How can you prepare your finances for a recession? Getting your finances in order for an extended period of economic difficulty or losses in the stock market will depend on your life stage and financial situation. The coronavirus outbreak has already significantly impacted the economy and financial markets, leaving investors wondering what they should do to prepare in the event the U.S. falls into a recession.

Financial planning during an economic crisis

Make sure you have enough cash to weather the storm after a sudden job loss

Having cash and investable liquid assets gives you flexibility for the unknown. If there’s a large unexpected expense, you may not need to take out a loan. If you’re out of work for a year, you may not need to sell your home.

Going overboard on your cash savings can hurt you too, so be careful not to sideline too much money in a cash account. In general, dual income households should have between 3 – 6 months of cash in an emergency fund while single individuals or couples with one breadwinner may want to have 6 – 9 months.

There are always exceptions – for example: business owners or professionals in M&A-heavy industries such as biotech and life sciences, it can be advantageous to be conservative with cash needs, but perhaps not more than one year.

Like the markets, life doesn’t move in a linear fashion. There will always be setbacks, unexpected hurdles, even a global pandemic. So if you’ve only saved the bare minimum or haven’t invested outside of your 401(k), you may find yourself in a tough spot if (or perhaps when) things don’t go according to plan.

The easiest way to save money is to spend less money. Having high fixed expenses relative to your income not only makes saving more difficult while you’re working, but it also affords you the least flexibility if you suddenly lose your job. Of course, the best time to prepare your finances for a recession is before one happens, but it may not be too late to try and right the ship.

Managing your investments during a bear market or a recession

For most investors, selling investments and going to cash will be a mistake. No one likes losing money. Wild swings in the stock market can make even the most level-headed investor second-guess their strategy. We all know that our accounts go up and down each day. Other times, like now, the market swings are much more volatile than usual. Checking your account can create unnecessary stress and perhaps worse, may end up pushing you to act when you shouldn’t.

Given how volatile the markets have been, a portfolio can deviate from target very quickly. For example, if you had a 70/30 portfolio of stocks and bonds on January 1st and left it alone, by March 24th the account would have drifted to 64% stocks and 36% bonds (assuming SPDR® S&P 500 ETF and 30% bonds and iShares Core US Aggregate Bond ETF).

Rebalancing is the process of periodically comparing your original asset allocation to your current portfolio, and if the holdings vary more than a maximum threshold of your choosing, then it may be time to rebalance. When you rebalance, you sell a portion of your portfolio that was outperforming (or underperformed less on a relative basis) and buy more of the underperforming asset to bring the investment mix back the way you originally intended.

Rebalancing is harder than it seems when markets have wild swings, but it is an important point to keep in mind to ensure you are well-positioned to participate in the inevitable recovery.

Since so many investors, even retired investors, are investing for the long-term, it’s imperative to stay the course and continue with your planned contributions to retirement accounts and brokerage accounts.

While it can be unnerving to invest during a recession or a downturn, there’s no way to accurately time the market or an “all clear” sign saying it’s now safe to get back in. And keep in mind – when the market is down that also means that valuations are cheaper, which can allow individuals to buy quality assets at cheaper prices relative to where they were before the downturn.

How a recession could impact recent retirees and workers planning to retire soon

The groups that are perhaps most impacted by the recent downturn from an investment perspective are recent retirees and those planning to retire soon.

Sequence risk is the impact the order of investment returns can have on your portfolio. Individuals are most vulnerable to a market downturn when their portfolio value is the greatest, which is typically while at the end of working years and at the onset of retirement. Withdrawals in retirement exacerbate the impact of losses on a portfolio.

Retirees who are concerned about the sustainability of their withdrawals amidst market volatility may decide to hold off on a major purchase or big trip. Pre-retirees may decide to work a little longer. Even if you can cut back, you may not have to, depending on your financial resources and the depth of your pre-retirement planning.

There’s no prize for being the richest person in the graveyard so it’s important to find a balance between living your life and your financial concerns.

