Restricted Stock Awards: Guide to Your Grant

A restricted stock award (RSA) is a form of equity compensation. RSA grants are commonly issued by private companies, particularly early-stage startups, and may be

Financial planning and investment insights tailored to individuals expecting sudden wealth from company stock options, sale of a business, inheritance, or trust fund distribution. Develop a strategy to make the most of the windfall and design an investment plan going forward. If you’re expecting a lump sum from an inheritance, sale of a business, trust, or stock options after an IPO, you’ll want to get a plan in place to best utilize your sudden wealth. An unexpected windfall can change your life.

A restricted stock award (RSA) is a form of equity compensation. RSA grants are commonly issued by private companies, particularly early-stage startups, and may be

For individuals with stock-based compensation, an 83(b) election has the potential to greatly reduce taxes on stock options or restricted stock. When you purchase unvested

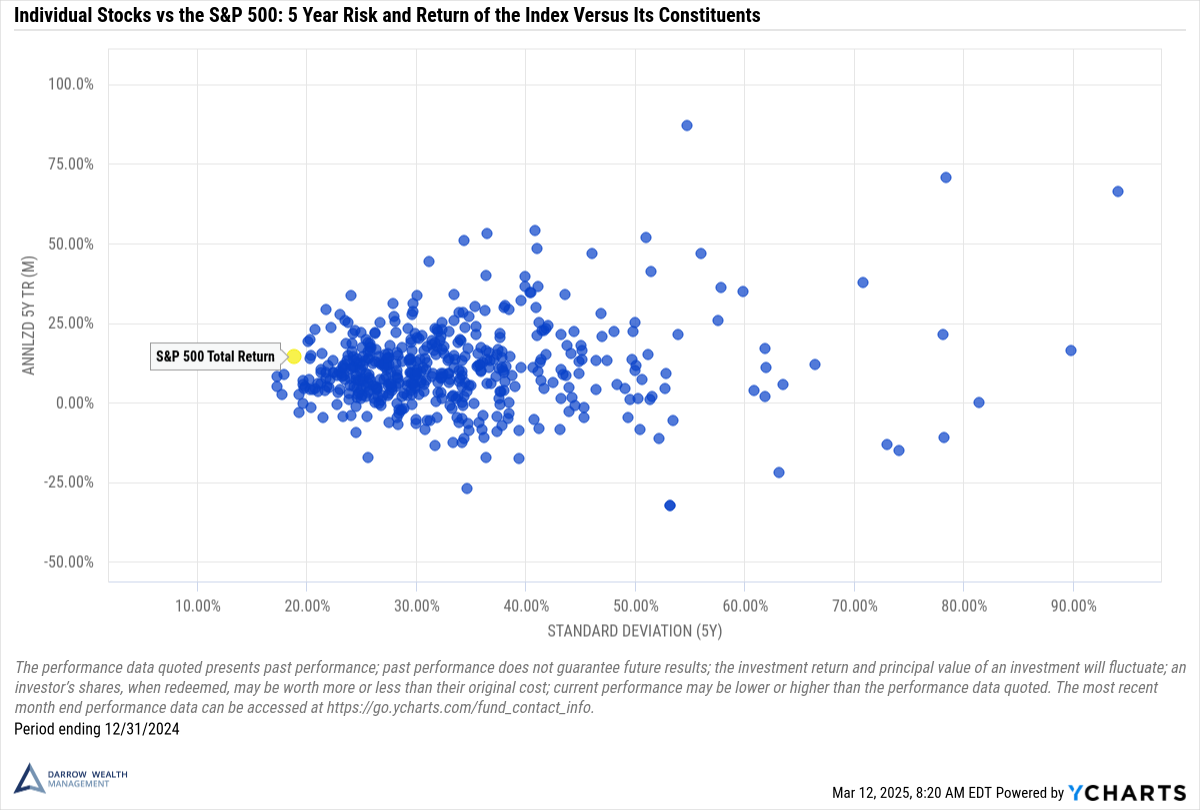

What is a concentrated stock position? If one stock makes up more than 10% of your overall asset allocation, it’s probably too much. A diversified

Whether you work for a private company about to IPO or one that’s recently gone public, you may wonder what that means for employees and

If you invested in a startup or small business (founders, employee exercise of stock options, business owner), you need to know about qualified small business

Selling your business for cash? Deciding how to allocate and invest the proceeds after the sale of your company is a big decision that requires

Next steps after a sudden wealth event or cash windfall Wondering what to do with a sudden financial windfall? Whether the windfall was expected, perhaps

Is exercising stock options right before a company goes public a good idea? Employees with pre-IPO incentive or non-qualified stock options often wonder if they

The sale of a business marks a major life event. It’s emotional, stressful, and exciting all at the same time. And unfortunately, it’s often a

There are many financial planning considerations before, during, and after a divorce. A key part of the process from a financial standpoint is dividing the