What to Do When a Parent Dies and You’re the Executor

Losing a parent is emotional. It can also be overwhelming for adult children when they’re the executor of the estate. Settling an estate is a

Losing a parent is emotional. It can also be overwhelming for adult children when they’re the executor of the estate. Settling an estate is a

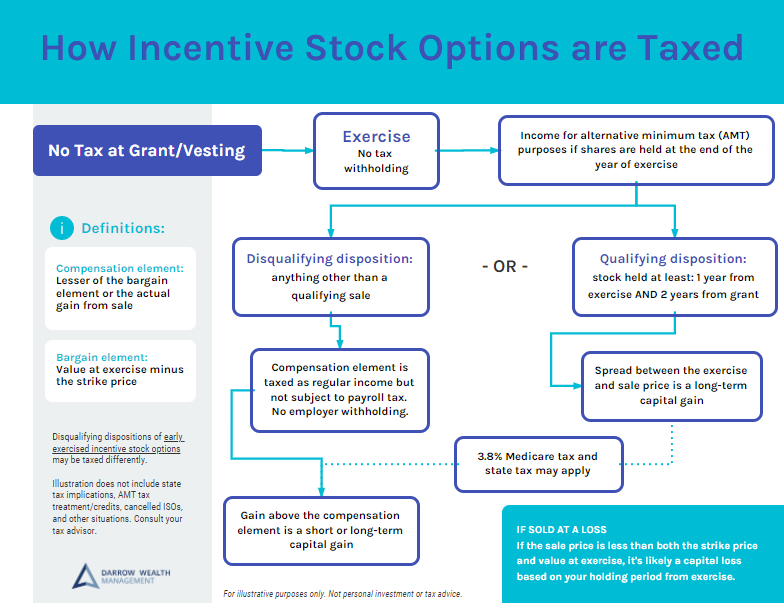

If you have incentive stock options, you’ve probably heard of the alternative minimum tax (AMT). Essentially, the alternative minimum tax is a prepayment of taxes.

6 tax strategies for incentive stock options and AMT Triggering the alternative minimum tax isn’t the end of the world, but you don’t want to

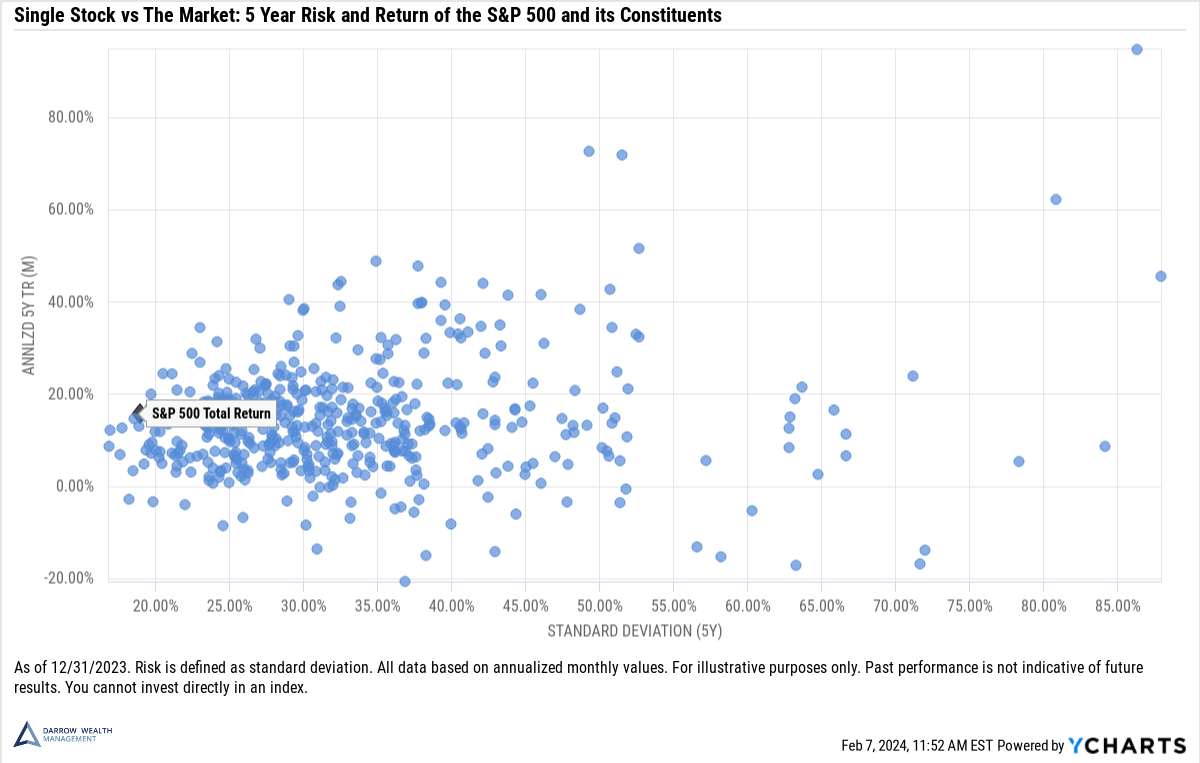

Investors can wind up with a concentrated stock position in different ways. But it’s most often from an inheritance, founder, or employee with company stock.

The IRS has released the 2024 contribution limits for retirement plans and other cost-of-living adjustments. Also, the 2024 income tax brackets and long-term capital gains

Is exercising stock options right before a company goes public a good idea? Employees with pre-IPO incentive or non-qualified stock options often wonder if they

Updated for 2024. There are lots of ways to spend an inheritance. But just because you have options, doesn’t mean they’re all good options. After

If you invested in a startup or small business (founders, employee exercise of stock options, business owner), you need to know about qualified small business

When should you exercise stock options? With stock options, employees have the right (not obligation) to buy the shares (called exercising). Vesting is often the

Updated for 2024. Can you give money to charity using your IRA? For individuals 70 1/2 or older – the answer is usually yes. What