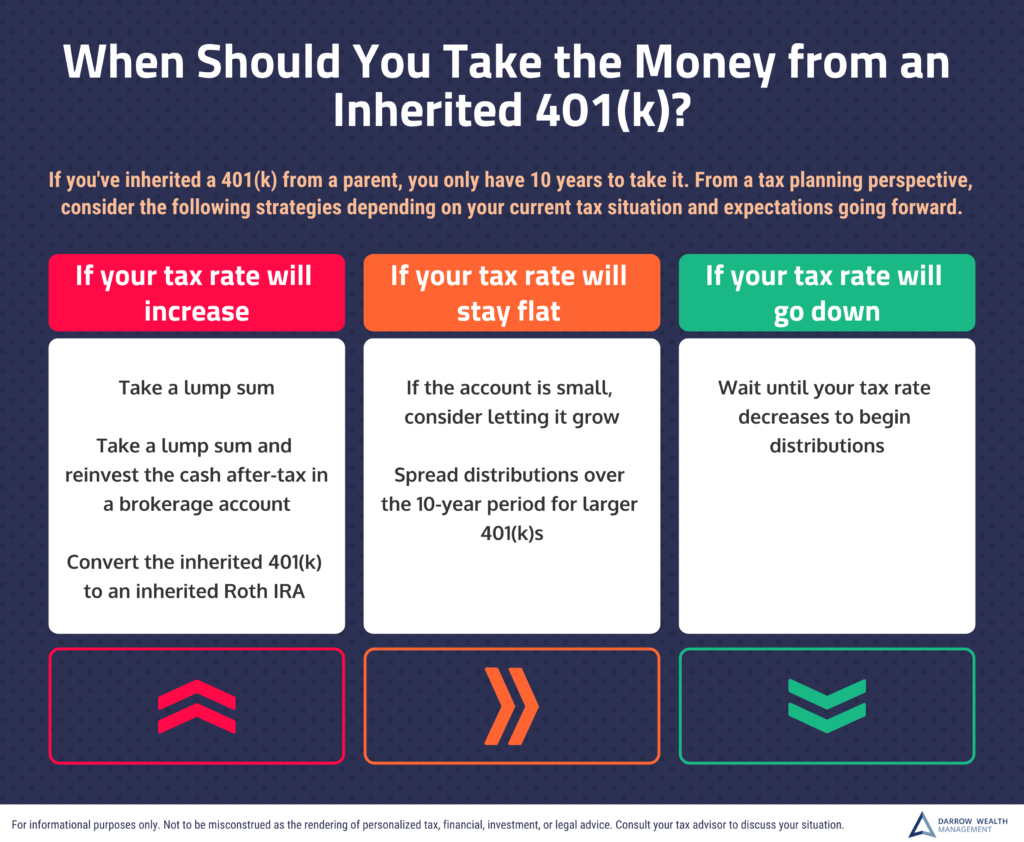

There’s also no one best withdrawal strategy for all beneficiaries. Your current tax rate relative to the future is an important consideration, as is your financial situation, and the account size. Similarly, any life changes in the next 10 years, like applying for financial aid or Medicare, can also impact your optimal strategy.

Here are some strategies to reduce the tax impact of distributions, though you’ll want to discuss with your CPA and financial advisor before making any decisions.

If you expect your tax rate to increase in the future

If you expect your tax rate to increase in the future

Do you need the money now? If yes, consider taking a lump sum. Also, if you’ve been laid off or suffered a big pay cut, you might need the cash. But if you don’t need the money right away, and still want to pay the tax while you’re in a lower tax bracket, you can reinvest the proceeds in a brokerage account. Another option could be to convert an inherited 401(k) to an inherited Roth IRA. This option is unique for beneficiaries of 401(k) plans; individuals who inherit a traditional IRA aren’t permitted. Although you could potentially avoid a big taxable event later by paying now, you’ll still need to take the funds within 10-years.

If you expect your tax rate to remain stable going forward

Do you have any major life events on the horizon? If not, consider letting a smaller 401(k) grow tax-deferred as long as possible, or for larger account, spread distributions over several years.

If you are in a high tax bracket now and expect that to change

You may want to consider holding off on tapping the inherited 401(k) until your tax situation improves. Perhaps you’re planning to retire or move to a state with no income tax. Strongly consider any life events that may impact your tax situation.

Learn more about what to consider and ways to reduce tax on distributions from an inherited 401(k).

Investing or reinvesting money from an inherited 401(k)

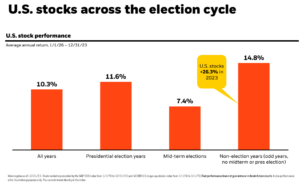

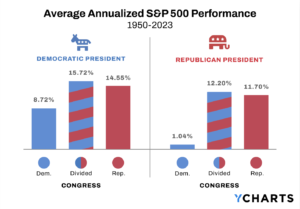

Delaying distributions from an inherited 401(k) carries investment risk, which is another topic entirely. Strategies for investing an inheritance should be a factor in your decision. After all, the stock market doesn’t just go up.

As with everything in investing and tax planning, there’s risk. The account may lose value, your tax rate doesn’t change as planned, it’ll impact your net proceeds.

Help deciding what to do with an inherited 401(k)

Losing a loved one is difficult. Navigating the emotional and logistical aftermath can be incredibly stressful. Particularly if you’re the executor of the estate, have strained family relationships, or if your parents didn’t have an estate plan.

Figuring out what to do with an inheritance can be a complex process. This is why it’s so important to have the right team in place. If your parent was working with a financial advisor and you don’t feel he/she is a good fit for you, consider finding your own fiduciary advisor to help you navigate your options.

This article was written by Darrow advisor Kristin McKenna, CFP® and originally appeared on Forbes.

[1] There are three exceptions to the 10-year rule. Minor beneficiaries have until they reach the age of majority (usually 21) before the 10-year payout period begins. The 10-year rule doesn’t apply to beneficiaries less than 10 years younger than the decedent or disabled beneficiaries. In these cases, beneficiaries can take the funds over their lifetime using the old required minimum distribution rules.

If you expect your tax rate to increase in the future

If you expect your tax rate to increase in the future