If you work for a private company or startup, you may be able to exercise your stock options early. With an early exercise, employees buy unvested stock options, as is common with restricted stock. Why would you want to pay for shares before they vest? In the right situations, early exercising stock options can reduce tax with an 83(b) election, and in the case of incentive stock options, potentially avoid the alternative minimum tax. An early exercise can also start the clock on the holding period for long-term capital gains. It doesn’t always make sense to early exercise options, so it’s important to understand the risks, pitfalls, and tax implications first.

Before getting into the pros and cons of early exercises, a word of caution. Employees with stock options often focus on one thing: taxes. And specifically, how to reduce them at all costs. Don’t fall into this trap. Sometimes, exercising options early is a terrific opportunity; other times it’s a terrible idea. Before getting wooed by the glimmer of potential tax savings, understand the risks, rules, and ways this approach could backfire.

What is an early exercise?

In most stock plans, option grants vest over time. Exercising isn’t possible until those restrictions lapse. But if the plan permits early exercises, employees have the ability to exercise before the shares vest.

This article has more on regular stock option exercises.

How stock options are taxed without an early exercise

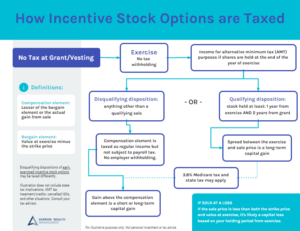

Understanding the potential benefits of this strategy requires knowledge of how stock options are taxed. In the typical scenario, there are no tax implications at grant or vesting. Below is an overview of the federal tax treatment of stock options. Your state has its own tax laws.

Incentive stock options (ISOs)

At exercise

At exercise, incentive stock options are not a taxable event for federal tax purposes. However, it is income for the alternative minimum tax (AMT) calculation if you hold shares at the end of the calendar year. The spread between the fair market value (FMV) of the stock at exercise (typically the 409a valuation) and the strike price is income for AMT purposes. This may or may not trigger the alternative minimum tax, but the income is includable in the calculation.

6 Tax Strategies for Incentive Stock Options and AMT

At sale

When you sell incentive stock options, it’s a taxable event as either a qualifying or disqualifying disposition. In a qualifying disposition, you hold the stock for at least 2 years from the grant date and at least 1 year after exercise. If you meet both holding requirements, the entire spread between the sale price and the exercise price is taxed at long-term capital gains tax rates.

If you don’t meet the holding requirements, it’s a disqualifying disposition. The difference between the value of the stock at exercise and your strike price is taxable as regular income, but not subject to payroll taxes. Any subsequent gain is a capital gain depending on the holding period after exercise. Currently, short-term capital gains rates are the same as regular income.

Nonqualified stock options (NQSOs)

At exercise

Exercising nonqualified stock options is a taxable event. At exercise, the compensation element, or difference between the FMV at exercise and the strike price is taxable as ordinary income and subject to payroll tax.

At sale

Any subsequent gain is a capital gain depending on the holding period (either short or long-term).

How early exercise stock options are taxed

Early exercises can offer significant tax savings in certain situations. Making an 83(b) election is typically a key part of that. With an 83(b) election, taxpayers elect to accelerate the tax treatment of exercising their options, even though the shares haven’t vested. Why is that important?

At grant, the strike price usually equals the current fair market value of the stock. If exercised immediately and timely filing of an 83(b) election, there may be an opportunity to have a $0 spread between the FMV and strike price.

Incentive stock options (ISOs)

With an 83(b) election and qualifying disposition (usually the goal)

If ISOs are early exercised when the strike price is equal to the FMV of the option, and an 83(b) election is made, the spread for AMT tax purposes is $0. There are still no federal tax implications.

If the regular ISO holding period is met (2 years from grant, 1 year from early exercise), the entire spread will be taxable as a long-term capital gain. To be clear: you must hold the shares for at least 2 years to qualify.

No 83(b) election and qualifying disposition

If you don’t make an 83(b) election, there are no tax implications at early exercise for the AMT or federal tax. Instead, when the shares vest, the spread between the strike price and FMV at vesting is income for AMT. To meet the terms for a qualifying disposition, you’ll need to hold the shares for 1 year after the shares vest (not when you early exercised) and 2 years from the grant date.

