83(b) Election: Tax Strategies for Unvested Company Stock

For founders, employees, and executives with stock-based compensation, an 83(b) election can be a powerful tax planning tool. When you make an 83(b) election, you’re

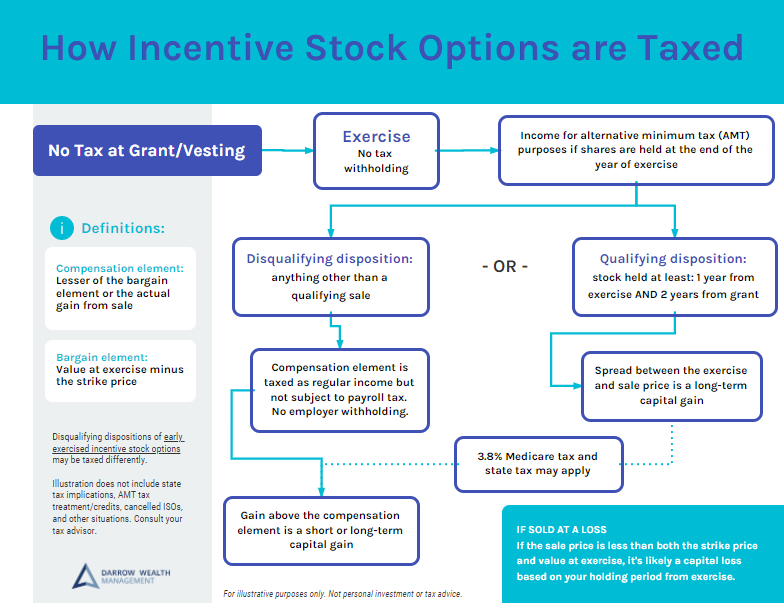

Incentive stock options (ISOs) are a type of stock option. If holding periods are met, incentive stock options qualify for favorable long-term capital gains tax treatment. But there are risks. Learn more about financial and tax planning considerations for ISOs, such as exercising options, tax planning strategies, Section 1202, considerations during a lock-up, and what to do with the proceeds. The blog also discusses liquidity events such as IPOs, mergers, or acquisitions and what happens to stock if you’re laid off or leave the company. Key insights for founders and executives on strategic stock option planning and strategies to best manage sudden wealth.

For founders, employees, and executives with stock-based compensation, an 83(b) election can be a powerful tax planning tool. When you make an 83(b) election, you’re

If you have incentive stock options, you’ve probably heard of the alternative minimum tax (AMT). Essentially, the alternative minimum tax is a prepayment of taxes.

6 tax strategies for incentive stock options and AMT Triggering the alternative minimum tax isn’t the end of the world, but you don’t want to

If you work for a private company or startup, you may be able to exercise your stock options early. With an early exercise, employees buy

What does an IPO mean for employees? And what should you do when your company is about to go public? For early-stage employees and executives with

How are stock options taxed? If you have stock options or equity-based compensation as a large part of your income, the tax treatment of your stock

Losing your job is stressful. If you’ve been laid off, you may be wondering what will happen to your stock options or restricted stock units.

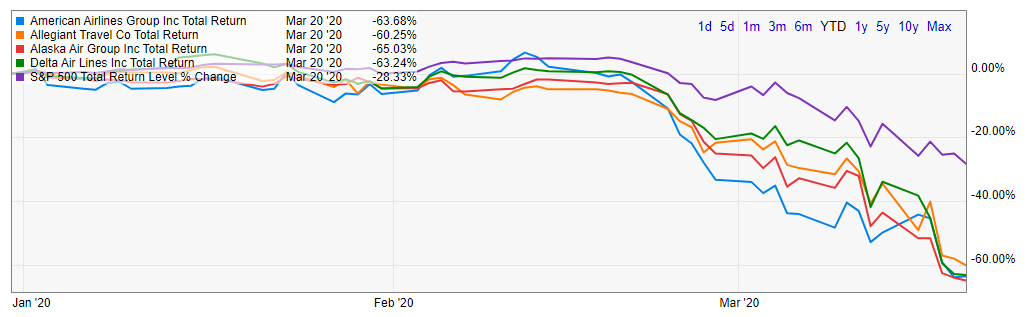

What can happen if you own too much of your company’s stock? The coronavirus outbreak is yet another example of the dangers of having too

What’s your post-IPO stock liquidation strategy? Working for a company as it goes public can be a very exciting and rewarding experience. If you have

It’s common for employees to move around, especially in tech. Before giving notice, understand what could happen to stock options, RSUs, or other shares if