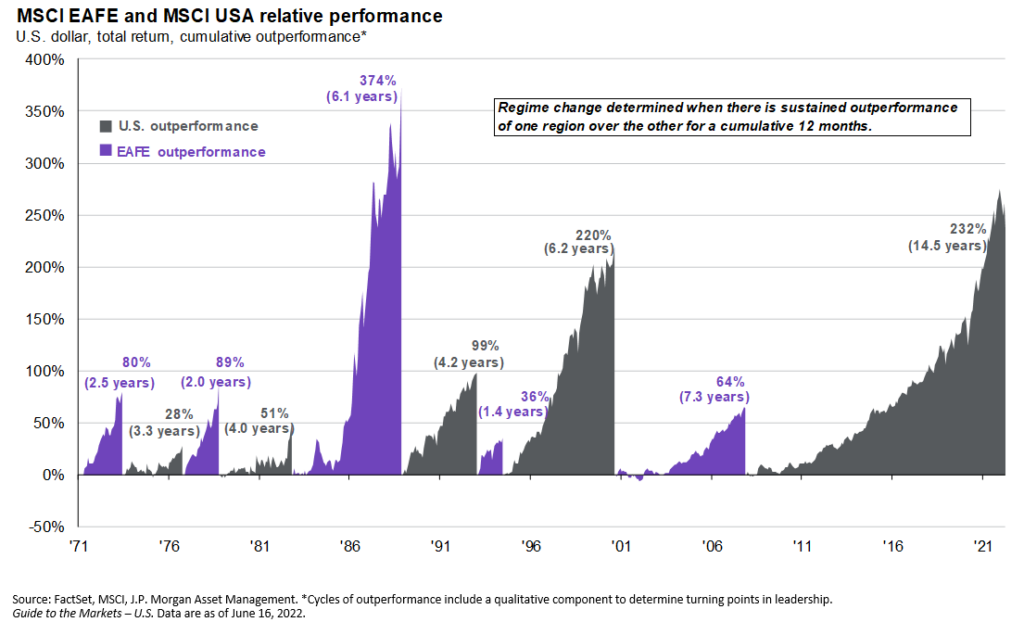

The United States currently represents 60% of the global equity market.¹ This means investors with an extreme home bias are ignoring 40% of the equity universe. In truth, doing so over the last 14.5 years would have worked out for you, but markets are cyclical, so it’s unlikely this lasts forever. There’s also a long history of throne-swapping between U.S. and international stocks (see chart). Particularly in today’s challenging market environment, investors should think twice before giving ex-U.S. assets the cold shoulder.

The U.S. stock market doesn’t always dominate

The United States doesn’t always dominate the global equity market! When U.S. stocks are facing headwinds, international stocks may rise to the occasion. Sustained periods of outperformance by one region have been fairly common historically.

These bouts can be significant. For example, consider the ‘lost decade’ for U.S. stocks that started in the early 2000s. Between 2000 – 2009, the cumulative total return for the S&P 500 was negative 9.1% vs positive 30.7% for the MSCI All Country World Index ex U.S.

