Investing through market volatility can be challenging. Should you go to cash? What investments perform the best during a market selloff? Is it a good time to consider tax-loss harvesting or buying the dip? Often, the best time to evaluate or make changes to your portfolio is before volatility arrives, not after. If you’re unsure whether you should take any action, then you probably shouldn’t. Staying the course through market volatility usually rewards the patient investor. Here are the three biggest mistakes investors make during a market ‘crash’.

Selling to cash

The biggest mistake investors make when stocks fall is to cease being an investor and sell to cash. Why? Because it’s practically impossible to perfectly (or even adequately) time your exit from the market and your reentry. Investors often focus on selling and give little thought to when they put cash back in the market again. This is a big mistake.

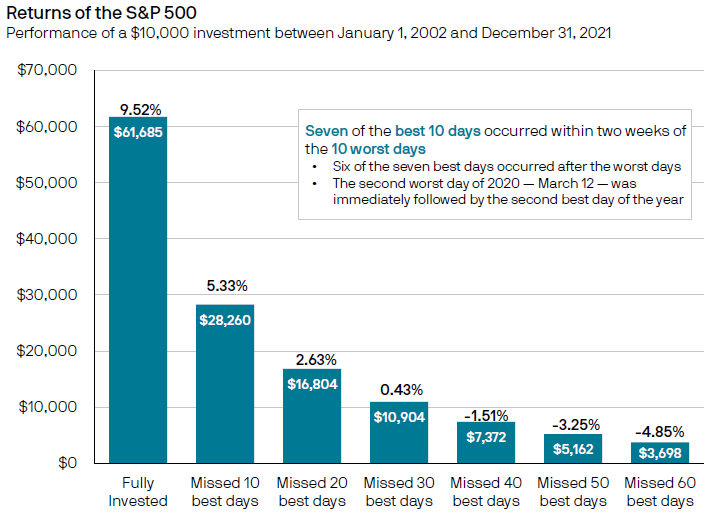

The graphic below from J.P. Morgan is one of my favorites. It shows the impact of being out of the stock market (S&P 500) over the last 20 years. Missing just the 10 best days over the last two decades would yield an ending portfolio worth over 50% less than a fully invested account. That equates to an average performance gap of almost 4.2% – per year!

Importance of staying invested

Source: J.P. Morgan Asset Management analysis using data from Bloomberg. Returns are based on the S&P 500 Total Return Index, an unmanaged, capitalization-weighted index that measures the performance of 500 large capitalization domestic stocks representing all major industries.¹

Further, adding to the difficulty of trying to time the markets, most of the best days happen around the worst days. Over the last 20 years, 70% of the best 10 days happened within two weeks of the worst 10 days. Incessantly going in and out of the market erodes returns and can have tax implications, transaction costs, etc.

Not putting extra cash to work

Everyone loves a sale, except when it happens in the financial markets. Fear over short-term volatility can lead investors to hold off on investing money they otherwise would have put to work. For long-term investors, the question of whether it’s a good time to invest shouldn’t have much to do with current market conditions at all.

If you have extra cash, a multi-year horizon, and you’ve considered what else you could do with the money (such as pay off high-cost debt), then it likely makes sense to invest the money in a diversified portfolio. Being able to buy assets cheaper because of market volatility is an added bonus. If you’re worried about volatile markets, consider dollar-cost averaging vs investing a lump sum.

Searching for the bottom isn’t an investment strategy. There are no smoke signals. No all-clear sign. Investing is about time in the market, not timing the market. Buying low and selling high sounds great, but over time, markets go up a lot more than down. So this approach can actually leave you worse off.

According to data from Dimensional Fund Advisors based on the Fama/French Total US Market Research Index, between 1926 – 2020, the average annualized returns for the five-year period after a correction (10% decline) was 9.5%; after a bear market (20% decline) was 9.7%; and after a 30% decline, 7.2%.

Compare this to investing in the S&P 500 between 1926 – 2021 after the index closed a month at a new high. Dimensional Fund Advisors reports the average annual returns over a 5-year period after reaching a record was just over 10%.