Disqualifying disposition

Regardless of whether you made an 83(b) election, if the sale of ISOs is a disqualifying disposition, the tax treatment is likely to be the same. Although IRS guidance isn’t crystal clear, many tax professionals agree with the treatment below.

In the event of a disqualifying disposition of early-exercised incentive stock options, the spread between the FMV of the stock at vesting and the strike price is ordinary income for federal tax purposes. Any subsequent gain or loss is a capital gain/loss, based on the holding period after vesting and the spread between the sale price and the FMV at vesting.

Nonqualified stock options (NQSOs)

With an 83(b) election

When an employee early-exercises non-qualified stock options with an 83(b) election, the difference between the FMV at exercise and the strike price is taxable as ordinary income and subject to payroll tax. It begins the 1-year holding period requirements for long-term capital gains tax treatment.

No 83(b) election

If exercising NQSOs early without an 83(b) election, you buy the shares, but there are no tax implications until the stock vests. At vesting, the spread between the exercise price and the FMV at vesting is taxable. The capital gains holding period begins when the stock vests.

When to consider an early exercise of stock options

For ISOs, when the strategy goes according to plan, there’s an opportunity to reduce or eliminate AMT and possibly start the clock early for a qualifying disposition on shares that may not vest for several years.

For NQSOs, the opportunity is typically much better. The early exercise of non-qualified stock options has the possibility to achieve the tax benefits of ISOs with a 1-year holding period and without AMT concerns.

Some situations where it may be beneficial to consider an early exercise:

- Spread between the exercise price and FMV is zero

- Company is unlikely to be acquired before desired holding period is met

- You have enough cash on hand to buy the shares and pay any tax due – without selling the stock

- You are confident about the growth of the company and the likelihood of a future IPO or liquidity event

Drawbacks and risks when exercising early

There are several serious risks when exercising unvested restricted shares. Here are a few to consider.

- If you leave your job with unvested shares. The company can repurchase the stock at the lesser of your strike price or the current FMV. You don’t get a refund on the tax paid with an 83(b) election.

- No liquidity event. Companies are staying private for longer. There’s no guarantee there will ever be an exit or secondary market for you to sell stock. Exercising options at a startup can be the easiest to do financially (low strike price – lots of potential upside) but it’s also the most unclear as to the longevity and path of the business.

- Stock price/valuations decline. Regardless of whether there’s a public market for the stock or not, the value of a company doesn’t just go up. Especially if considering an exercise before an IPO, the private valuation may be higher than what the public market thinks it’s worth. Further, your taxable spread could be very large.

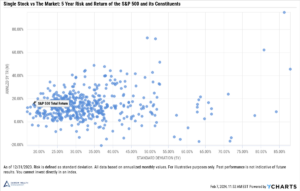

- Cash and concentration risk. Exercising options can sometimes require a significant cash outlay to buy the shares and possibly pay tax. Robbing your emergency fund or taking out a loan only increases your risk. Also consider your overall concentration and liquidity. Serial startup employees may have private shares with past companies, creating an overall situation that’s very illiquid and concentrated in a few companies.

- Future tax laws. Exercising early also means placing a bet on future tax rates. There’s currently proposals that would nearly double the long-term capital gains tax rate. Affected taxpayers may actually be worse off by exercising early, especially considering any opportunity costs.

- M&A can ruin your plans. The IRS doesn’t care why you have a disqualifying disposition or short-term capital gain. If your company is bought or acquired before your holding period is met, there may be negative tax implications. Note: unexercised ISOs can be considered cancelled options in some buyouts, triggering payroll taxes.

What’s the best exercise strategy?

There’s no one best strategy for every situation. But sometimes, waiting to exercise until there’s certainty can be a good approach. Especially if the goal is diversification, knowing the tax impact and net profit helps decision-making. Further, when the company is public, there are often other ways to purchase the stock, such as a cashless or net exercise. Public markets offer liquidity, after the lockup expires. When considering the pros and cons of any exercise strategy, don’t let the tax tail wag the dog.

Important Disclosure

This article is for informational purposes only and not to be misinterpreted as personalized advice or a recommendation for any specific investment product, strategy, or financial decision. This article does not contain sufficient information to support a financial or investment decision. If you have questions about your personal situation, consider speaking with a financial or tax advisor.

Last reviewed March 2024