Crisis investing: where does the stock market go from here? The COVID-19 outbreak has affected us all in some way at this point. Even investors a ways off from retirement might be wondering whether it’s a good time to put money in the stock market, whether we’re passed the bottom, and how long the recovery will take. We’re answering the most common questions about the bear market, likely economic recession, possible recovery, and investment strategies during the current crisis.

What happens in the stock market after a bear market or recession?

Various facts about bear markets and the recovery from market lows

- Taking into account all U.S. bear markets since the mid-1920s, it took an average of 3.1 years for the broad market to recover from where it stood before the bear market began on a dividend and inflation-adjusted basis Source: WSJ

- The average bear market wipes roughly 36% off the S&P 500 and lasts for about 7 months, according to Dow Jones Market Data. If that holds this around, it would put the S&P at about 2200 some time around September. Source: WSJ

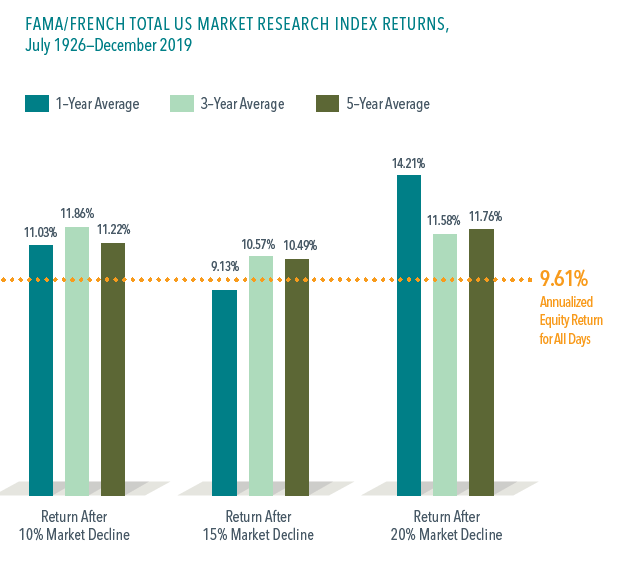

Source: Dimensional Fund Advisors.

Keep in mind that because of the way returns are compounded, you will require a gain greater than your loss to break even as you have fewer dollars left to grow. For example, if you started with $100,000 and lost -25%, you would need a gain of over 33% the next year to get back to $100,000.

Variance drain (or volatility drag) represents the negative impact volatility has on compounding. The more volatile an investment (measured by standard deviation), the more the arithmetic mean will vary from the geometric mean. The variance of returns effectively drains the portfolio, leading to smaller compounded returns.

How do sudden declines in the stock market during the year impact annual returns?

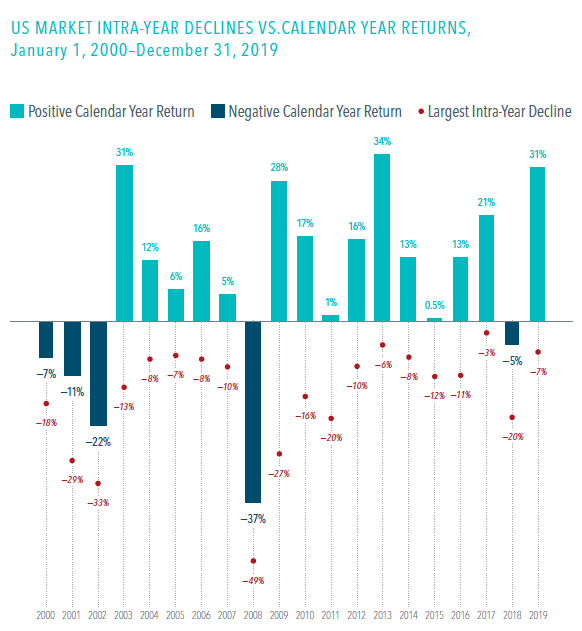

The stock market is volatile. Hard stop. That said, the Russell 3000, which represents about 98% of the U.S. stock market, finished 15 of the last 20 years in positive territory.

While daily declines and bouts of downward price pressure can cause investors a lot of stress, it’s important to remember that short-term swings don’t dictate how the market will do over the course of the entire year.

Source: Dimensional Fund Advisors. Russell 3000.

And 2009 is a great example: despite a -27% downturn, the broad-based market rebounded to finish the year +28%. This leads me to another critical point: staying invested, even during a recession. Over the last 20 years, 60% of the best 10 days for the S&P 500 fell within two weeks of the worst 10 days (more on that below). If you miss out on the recovery, you simply can’t make that up.

Which raises another key investment principle: global asset class diversification.

Was this the bottom? Putting recent volatility in the stock market into context

Historically, the stock market has bottomed out long before the worst of the economic data unfolded. On average, the market reaches its trough about 4-8 months before the economic data.

That said, no one knows whether we’ve already reached the bottom. You can only define the bottom when we’re clearly looking back in history and can pinpoint the day things began to turn around. And that usually happens in fits and starts—it isn’t a clean-cut ‘V’ shape. As of the writing of this article, the S&P 500 is almost back in a bull market, which will be a gain of at least 20% following the recent lows.

But do these labels even matter or are they just semantics? Statistics like this are like breadcrumbs: together they create something useful, but as stand-alone bites, they can leave you astray. Context is everything.

Even if we do creep into a bull market tomorrow or the next day, on one hand, the S&P is still down nearly -18% on the year, but on the other, we’re only back to early 2019 price levels—so it’s all relative.