International stocks could outperform if U.S. stocks are struggling

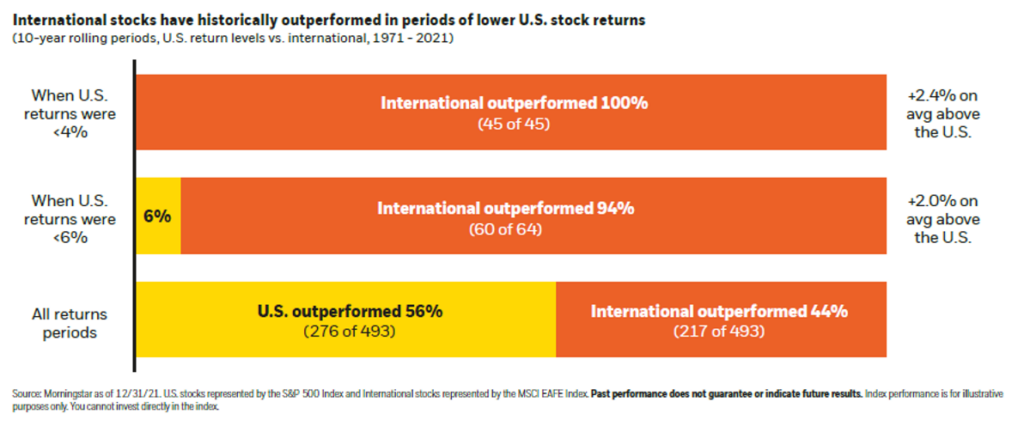

The graphic above breaks down performance of the S&P 500 vs the MSCI EAFE. During periods when domestic stocks produced below-average returns, international equities did better, by over 2% on average. Further, during all rolling 10-year periods since 1971, the top performer was almost a coin toss: the U.S. only did better 56% of the time.

Since trying to time regime changes is very difficult in real time without the benefit of hindsight, there are reasons to consider allocating both U.S. and ex-U.S. equities to an asset allocation.

Ex-U.S. equity may be able to help reduce risk in a portfolio

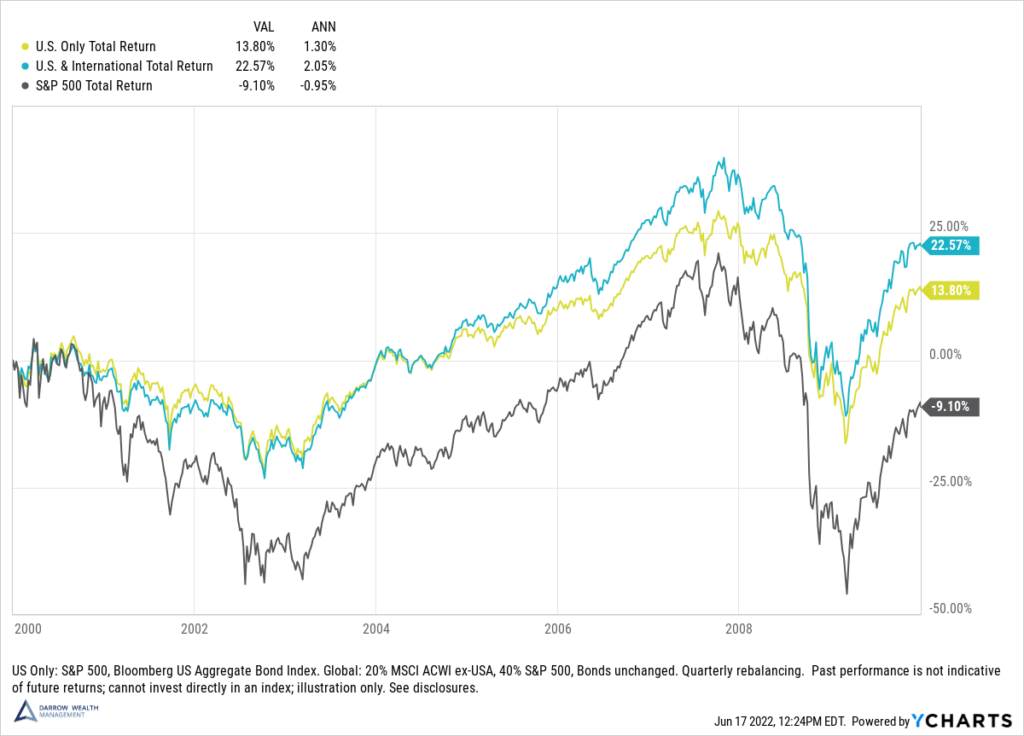

Having international exposure in your portfolio in the early 2000s and throughout the Global Financial Crisis would have been a key ingredient in reducing overall risk and maintaining some level of investment return.

By way of example, consider this hypothetical 60/40 portfolio of stocks to bonds. The U.S. only portfolio includes the S&P 500 and Bloomberg Barclays U.S. Aggregate Bond index while the U.S. & international portfolio allocates 20% of the equity exposure to the MSCI All-Country World Index ex-U.S.

