The idea of living off dividends in retirement sounds nice, but it’s challenging. What investors don’t always realize is how much money they’ll need invested to generate enough income from dividends. For example, over the last 25 years, the S&P 500’s average dividend yield was 2.01%.¹ If you have a $1M portfolio, the imputed dividend income is $20,100 per year on average. As you consider the various ways to create passive portfolio income, be aware of the less obvious risks.

Living off stock dividends

Metrics matter

Yield is the metric often used to compare the income stream of different securities. It equals 12 months of income (dividends or bond income, trailing or forward) divided by the market price of the security. For example, if a stock issues $5 in dividends for the year and is currently trading at $200/share, the dividend yield is 2.5%. If you own 10,000 shares, you receive $50,000 in dividend income (pre-tax) and have a portfolio currently worth $2M.

Yields can be deceptive, though.

Following on the previous example, assume the company maintains its $5 dividend but the stock price falls to $150. The dividend yield is now 3.33%. You’ll receive the same $50,000 in dividend income but the value of your portfolio drops to $1.5M.

Before you can evaluate stocks or bonds to invest in, you’ll need to develop the metrics you plan to use in the analysis. Some examples include dividend growth and consistency, dividend payout ratio, total returns, volatility, and sensitivity, among others.

If you’re not working with a financial advisor, seriously consider your appetite for ongoing portfolio management, fund analysis, rebalancing, and so on.

Income from the S&P 500

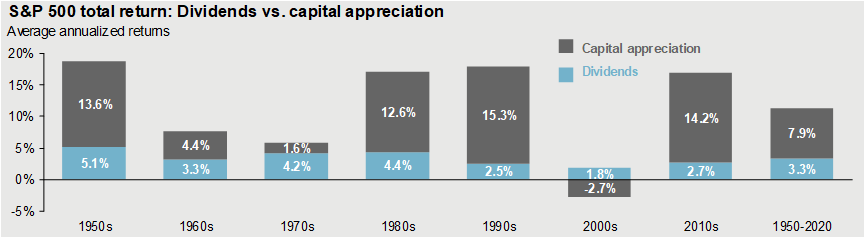

The dividend yield for the S&P 500 is currently 1.45%.¹ Not only is this less than the 25-year average, but as the table below illustrates, since the 1990s, dividends began to comprise a relatively smaller portion of the overall total return of the S&P 500.

Without a large portfolio or other source of funds, dividends alone are unlikely to provide enough income in retirement, especially after paying tax. And there’s always the risk that the company will reduce its dividend or stop paying one entirely. Struggling businesses may need to preserve cash to maintain operations, putting pressure on the stock price and your income steam.

Dividend funds

Of course, the S&P 500 isn’t the only game in town. There are thousands of income-focused ETFs and mutual funds to choose from. While a fund with a mandate for income may produce greater dividend income than the S&P 500, there are many other factors to consider.

Here are a few:

- Is the fund diversified? Number of holdings? Are the assets overly concentrated in one factor, like value, or sector, like industrials, financials, or utilities?

- How does the total return of the fund compare to its peers? Time since inception? Remember, living off dividends also requires preservation of principal to keep the income stream alive and keep pace with inflation. So, it’s important not to prioritize income at the expense of the underlying assets.

- What are the fund fees, expenses, sales charges, investment minimums, and redemption restrictions? Some actively managed funds can charge well over 2%!

- How does the current dividend yield compare to the historical yield? In another words, is the investment likely to provide regular income? Some funds may show double-digit dividend yields now, whereas a few short years ago the yield was closer to 3% or 4%. If so, why; look at how the dividends change relative to the asset price. Understand what that type of volatility could do to your cash flows – and principal.

Single stocks

Some investors look to individual stocks for dividend income rather than an ETF or mutual fund. While buying stock outright can be cheaper (no fund expenses), it can also add a significant amount of risk.

For example, some well-known high dividend stocks now offer very strong yields (8%+), but it’s typically due to deeply negative price returns over the last several years. Value stocks, which tend to be more established companies and dividend-payers have underperformed high-flying growth companies over the last 10 years, to the magnitude of 6% total return per year on average.¹ That’s not to say you shouldn’t have value stocks in your portfolio, rather investors need income and growth to maintain their lifestyle in retirement.

Clipping the coupon: adding bonds to an income stream

Bonds are called fixed income because they offer regular (usually fixed) interest (coupon) payments. As such, bonds can provide a steady cash flow for investors. The income component is a key reason investors own bonds in their portfolio.

A bond’s coupon is a fixed interest rate and represents a percentage of the par value that the buyer will receive in ongoing interest payments. For example, a bond with a $1,000 par value and a 5% coupon will make annual interest payments of $50 until the bond matures and the par value is fully repaid. Coupon payments may occur more frequently depending on the bond.

While bonds can add stability and income to a portfolio, as interest rates have declined over the last few decades, yields have followed suit. The relationship between interest rates and bond yields is an important one.

When rates decline and yields drop, it supports equities, as investors seek out riskier assets for higher expected total returns since stocks provide the opportunity for price appreciation and comparable or even more favorable income.

Searching for yield: comparing income in stocks vs bonds over time¹

Current bond vs forward stock yields |

Oct-21 |

Feb-20 |

Oct-07 |

S&P 500 |

1.50% |

1.90% |

1.90% |

10-Year Treasury |

1.60% |

1.60% |

4.70% |

As with equities, the prices of underlying assets, correlations, and fluctuations in the market can impact your ability to live off portfolio income.

How Much Money Do You Need to Retire At 60?

Buying individual bonds vs bond funds

Are there benefits to investing in single bonds vs shares of a bond fund? There are several important differences between owning individual bonds and investing in bond funds. For individual investors, investing in bond mutual funds or ETFs is often the best way to gain exposure.

As with stock funds vs individual stocks, owning a bond fund provides greater diversification and liquidity. Building a diversified bond portfolio on your own can be difficult due to minimum purchase sizes. Some corporate bonds may require a minimum purchase of $250,000 or more. Small buyers won’t be given as favorable pricing offers from dealers who favor large institutional purchasers.

But when you own bonds outright, you have the most control over how long you hold that particular security. Holding an individual bond to maturity gives investors a reliable payment of par.

As you look to bonds for income, consider the pros and cons of sector diversification, duration, and credit quality. For example, high yield bonds can offer additional income and risk (of default). High yield (or junk) bonds are also strongly correlated with stocks, which limits their diversification power. Also, corporate and long-term bonds tend to be the most sensitive to changes in interest rates. There’s a lot to consider.

Final word on asset allocation and diversification

Living off dividends may be feasible depending on your expenses, income needs, and asset level. However, it’s essential not to let dividends drive your entire asset allocation strategy. Doing so could not only jeopardize your income stream, but also your entire portfolio. As you evaluate how to retire comfortably or achieve financial flexibility, (re)consider the importance of living off dividends in your financial plan. It may not be as essential as you think.

¹ Source: J.P. Morgan Guide to the Markets, as of 10/11/2021