Sudden Wealth: Managing a Large Financial Windfall

Next steps after a sudden wealth event or cash windfall Wondering what to do with a sudden financial windfall? Whether the windfall was expected, perhaps

Financial planning and investment insights tailored to individuals expecting sudden wealth from company stock options, sale of a business, inheritance, or trust fund distribution. Develop a strategy to make the most of the windfall and design an investment plan going forward. If you’re expecting a lump sum from an inheritance, sale of a business, trust, or stock options after an IPO, you’ll want to get a plan in place to best utilize your sudden wealth. An unexpected windfall can change your life.

Next steps after a sudden wealth event or cash windfall Wondering what to do with a sudden financial windfall? Whether the windfall was expected, perhaps

For founders, employees, and executives with stock-based compensation, an 83(b) election can be a powerful tax planning tool. When you make an 83(b) election, you’re

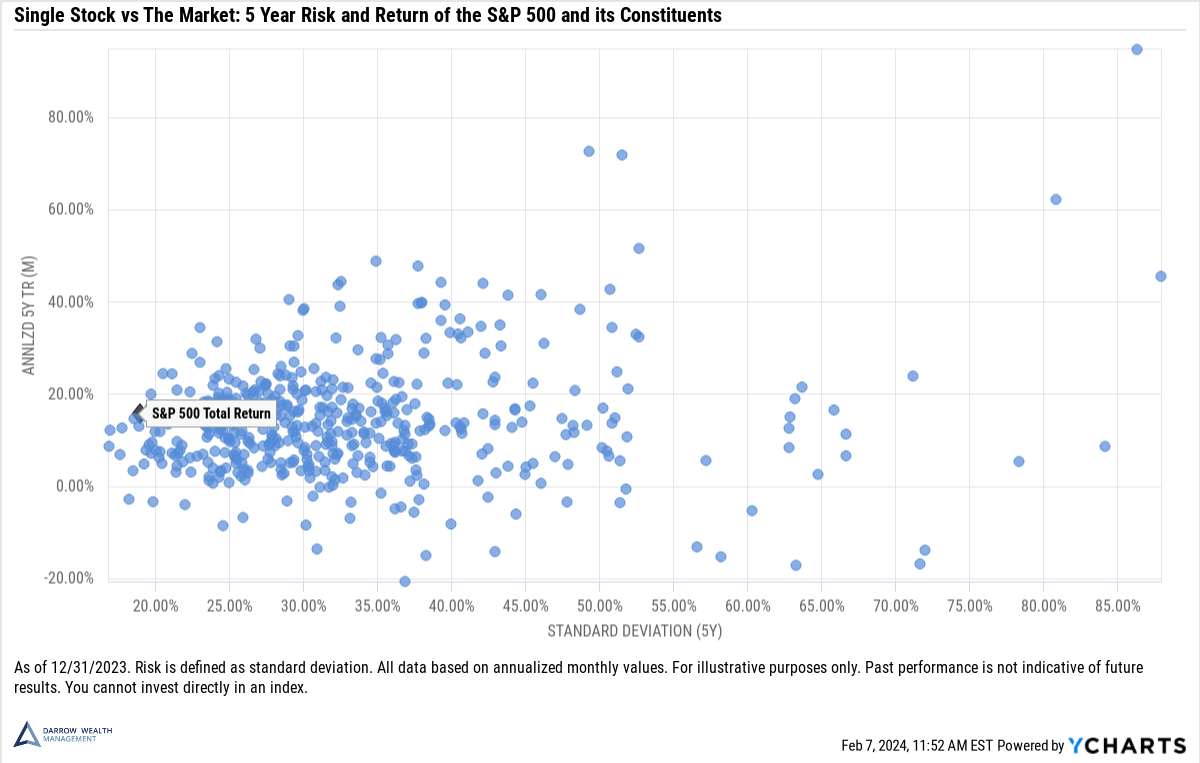

Investors can wind up with a concentrated stock position in different ways. But it’s most often from an inheritance, founder, or employee with company stock.

Is exercising stock options right before a company goes public a good idea? Employees with pre-IPO incentive or non-qualified stock options often wonder if they

The sale of a business marks a major life event. It’s emotional, stressful, and exciting all at the same time. And unfortunately, it’s often a

There are many financial planning considerations before, during, and after a divorce. A key part of the process from a financial standpoint is dividing the

Taxachusetts is back. In November 2022, proponents of the Massachusetts ‘millionaires’ tax (question 1) won their bid to nearly double the income tax rate on

The Instacart IPO is on hold…again. What should employees with stock options do when their employer’s IPO stalls? In truth, best practices around an IPO

Updated for 2024. There are lots of ways to spend an inheritance. But just because you have options, doesn’t mean they’re all good options. After

More companies entered the public markets in 2021 than any other year on record. From traditional IPOs or SPACs, and even direct listings, it was a banner