We’re all ready to put 2020 behind us. But before closing the books, it’s worth reflecting on what was a crazy year in the stock market. Here are 6 stunning facts about the stock market in 2020.

1. It happened really fast

- It took only 16 trading days to enter a bear market (a decline of 20% or more from a previous peak), which is the fastest drop into a bear market in history.

- Lasting only one month, 2020 was also the shortest bear market in history.

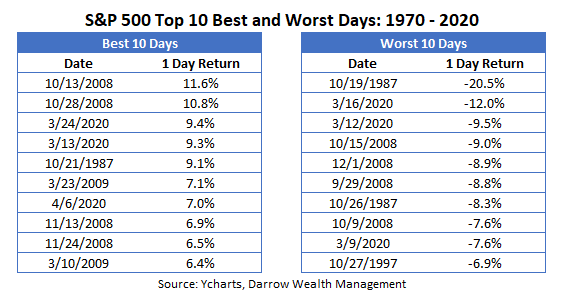

- March 12th was the second worst day of the year. The S&P 500 was down over 9.5%. On March 13th, the S&P 500 returned 9.3%, the second-best day of 2020.

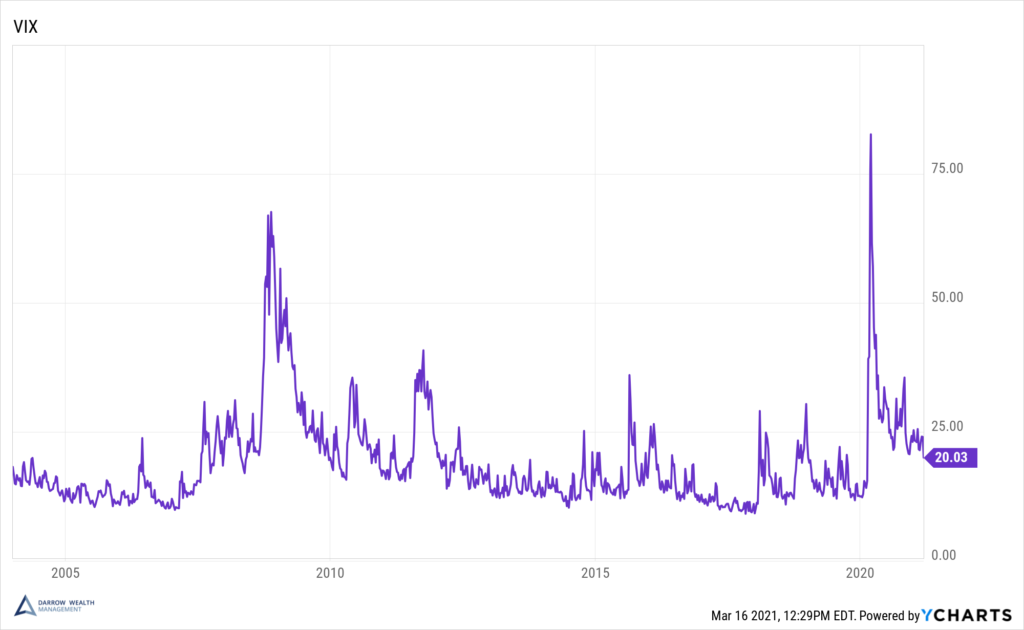

2. Volatility peaked

- The Cboe Volatility Index (VIX) is a real-time index that represents the market’s expectations for the relative strength of near-term price changes of the S&P 500 index (SPX). In March 2020, the VIX peaked at over 82.

- March 2020 was the most volatile month ever. The average daily swing in the S&P 500 was 5%. The last record was from November 1929 when the average daily swing was 3.9%.

3. Record highs…and lows

- Going back to 1970, three of the top 10 best and worst days for the S&P 500 occurred in 2020.

- Of the top three worst days, two were from March 2020.

- The 10-year treasury yield hit all-time lows.

- The S&P 500 set 33 record all-time highs.

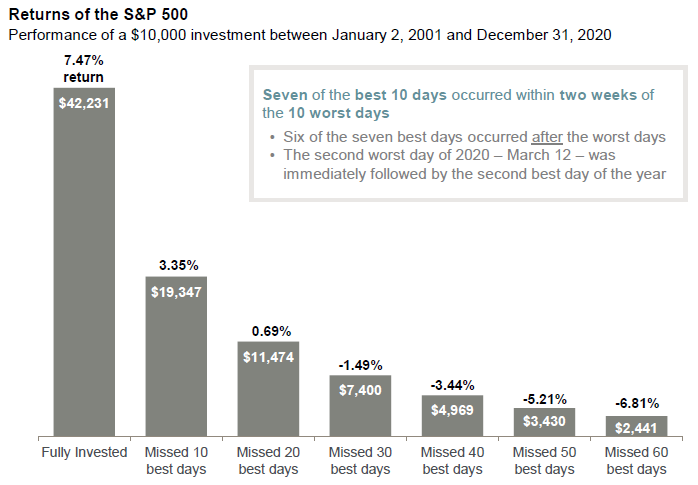

4. 2020 was a clinic in why you shouldn’t try to time the market

- The S&P 500 gained 70% from the March low to the end of the year. If you just missed the first week of the recovery, you’d ‘only’ be up 45% by the end of the year.

