When should you exercise stock options? With stock options, employees have the right (not obligation) to buy the shares (called exercising). Vesting is often the earliest employees can exercise, though early exercises are possible. If you stay with the company, you’ll likely have 10 years from grant to buy the stock before the option expires. Exercising has tax and financial implications. There is not one best time to exercise stock options, and just because you can, doesn’t mean you should. Here are some of the elements you should consider in deciding when to exercise stock options.

This article will discuss some of the pros, cons, and key factors to consider when evaluating the timing of stock option exercises. For simplicity, we’ll assume the shares are held after exercise unless otherwise indicated. If you are new to managing stock options, please refer to this article on how stock options work.

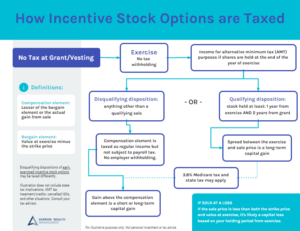

Tax treatment at exercise

Why does the timing of stock option exercises matter? Taxes, for one. The tax implications of an options exercise will depend on the type of stock options you have.

Incentive stock options

With ISOs, there’s no automatic tax impact when exercising. However, holding ISOs through the end of the calendar year of exercise can trigger the alternative minimum tax (AMT), particularly if the spread between the value of the stock at purchase and the strike price is large (and/or you’re exercising a lot of options).

Triggering the AMT can be significant: the tax rate ranges between 26% -28%. The employer is not required to withhold any amount at exercise or sale to cover any potential tax liability. Think about the AMT like pre-paying tax. In future years when not subject to the AMT, you can receive an AMT tax credit.

6 Tax Strategies for Incentive Stock Options and AMT

Tax after exercise: If you hold the shares for at least 2 years from the grant date and 1 year from exercise, the entire gain will be taxed at more favorable long-term capital gains tax rates. Different tax treatment may apply in other situations (e.g. shorter holding periods, cancellation and cash-out, if your final sale price isn’t greater than both your strike price and the value of the stock when you exercised, etc.). Also consider state taxes.

Nonqualified stock options

With NSOs, at exercise, the spread between the value of the stock price and the strike price is taxable income and tax withholding is generally required. If the spread is under $1M, the federal statutory withholding rate is 22%, if above, it’s 37% through 2025. State income tax withholding may be required also. The compensation element is also subject to payroll taxes (Social Security and Medicare).

The statutory withholding may not be enough to cover your tax liability. Further, there may not be withholding for individuals who were/are not classified as employees, such as independent contractors or consultants.

Tax after exercise: unlike ISOs, there are no special tax benefits after exercising NSOs. Essentially, the market value of the stock at exercise becomes your new tax basis. Any subsequent gain or loss will be either a short or long-term depending on your holding period.

Factors in deciding when to exercise stock options

Most decisions around equity compensation are complex as it involves many aspects relating to your personal circumstances/grant. Keeping all the above in mind, here are several key factors to help inform your decision about the timing of your stock option exercise.

Very low strike price and spread

For early employees at startups, stock option grants often include a very low strike price (think pennies). This makes buying the shares really affordable. If the spread between the exercise price and current value of the stock is small or zero, it’s a huge advantage for tax purposes.

In this situation, it’s also worth considering an early exercise of unvested stock options if available. Early exercising means buying shares before they vest, potentially locking in favorable tax treatment (often with the help of an 83(b) election) and starting the holding period. There are other considerations, though, so learn more about how it works before doing it.

Do you have liquidity? Do you need it?

Exercising pre-IPO stock options

Employees of private companies don’t have a readily available market for their shares. As explained earlier, exercising stock options can have tax consequences. And you need cash to buy the stock in the first place. If you’re stretching yourself thin financially to exercise, it might not be worth it. There’s a real risk of using liquid assets to further invest in a concentrated position with an unknown outcome.

The company may decide to structure a tender offer or permit sales on the secondary market. So it’s possible to have liquidity without a public market, but it’s not guaranteed. Figure out what exercising will cost you (including taxes) before doing it.

Exercising stock options at a public company

Employees of public companies (or soon to be) have liquidity, but not all the time. Public companies have blackout periods around earnings releases or other big events. But this usually just prohibits sales or cashless exercises. In this situation, an employee may be able to exercise using a net exercise or cash payment. But keep in mind, you may need outside funds to pay tax at exercise for NSOs, and can’t sell your shares until the blackout is over (at a TBD price). Recall the tax treatment of NSOs as there might not be any real benefit of exercising in this situation.

Also consider lockup periods for newly public companies. After an IPO or SPAC, shareholders will generally be restricted from selling stock for a period of time, up to 180 days. This presents challenges for employees who need liquidity to diversify, buy the shares, or pay the tax.