3 noteworthy breadcrumbs: price swings on the S&P 500 in March 2020

- On March 12th the S&P 500 closed down -9.5%. On March 13th the index closed at +9.3%. That is nearly a 19% swing in 2 days!

- March 2020 was the most volatile month ever: the S&P’s average daily swing was 5%. The last record was from November 1929 – the average daily swing was ‘only’ 3.9%.

- When ranking the best and worst days for the S&P over the last 80 years, as of March 26th, 9 days in March 2020 made the list of top 31 worst days of all time and top 33 best days of all time. So before March was even over, nine days were historically bad or good!

Is now a good time to buy?

Should you stop making scheduled contributions to a non-retirement investment account or double-down on your investment strategy?

The right time to invest in the stock market depends more on your personal circumstances than it does current market conditions. At a high level, you’ll want to consider whether you need the money for anything else in the next few years and whether you should put the cash to work somewhere else (such as high-cost debt).

In volatile markets, some investors with cash to put to work wait for clear signs of one of two things: the bottom or the recovery. Unfortunately, it doesn’t work that way. No one knows where the bottom will be and the only way to know when the recovery begins is after it happens, when we can look back and identify the moment things finally began to turn around.

In fact, even if you bought at some of the pre-financial crisis highs, you’d be better off staying invested than if you sold before the bottom and got back in during the recovery. During down markets, dollar-cost averaging can pay off. Dollar-cost averaging is the process of systematically putting cash in the market at predetermined intervals. That way you smooth out the impact that volatile price swings can have on your investments.

The stock market is the only place that investors walk away when prices go on ‘sale.’ Valuations are all relative, but when you buy a stock you’re paying for future earnings of the company—that extends well beyond the current year. While investing through a recession may seem counterintuitive, it’s about time in the market—not timing the market.

How long until the market recovers after a recession?

Source: Dimensional Fund Advisors

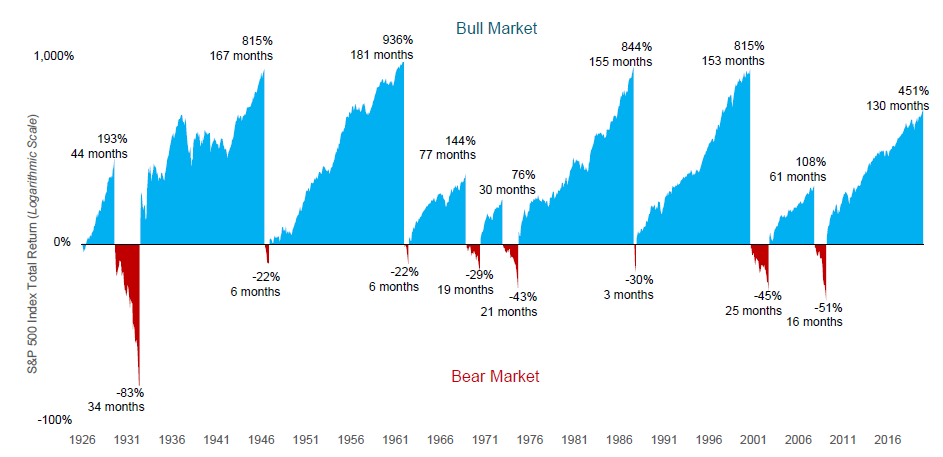

As you know, a bear market (generally thought of as a decline of 20% or more from recent highs) is not the same as a recession, which is broadly defined as two or more consecutive quarters of negative GDP growth.

On average, the S&P 500 has been up over 15% in the year following a recession. In fact, the index even averaged nearly 4% during the recessions.

There is also not a definitive correlation between the severity of a recession and losses in the stock market. By way of example, during the financial crisis, annualized GDP growth was -5.1% despite a total drawdown in the stock market of over 50%. But on an annualized basis, the S&P was down around -38% in 2008 only to finish 2009 up over 23%. It really just depends on how you measure it and what your endpoints are.

The point is that statistics are a helpful guide, but they only take us so far. Depending on the index you’re looking at, time period, and how many different measuring sticks you use, you could get a different outcome.

Looking back, would you regret investing during 2008 or not investing enough? [Hint: through 2019 cumulative returns could be +450%]

Thinking through the current crisis

The U.S. has never been in this situation before in modern history, so while past downturns offer the only guide as to what might be to come, the truth is that no one knows for sure. The constantly changing nature of the virus and fiscal interventions require financial professionals and economists to continually adjust.

For investors, it’s critical to vigilantly manage your finances during a downturn and focus on what you can control. You can only spend (or invest) a dollar once, so you shouldn’t settle for a mediocre plan. Having confidence in your strategic plan to build—and protect—your wealth requires robust planning and a comprehensive approach.

At Darrow Wealth Management, we can stress-test a portfolio and financial goals in tandem using a Monte Carlo simulation as part of a client’s financial plan. To learn more about our wealth management services and how we work with clients, please contact us to discuss your personal situation.

Related:

March 2020 Has Become the Most Volatile Month in Stock Market History

How to Prepare Your Finances for a Recession or Prolonged Market Downturn

Analysis: How Market Volatility and Cash Flows Impact Your Account

Should You Keep Investing During a Recession?

The U.S. is in a Bear Market. There Could be a Recession. But This Isn’t 2008.

Should You Go To Cash Until The Market Recovers Or Ride It Out?