If your spouse has named you as a beneficiary on their traditional IRA, SEP IRA, or SIMPLE IRA, you will need to understand your options for the account you have just inherited. In general, you will have three choices for the IRA you have inherited. As you review your options, consider your age, the age of your spouse, and your current financial situation.

Losing a loved one, especially a spouse, can be an extremely difficult time. For help managing your finances and assistance navigating the decisions to come, please contact us today.

Also read: What to do After the Death of a Spouse

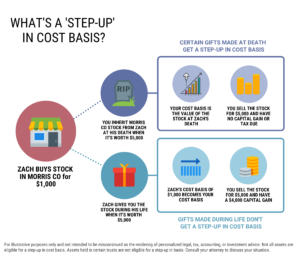

INFOGRAPHIC: Options for a Spouse Beneficiary of an IRA

Last reviewed October 2023