If you exercise NSOs right before the IPO or during the lockup, it’s quite possible you’ll pay tax on the stock at a higher price than when the shares are released. If you have ISOs, the spread at exercise may trigger the AMT unless you are able to sell the stock before 12/31 the year of exercise. Pay close attention to the dates.

Finally, employees with material non-public information (insiders) may not be able to sell even when not subject to a blackout or lockup period. One possible solution is adopting a 10b5-1 plan. A complete discussion of 10b5-1 plans is outside the scope of this article.

The value of an unexercised option

There’s an opportunity cost to exercising and holding a stock option well before expiration. The time value of money is real and quantifiable. Exercising means taking cash that could have been invested elsewhere to generate return and using it to buy the stock and pay the tax. Unless you need to exercise or risk losing the options, or there’s another potential advantage in doing so, it may not make the most sense to exercise.

At public companies, cashless (exercise and sell same-day) and net exercises (exercise using shares to cover the cost, hold the rest) might be alternatives. But carefully consider the tax implications and plan rules for both ISOs and NSOs. For example, with ISOs, there are different interpretations about whether a net exercise will invalidate the entire ISO grant from favorable tax treatment or not, so consult your tax advisor. At the very least, the shares used to buy the stock are taxable as a disqualifying disposition. Recall employers do not withhold for taxes with ISOs.

Not exercising has downsides, of course. If you leave the company, you may only have a few months to exercise your options. This could trigger a massive taxable event or just not be feasible depending on the cash outlay/availability of other exercise methods.

Tax benefits/implications

Consider what potential tax benefits or implications will apply after exercising and holding the stock.

Common tax benefits that can follow an advantageous stock option exercise:

- If you have incentive stock options and meet the holding requirements, the tax savings can be significant (all long-term capital gains)

- If you have liquidity, exercising incentive stock options in January or December can be a good strategy. By exercising in January, you can assess your entire tax situation at the end of the year and decide whether to sell the stock before 12/31 to likely avoid the AMT. Assuming you meet the 2 year holding period since grant, you could sell the next January with favorable tax treatment. Exercising ISOs in December follows a similar logic.

- If your shares currently meet the initial criteria for Section 1202 Qualified Small Business Stock, exercising may be imperative to increase the likelihood that your shares may ultimately qualify for a federal capital gains exclusion of up to 100%!

- Exercising when the taxable spread is near zero (or at least significantly lower than conservative estimates would imply it will be in the future)

- Utilizing an 83(b) election on an early exercise of unvested options (that later vest)

- Potential to reduce state tax. Depending on the state, tax rules will differ, but you could incur state tax even after moving depending on the date (or percentage of time) between key events like vesting, exercise, and sale.

Common tax implications of exercising and holding options:

- Unless the spread at exercise is around zero, all else equal, there generally aren’t any tax benefits in exercising and holding non-qualified stock options

- Impact on the rest of your tax situation (triggering the AMT, recognizing a large amount of ordinary income and getting pushed into a higher tax bracket)

- If you early exercise and don’t stay long enough to vest, you can’t get a refund of the tax paid on an 83(b) election

- M&A events can thwart well-laid exercise plans, potentially triggering disqualifying dispositions of ISOs, cash redemption, etc.

- Valuations can change quickly at startups. The latest 409a may not be accurate, particularly during fundraising or right before an IPO. Get clarity on the current value of the stock before you exercise, because you can’t undo it afterwards.

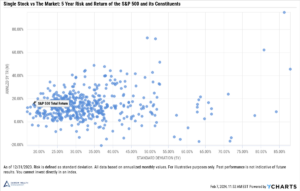

Your level of concentration

Another factor when deciding on an exercise strategy is your level of concentration in the stock now and post-exercise. If you already have a significant amount of your net worth attached to the stock, it may not make sense to exercise and hold more shares.

In this case, consider whether to exercise with a same-day sale or divest long shares while exercising new ones. The latter is an example of a strategy to consider with qualifying sales of ISOs. Particularly for employees of private companies, redirecting non-company stock assets (e.g. cash) to buy more stock (and/or pay tax) only serves to further concentrate your holdings.

Stocks don’t always go up! When evaluating exercise-and-hold scenarios, consider whether you’d use a cash bonus to buy the stock.

In situations where the strike price is so low it only costs a few hundred dollars in total to exercise and the taxable spread is at/around zero, this risk is considerably lower, potentially non-existent.

Support from stock option specialists

Having a lot of stock with your company can be a tremendous opportunity to build wealth. But paper-profits can evaporate without a tax and financial strategy in place. Darrow Wealth Management specializes in helping individuals with stock options before a liquidity event. Contact us to schedule a call and discuss your situation.

Last reviewed March 2024