More companies entered the public markets in 2021 than any other year on record. From traditional IPOs or SPACs, and even direct listings, it was a banner year for exits. Unfortunately, the sharp pullback in the equity market to start 2022 is leaving employees and shareholders subject to a lock-up agreement in a very tough spot. Here’s what you need to know if the stock price is falling but you can’t sell your shares because of a lock-up.

What can you do during a lockup?

In short: not much. That’s sort of the point of a lock-up period. You’ll want to refer to your lockup agreement specifically, but in general, shares cannot be transferred to another financial institution, sold, pledged, or hedged in any way. Most lock-up agreements allow transfers for estate planning purposes (though lock-up provisions will transfer also).

So to clarify, when subject to a lockup, you cannot sell call options or buy put options to reduce the risk on restricted shares (at least not without prior approval from the underwriter). Further, these tactics are generally prohibited for current employees and insiders even after the lock-up ends. For those with concentrated positions, this is a significant risk.

Just how big?

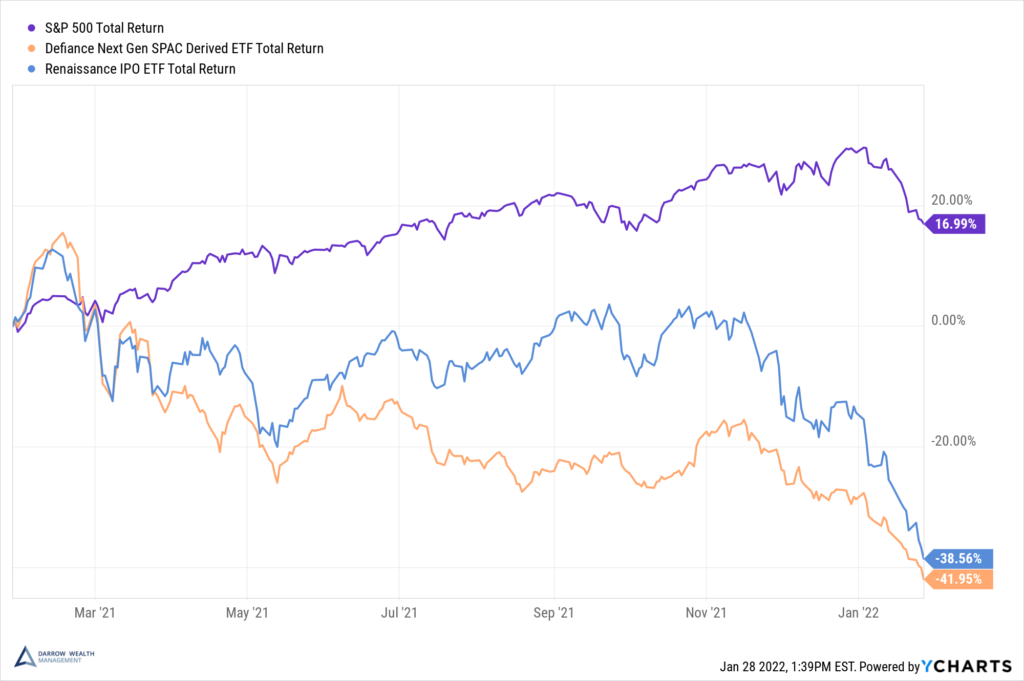

Over a one-year period, shares of IPOs and SPACs have suffered big losses. In absolute terms, shares of new public companies have underperformed the S&P in the last year by roughly -60% as of 1/27/22. Past performance isn’t indicative of future results. The challenge is, no one knows what those results will be.

Ways to help reduce risk before and during a lock-up

While there aren’t any assured ways of reducing risk of price declines during a lock-up, there are ways to help yourself on the margins.

Exercise wisely

Understand the tax treatment of shares at exercise. If you exercise NSOs right before the IPO or during the lockup, it’s possible you’ll pay tax on the stock at a higher price at exercise than when the shares are released. If you have ISOs, the spread at exercise may trigger the AMT unless you’re able to sell the shares before 12/31 the year of exercise.

Putting diversified and liquid assets (cash in this case) into the illiquid and volatile stock may be an unnecessary risk. It makes you even more concentrated. After the lock-up, you could do a cashless same-day sale and not have to dip into other resources.

Don’t pre-spend the proceeds

Nothing is certain until it is. Until you turn paper-profits into real ones, your financial situation may not change that much. Obviously founders and early employees with super-low strike prices are bound to realize a windfall of some magnitude. Just understand that the proceeds could end up being worth millions more – or less – than you’re anticipating.

Manage the concentration position alongside the rest of your investments

When considering how much investment risk to take with your other investment accounts, don’t ignore your stock or options in the restricted shares. If you work for a tech company, consider reducing your exposure of tech stocks in your diversified portfolio. Perhaps it makes sense to be more conservative all-around for a time.

If the stock price hasn’t recovered when the lock-up ends

Whether the market isn’t as excited about the IPO as you are or overall financial conditions have changed, it would be a mistake to assume that every company that recently went public will eventually recover to its IPO price.

In fact, big losses are common in equities. According to JP Morgan, between 1980 – 2020, nearly 45% of all companies that were ever in the Russell 3000 Index experienced a 70% decline in price from the peak and never recovered. Remember, one stock doesn’t move the same as the whole market.

So you need a plan if the stock is trading below your expectations.

What the data says about IPO returns

Professor Jay Ritter from the University of Florida is an expert in IPOs. According to his research, between 1980 and 2019, IPOs have lagged other firms of the same size by an average of -2.4% per year during the five years after issuing, excluding the first-day return.

Though average returns over the first six months generally outperformed similarly-sized firms by 1.2%, this is when most shareholders are subject to a lock-up. After most lockups end (months 6-12) shares typically underperformed by -4.6%. Returns in the first and second years after going public lagged by -3.4% and -7.2%, respectively.

It can be hard not to anchor expectations to past performance. But stocks don’t only go up. At the end of the day, the only price that matters is the one you can sell it for.

So let’s consider your options.

Sell stock when the shares are released

A good case can be made for selling stock when the lock-up ends. Particularly if you have a lot riding on the windfall, you may have more to lose from further declines in the stock price than you stand to gain by a recovery. By selling a portion of your holdings, it can help protect some downside. Insiders and current employees may face additional restrictions so be sure to check with the company.

Trading strategies when selling shares over time

If you are no longer at the company and also not an insider, you’ll usually have more choices to exit a concentrated stock position over time. Consider working with a financial advisor to help you manage this process. By using different trading techniques (examples include stop-loss, stop-limit, trailing stop-loss, etc.) or options strategies (calls, puts, straddles, collars, etc.) you *may* be able to structure an approach to capture upside over time (should it occur) while potentially limiting your downside.

These trading strategies are very nuanced and complex so working with a professional equity trader is strongly encouraged. Further, to avoid any potentially major tax or financial mistakes, consider engaging tax and financial professionals to help. For example, if you have qualified small business stock and haven’t met the five-year holding period, entering into an options contract would disqualify your shares for potentially tax-free treatment.

Current employees and insiders can consider setting up a 10b5-1 plan or utilizing limit orders during open trading windows. Be sure to discuss your plan with the company’s compliance department if you have questions about what you’re allowed to do.

There are other approaches to consider and this is not an exhaustive list of considerations and strategies. Always consider your personal financial situation and goals before making a decision.

Sudden wealth advisors

Darrow Wealth Management is a fee-only financial advisory firm. We specialize in helping individuals with employer stock plan for sudden wealth before, and after, their company goes public.