From 2000 to the end of 2009, the global allocation would have outperformed by nearly 8.8% in total.²

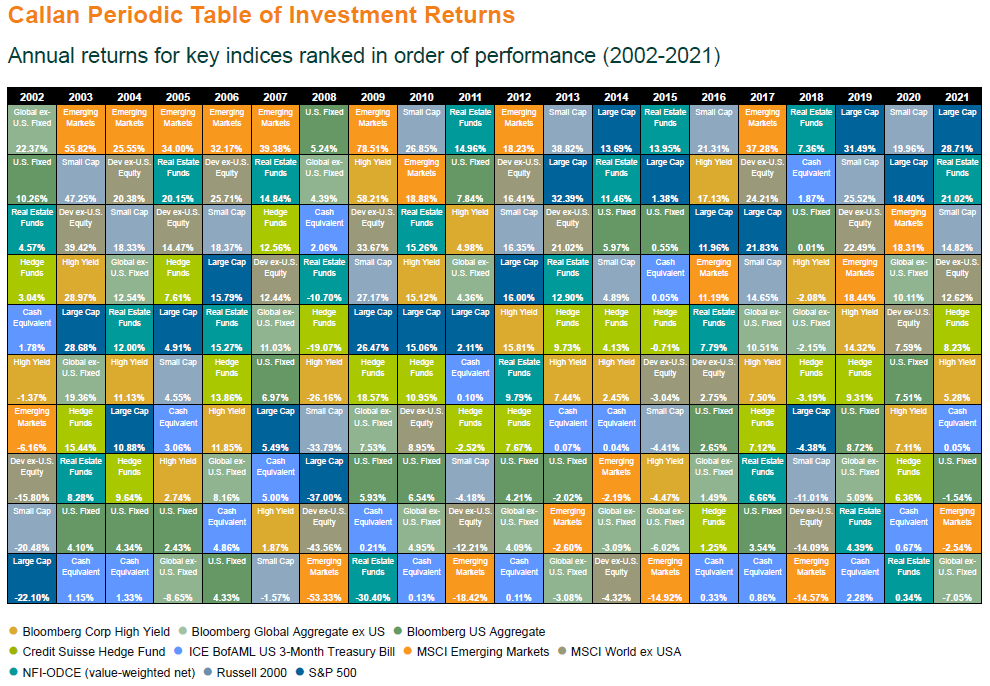

Other reasons to consider international assets in your portfolio

- Different sector concentrations. The U.S. is fairly tech heavy. The S&P 500 is currently about 27% technology companies. Compare that to Europe at 7%. Exposure to other sectors like financials and commodities in emerging markets can add overall diversification.

- Currency risk and return. At a high level, the relative strength of foreign currencies to the dollar has the potential to help or hurt returns. Asset managers can engage in different strategies to hedge or boost returns around foreign exchange rates, but the takeaway is that currency can be another layer of diversification.

- Valuations. Valuations outside of the United States have been much cheaper to the long-run averages for quite some time. Especially relative to the U.S., international stocks look much more attractive on a valuation standpoint. Despite the selloff in 2022, the S&P 500 is only now just in line with the 20-year average P/E ratio.

The takeaway

Adding ex-U.S. stocks to your portfolio may be able to help reduce risk over the long-term. But there are downsides to be aware of. Most notably, international assets tend to be more volatile. These swings can be to the upside or the downside. And just as the unique elements of investing overseas (like foreign exchange rates or sector exposure) can help investors at times, they can also hurt U.S. investors in other circumstances.

As with anything in investing, consider your personal risk tolerance, time horizon, and circumstances. Diversification isn’t a magic bullet, and if you do add international exposure to your portfolio, be sure to appropriately size the position to meet your needs.

Article written by Darrow Advisor Kristin McKenna, CFP® and originally appeared on Forbes.

¹As represented by the MSCI All Country World Index.

² For illustration purposes only and should not be misconstrued as a recommendation for any specific investment product, strategy, or personal advice of any kind. Does not include investment costs or expenses; you cannot invest directly in an index. Past performance is not indicative of future results.