How are stock options taxed?

If you have stock options or equity-based compensation as a large part of your income, the tax treatment of your stock options is especially important. How stock options are taxed usually depends on the type of options you have (incentive or non-qualified) and your sale and exercise strategy. However, the tax treatment of options can change during a merger or acquisition.

Incentive stock options receive favorable tax treatment compared to non-qualified stock options if you hold the stock long enough. Not sure if you have ISOs or NQSOs? Here’s more on incentive vs non-qualified stock options.

Tax treatment of incentive stock options (ISOs)

Generally, there are no tax consequences at grant, vesting, or exercise of incentive stock options. In another words, these aren’t usually taxable events. There is one caveat though, the alternative minimum tax (or AMT) which we’ll address in a moment.

Your employer will not withhold taxes at exercise. Even at sale, employers don’t have to withhold proceeds to pay tax on your behalf. You’ll want to coordinate your plans with your financial advisor and CPA prior to selling your stock options.

How ISOs are taxed when you sell the shares

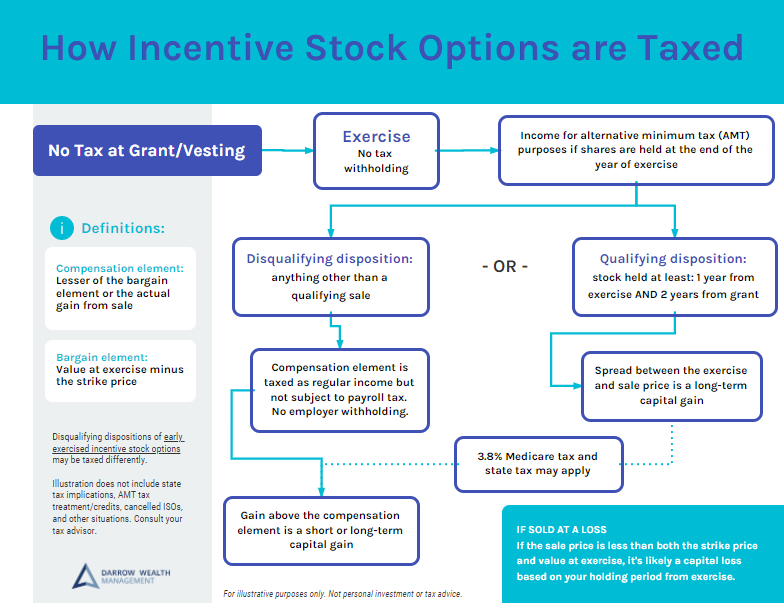

When you sell incentive stock options, it’s considered either a qualifying or disqualifying distribution depending on how long you held the stock. A qualifying disposition carries tax benefits and a disqualifying disposition does not.

To meet the criteria for a qualifying disposition, you must hold your stock for at least 2 years from the grant date and at least 1 year after exercise. Everything else is a disqualifying disposition. A qualifying disposition means you’ll pay tax at favorable long-term capital gains tax rates. A disqualifying disposition means paying tax at regular income tax rates and potentially capital gains too.

In addition to federal income tax and/or capital gains tax (discussed below), you may also need to pay tax at the state level.

Tax benefits of holding incentive stock options

If you meet the standards for a qualifying disposition of ISOs, then you will generally only pay long-term capital gains tax on the gain. For tax purposes, the gain is typically the sale price minus the strike price multiplied by the number of shares sold. Given that long-term capital gains rates are the most favorable, this can save considerably on your tax due.

But there’s also the risk that the stock declines in value and you’re left with less or perhaps even a loss. Holding onto stock long enough to qualify for favorable tax treatment can mean paying less in tax. Declines in the value of the stock can also yield tax savings too, and fewer proceeds along with it. Don’t let the tax-tail wag the dog when developing a strategy for the sale of your stock options!

Tax treatment of a disqualifying sale of incentive stock options

If you don’t meet the holding period for a qualifying disposition, when you sell, you’ll pay tax as a disqualifying disposition. If you exercise and hold the shares, the disqualifying disposition is typically taxed as ordinary income and capital gains (assuming there is a gain). The difference between the market value of the stock at exercise and your strike price is taxed as regular income, but not subject to payroll taxes.

Short-term capital gains apply if you hold the stock for less than a year before selling. If so, the gain (the difference between the price you sold the stock for and the value at exercise) is a short-term capital gain. Currently, short-term capital gains rates are the same as regular income.

If you keep the stock for more than a year, it’s a long-term capital gain. But if you exercise and sell right away, you shouldn’t have a capital gain to report. This infographic includes a visual on how ISOs are taxed.

However, if ISOs are cancelled and paid out (perhaps in conjunction with an acquisition), payroll taxes are generally assessed on the spread in addition to income tax.

If you have incentive stock options, watch out for the alternative minimum tax

Exercising incentive stock options could have other tax implications if you don’t sell the shares before the end of the year. Holding ISOs through the end of the year can trigger the alternative minimum tax (AMT). The AMT is a parallel tax calculation to the usual method which adds back or disallows certain tax deductions so the taxpayer pays more in tax than they would under the traditional system. Again, you’ll want to work with your accountant in advance to run the numbers.

A handful of states, such as California, also impose a state level alternative minimum tax.