Most investors would (and should) be pretty happy with any of these figures.

Forgetting to diversify

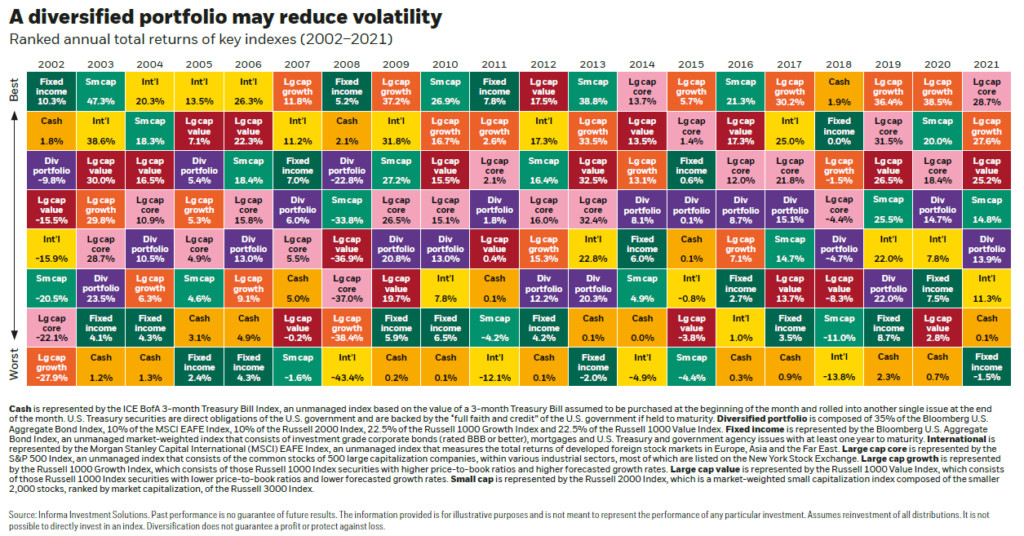

Diversification isn’t a magic bullet, but it is perhaps the best tool investors have to protect their portfolio from volatile markets. At the most basic level, adding bonds to a portfolio can provide stability and income. But this is just the tip of the iceberg. Asset classes respond to market conditions differently. Further, the correlation and diversification properties within an asset class are also critical to managing market volatility.

The goal of diversification is to smooth investment returns over time and potentially even outperform a concentrated portfolio as a result. As investors move through life, limiting downside risk can become more critical than further upside. This is particularly true when beginning to draw from your portfolio in retirement. By taking steps to limit wild swings in your portfolio, it increases the odds you’ll have the fortitude to stay the course.

This article was written by Darrow Wealth advisor Kristin McKenna, CFP® and originally appeared in Forbes.

Disclosures

Examples in this article are generic, hypothetical and for illustration purposes only. Both past performance and yields are not reliable indicators of current and future results. This is a general communication for informational and educational purposes only and not to be misinterpreted as personalized advice or a recommendation for any specific investment product, strategy, or financial decision. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. If you have questions about your personal financial situation, consider speaking with a financial advisor.

All indexes are unmanaged and an individual cannot invest directly in an index. Index returns do not include fees or expenses. Past performance is not indicative of future results.

¹ Indices do not include fees or operating expenses and are not available for actual investment. The hypothetical performance calculations are shown for illustrative purposes only and are not meant to be representative of actual results while investing over the time periods shown. The hypothetical performance calculations are shown gross of fees. If fees were included, returns would be lower. Hypothetical performance returns reflect the reinvestment of all dividends.

The hypothetical performance results have certain inherent limitations. Unlike an actual performance record, they do not reflect actual trading, liquidity constraints, fees and other costs. Also, since the trades have not actually been executed, the results may have under-or overcompensated for the impact of certain market factors such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. Returns will fluctuate and an investment upon redemption may be worth more or less than its original value. Past performance is not indicative of future returns. An individual cannot invest directly in an index. Data as of December 31, 2021.