- Longer term, missing out on the 10 best days can impact your financial goals. A J.P. Morgan analysis showed that investors who missed the 10 best days on the S&P 500 between 2001 – 2020 would have an average annualized return of 3.35% vs 7.47% had the individual stayed fully invested. That’s a difference of over 50%!

5. Markets can move unexpectedly

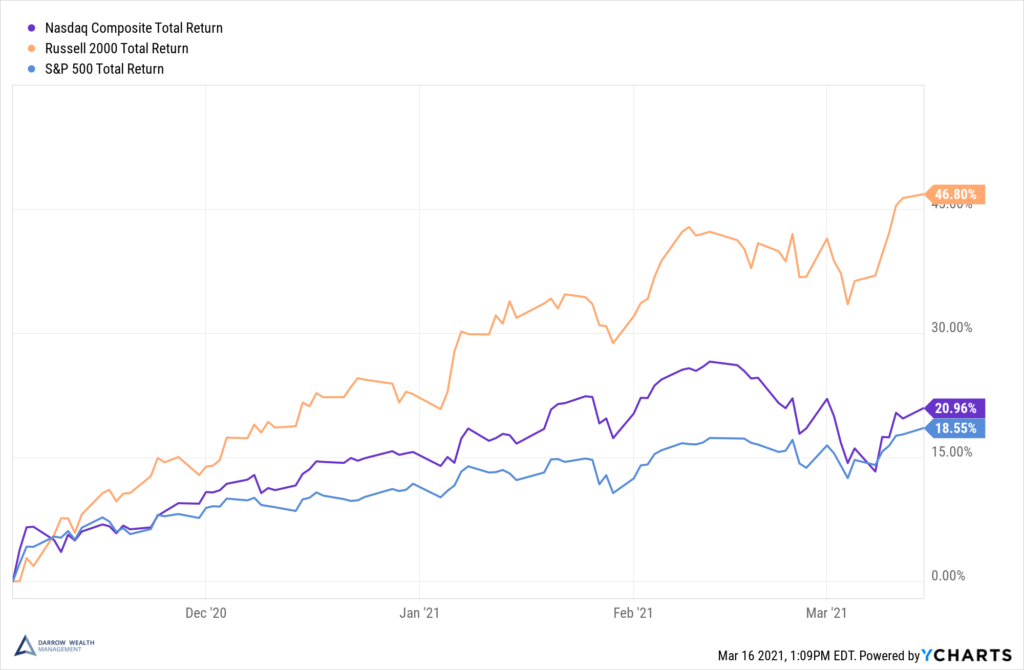

- Returns have been strong since the 2020 presidential election to 3/15/2021. But if you sold to cash, don’t let the thought of buying when the market is high be the only reason not to invest.

- 2020 was also a great reminder that the stock market is not the economy.

6. Risk tolerance gut check

- Diversification works because asset classes don’t move in lockstep. In March, when the S&P 500 fell 34% from recent highs, the U.S. small cap index (Russell 2000) was down roughly 40%.

- Year-over-year, changes to the risk-reward assumptions change, especially after volatile years like 2020. It’s another reason why it’s important to strike a balance between set it and forget it and day trading your accounts.

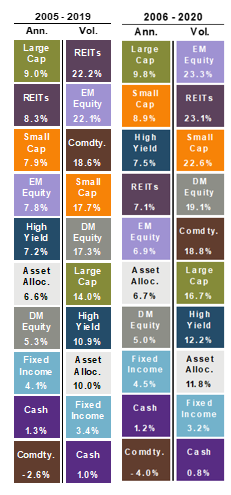

Ranked returns and volatility: 2005 – 2019 vs 2006 – 2020

What a difference a year makes!

As much as we would all like to put 2020 behind us, it’s important we remember what can happen when investing in the financial markets. Past performance is not an indication of future results, but history provides helpful context when evaluating long-term investment decisions.

Important Disclosures

All indexes are unmanaged and an individual cannot invest directly in an index. Index returns do not include fees or expenses. Both past performance and yields are not reliable indicators of current and future results. Examples in this article are generic, hypothetical and for illustration purposes only. This is a general communication for informational and educational purposes only and not to be misinterpreted as personalized advice or a recommendation for any specific investment product, strategy, or financial decision. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. If you have questions about your personal financial situation, consider speaking with a financial advisor.