6 Tax Strategies for Incentive Stock Options and AMT

Other factors impacting the tax treatment of ISOs

There are other caveats to be aware of which often require coordination with your CPA and financial advisor. For example, there’s an annual vesting limit of $100,000 per year for incentive stock option tax treatment. This is based on the market value of the ISOs at the time of grant. Also, taxes may change depending on what happens to stock options during a merger or acquisition. Alternatively, if you work for a public company that goes private, you may not be able to control when you recognize taxable income.

Keep in mind, while incentive stock options have tax benefits if you satisfy the holding period requirements, it still may not be beneficial to do so based on the risk. Learn more about tax planning for ISOs.

Tax treatment of non-qualified stock options (NQSOs)

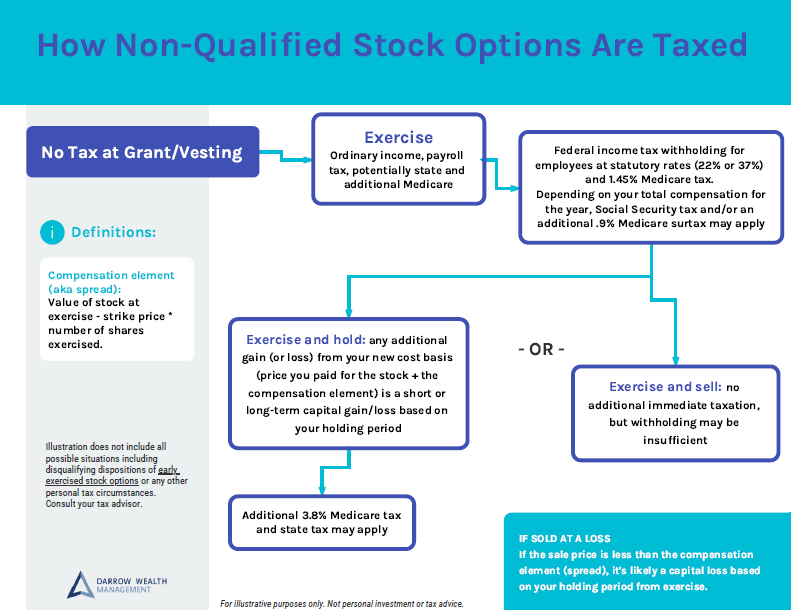

Although NQSOs don’t offer any tax benefits, the tax treatment is more straightforward. Unlike ISOs, your employer will reserve some funds for federal income tax purposes. However, this doesn’t mean flat withholding will be enough. Automatic withholding is based on a flat rate which may not apply to your tax situation.

Taxes when you exercise non-qualified stock options

Like ISOs, there are generally no tax consequences at grant or vesting. But exercising non-qualified stock options is a taxable event. At exercise, the amount that is typically subject to tax as ordinary income is: (current market price – the strike price) * number of shares. This is called the compensation element.

Generally, federal tax withholding at exercise is required. If the spread is under $1M, the rate is 22%, if above, it’s 37%. If your state has an income tax, withholding is likely required too. The compensation element is also subject to payroll taxes.

The statutory withholding may not be enough to cover your tax liability, though. Further, there may not be withholding for individuals who were/are not classified as employees, such as independent contractors or consultants.

Again, coordinate your plans with your financial advisor and CPA prior to exercising or selling stock options.

Tax treatment when you sell non-qualified stock options

When you sell NQSOs, any change in the share price after exercise will be subject to tax at short or long-term capital gain tax rates depending on your holding period. However, if you exercise and sell the stock immediately, you shouldn’t have a capital gain, only ordinary income tax.

If you’ve kept the stock for less than 1 year, it’s a short-term capital gain for tax purposes. The tax rates on short-term capital gains are the same as ordinary income. If you keep the stock for more than 1 year, long-term capital gains rates will apply.

At a high level, the capital gain is based on your sale price, less your cost basis. For simplicity, you can estimate your cost basis as the market price when you exercised. Again, it’s important to work with a CPA to do the real math for you!

This infographic has more on how non-qualified stock options are taxed.

How is an early exercise of stock options taxed?

In most stock plans, option grants vest over time. Exercising isn’t possible until those restrictions lapse. But if the plan permits early exercises, employees have the ability to exercise before the shares vest. Early exercises can offer significant tax savings in certain situations. Making an 83(b) election is typically a key part of that.

With an 83(b) election, taxpayers elect to accelerate the tax treatment of exercising their options, even though the shares haven’t vested. At grant, the strike price usually equals the current fair market value of the stock. If exercised immediately and timely filing of an 83(b) election, there may be an opportunity to have a $0 spread between the FMV and strike price.

Learn more about early exercising stock options.

Tax planning strategies for stock options

Deciding when to sell your stock options isn’t a no-brainer. You’ll need to weigh several complex factors:

- What’s your current tax situation? Do you expect your tax situation to change next year, aside from the stock options? For example, are you getting married, divorcing, moving to another state, getting a raise, selling a home or rental property, expecting an inheritance, etc.?

- What are your expectations for the company? What’s the risk (or opportunity) for a buyout, IPO, bankruptcy, or other significant decline in the stock price or valuation?

- How much company stock do you already own? Diversification is so important. Taking some risk off of the table by selling shares can help you avoid the worst outcome, even if it means paying more tax in the short run.

Stock compensation specialists

Darrow Wealth Management specializes in stock options and equity compensation. Especially for founders and early employees, stock options can create a major liquidity event that transforms your financial life. To maximize the opportunity, it’s critical to get the right team of advisors in place before making irreversible decisions with your shares.

Last reviewed March 2024