Position your finances for the recovery in the market

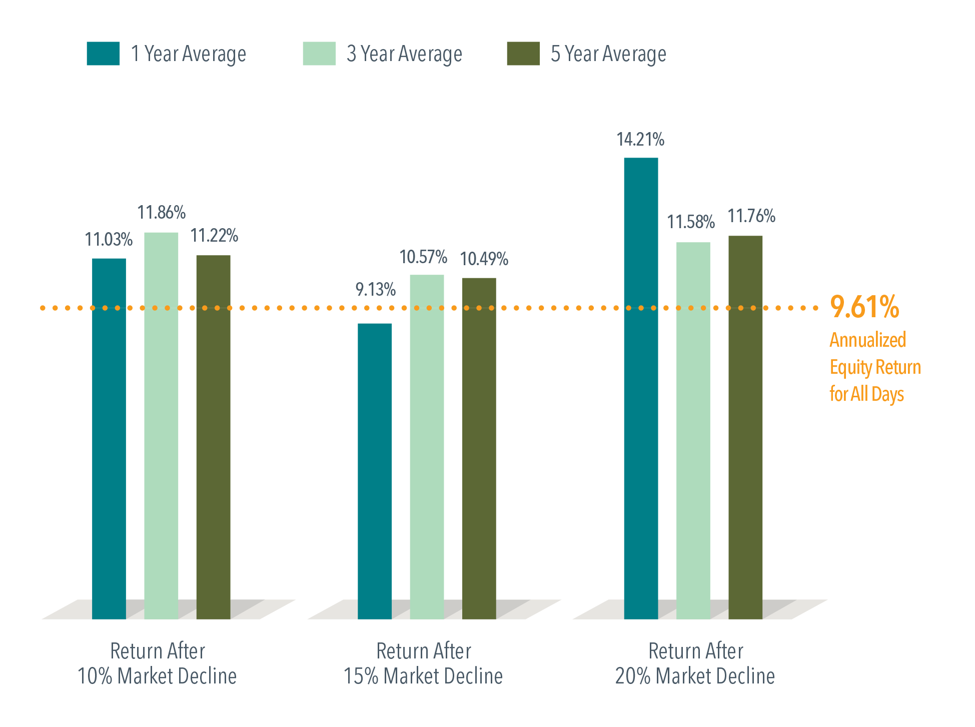

According to Dimensional, the stock market has, on average, performed quite well in the 1, 3, and 5-year periods following a 10% decline or worse. Past performance is not indicative of future results, but it does present a positive picture and helpful reminder that things will eventually get better, and could even faster than you might have expected. This reinforces how important it is to stay invested.

Average Stock Market Returns After Decline (Fama/French Total US Market Research Index Returns, July 1926 – December 2019)

Preparing your finances for a recession by maintaining a well-diversified portfolio

Preparing your finances for a recession by maintaining a well-diversified portfolio

Diversification is one of the best ways to reduce investment risk in your portfolio. We can’t control the financial markets, but we can control how we invest in them.

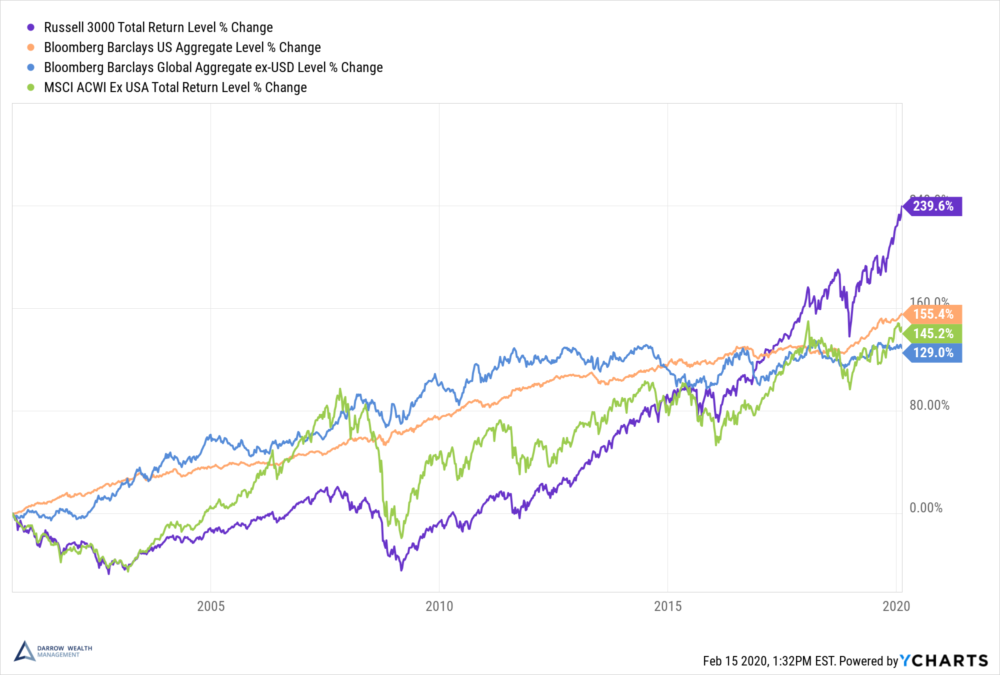

In the graph below is the U.S. stock market (in purple, the Russell 3000), U.S. bonds (in orange, Bloomberg Barclays Aggregate U.S. bond index), global bonds (in blue, Bloomberg Barclays Global Aggregate ex-U.S. bond index), and global equities (in green, MSCI ACWI ex-U.S.).

Source: YCharts

Source: YCharts

Each asset class comes out on top at least once over this period. For an extended period of time during and after the financial crisis, global bonds outperformed the other indices. More recently, the range of returns narrowed, especially around 2017. Other times, such as the 2008 financial crisis, the range of returns between the asset classes is more significant.

In another words: your asset allocation might not matter as much when the markets are chugging along (for reference, the S&P 500 was up nearly 22% in 2017), but when economic conditions weaken (like in 2008), the impact of diversification is much more evident.

There’s no telling how long a downturn will last or how severe it will be, but there are steps you can take to ensure you are well-positioned to manage the risk to your financial life.

Should You Keep Investing During a Recession?

The U.S. is in a Bear Market. There Could be a Recession. But This Isn’t 2008.

Preparing your finances for a recession by maintaining a well-diversified portfolio

Preparing your finances for a recession by maintaining a well-diversified portfolio