Amidst a flurry of IPOs, many employees are experiencing their first major liquidity event from stock options. Unfortunately, for stock option rookies and veterans alike, there are plenty of potholes you’ll want to avoid when your company goes public. The crux of the issue boils down to planning, or lack thereof. Here are the top five mistakes employees of private companies often make when their employer is going public via IPO, SPAC, or direct listing.

5 Common Mistakes Employees Make with Stock Options During an IPO

If your employer (or former employer) is going public, you’ve likely done some Googling to learn more about what an IPO means for employees.

In your research, it’s also likely that you’ve been frustrated by the lack of concrete advice and frequent use of ‘it depends’.

Why is that?

It’s not because financial advisors are lazy, it’s because companies have a lot of latitude when structuring stock plans and public offerings. So the rules of the road for someone with stock options at one company going public may be totally different for another.

For example, the length of a lockup period depends on how a company goes public. In a traditional IPO, lockup periods are typically six months. In a direct listing, there’s no lockup, yet when a company goes public via SPAC merger/acquisition, the lockup period can be a year. So it depends!

While stock plans and planning strategies during an IPO differ, the most common mistakes people make usually don’t.

This article was written by Darrow advisor Kristin McKenna, CFP® and originally appeared on Forbes.

Failing to plan is planning to fail

When you have stock options, there’s a lot to consider before and after an IPO. Here are a few considerations:

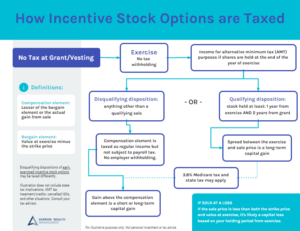

- What’s your exercise strategy? When you have incentive stock options, exercising early might ultimately save money in taxes. But it could also leave you with a big alternative minimum tax bill without any liquidity to pay it. Further, employees of private companies typically must pay cash to exercise options, whereas public companies may offer cashless exercises. Another consideration is risk tolerance. Exercising early is riskier compared to a same-day sale. This is only the beginning, so it’s important to speak with a CPA and financial advisor.

- Do you have a plan to take and redeploy profits? In anticipation of an IPO, it’s a good idea to evaluate your concentration risk, goals, and opportunities to utilize the proceeds. For example, reinvesting profits in a brokerage account may help you get closer to an early retirement. Other possibilities include super-funding 529 plans or paying off student loans. You may want to think twice before paying off your mortgage, though. Also consider a tentative timeline for stock sales to fund these goals. If you’re a former employee, you may not be subject to a lockup at all. Maintaining some exposure to the stock is fine, perhaps even unavoidable. But letting it all ride or not having a plan at all is typically a mistake.

- How do taxes fit in? Employees with stock options often focus too much on taxes. If you have stock options, don’t let the tax tail wag the dog when your company goes public. Understanding how taxes work in different exercise/sale situations, withholding rules, and planning strategies with various grants or types of options is a great idea. But letting that drive your decision-making is short-sighted.

Don’t rely on water cooler information in lieu of professional advisors

Please don’t take tax advice from Bob in accounting. Sure, he’s in finance, and very smart I’m sure, but he knows nothing of your financial and tax situation, stock grants, and perhaps not much about how stock options work in general. In fact, many financial advisors aren’t even experienced with equity compensation plans. And even when they are, the ultimate number-crunching tax guidance should come from a CPA or qualified tax advisor.

Aside from getting tax advice from unqualified professionals, other common rumor-mill mistakes include not understanding your grant terms, vesting (any accelerated vesting provisions, double-trigger clauses), and access to liquidity. For example, even when the lockup period expires, if you’re an insider without a 10b5-1 plan, you probably can’t sell any shares.

Temper mile-high expectations about the IPO

Stocks don’t only go up.

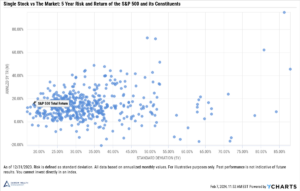

And newly public companies are notoriously volatile. Professor Jay Ritter from the University of Florida tracks IPO data and trends. His research showed that between 1980 and 2019 IPOs have underperformed other similarly sized companies by 2.8% per year on average during the five years after issuing, excluding the first-day return which can be significant (18% on average according to Ritter).

To be clear: IPOs can be wildly successful. Many of our clients, particularly early employees, have benefitted significantly from sudden wealth following a merger, acquisition, or public offering. But it’s important to accept that it’s not a foregone conclusion. Paper profits are only that until the gains are realized when the stock is sold. This brings us to the next mistake employees make with stock options during an IPO.

Don’t pre-spend the proceeds

A company isn’t publicly traded until it is. In 2019, WeWork was planning an IPO: it failed. Now, WeWork is merging with a blank check company to go public via SPACquisition. That deal isn’t done yet either.

Even after a company goes public, there’s no telling how the market will react. Coinbase went public via direct listing in April 2021. As of July 16, 2021, the stock was down over -31% on the year. Compass went public around the same time and the stock is down nearly -37% YTD. Upstart Holdings went public mid-December 2020 and is up 286% since then.

Because of the volatility and uncertainty, pre-spending paper profits is an important stock option mistake to avoid when your company goes public. After realizing gains, the next step will be avoiding lifestyle inflation, but that’s another topic entirely. Aside from stock volatility, consider how potential changes in tax laws may impact your net gains and that you may not earn unvested shares if you change jobs.

Appreciate that sudden wealth changes your entire financial picture

Before a major liquidity event, employees with stock options may not have an overly complex financial situation. However, sudden wealth from an IPO often requires more sophisticated planning and assistance from professional advisors. For example, you may want to consider updating your estate plan or setting up trusts.

Having a cohesive investment strategy and financial plan is also critical at this juncture. After all, you only have one chance to save, spend, or invest every dollar from a windfall. A fiduciary financial advisor can also help you evaluate other opportunities, like using stock options for charitable goals.

For employees with stock options, an IPO may not change your life or financial situation. For some, going public could provide a modest windfall and welcome financial boost. In other situations, it’s a path towards early retirement or multi-generational wealth. In any case, consider taking steps to help ensure you don’t make any major stock option mistakes when your employer goes public.

Financial advisor for stock options and sudden wealth

Darrow Wealth Management specializes in stock options and equity compensation. If your employer is going public, work with an advisor experienced with strategic stock option planning, tax implications, and strategies to best manage sudden wealth. You only get one shot at this.

Here are some of the ways we work to help executives, founders, and employees navigate an IPO:

- Exercise strategies

- Trading plan and execution

- Assist with identifying and tracking shares likely to qualify for the tax-free sale of qualified small business stock

- Decide on a strategy to best use the proceeds, including funding multiple goals and investment management services to help you diversify sudden wealth

- Incorporating the proceeds from a major liquidity event into your financial goals and projections

- 10b5-1 plan provisions

Schedule a call with an advisor

Nationally Recognized Wealth Advisor in Stock Compensation

Kristin McKenna CFP® is a nationally recognized specialist in employee stock options and equity compensation.

Publications above reflect media organizations that have quoted and/or published articles authored by Kristin McKenna and should not be misconstrued as a current or past endorsement of Kristin McKenna, Darrow Wealth Management, or any of its advisors. Please refer to the media page for more information and links to published works.

Publications above reflect media organizations that have quoted and/or published articles authored by Kristin McKenna and should not be misconstrued as a current or past endorsement of Kristin McKenna, Darrow Wealth Management, or any of its advisors. Please refer to the media page for more information and links to published works.