What You Need to Know About Capital Gains Tax

What is a capital gains tax? When you sell an asset like a stock or a home, your gain could be taxable. The tax rate

Home » Wealth Management Services » Financial Modeling and Retirement Projections

At Darrow, all of our financial models are developed in conjunction with a CERTIFIED FINANCIAL PLANNER™ professional. We are also a fee-only registered investment advisor. This means that we do not sell any products or receive commissions; and we have a fiduciary duty to make recommendations that are only in the best interest of our clients.

Common topics for analysis may include:

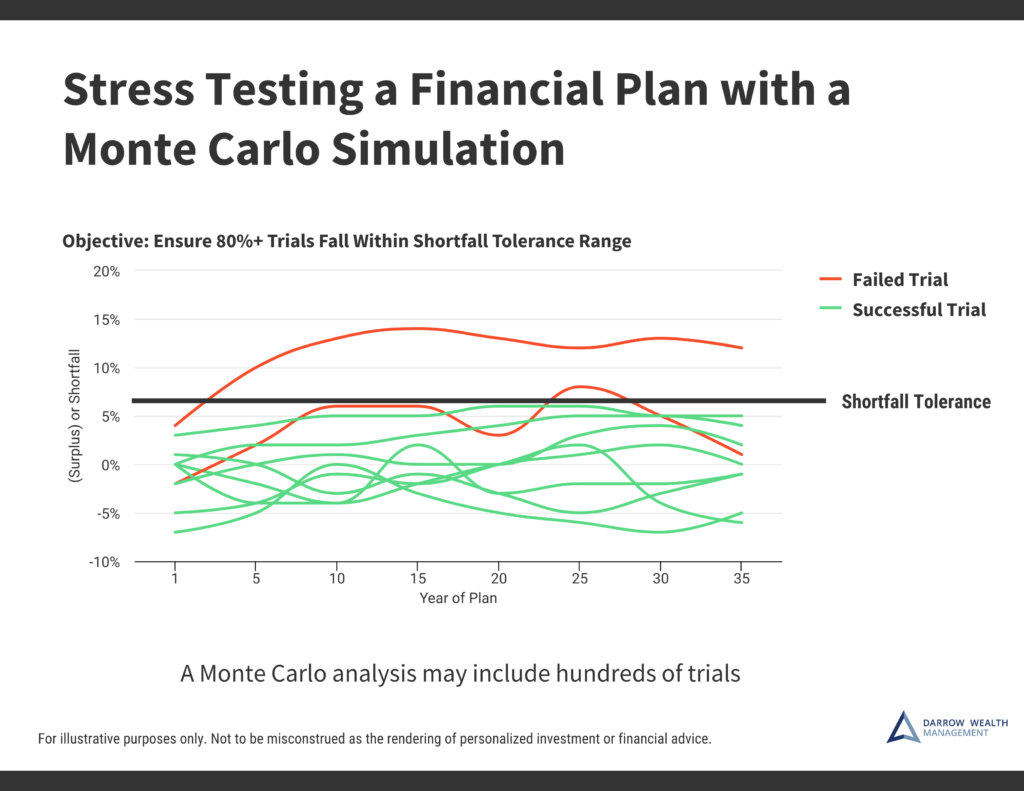

To help assess the feasibility of your retirement and financial goals, we develop a comprehensive financial model to include pre-retirement income and expenses, anticipated living expenses in retirement, contributions to investment accounts, projected Social Security benefits, taxes, life expectancy, inflation, etc. Detailed assumptions about the standard deviation and average expected annual return are added to the plan at the account level.

Stress testing a financial plan and retirement projections can help investors feel more confident in the likelihood they won’t run out of money under different conditions in the financial markets. Learn more.

Darrow Wealth Management does not provide tax and/or legal advice. Certain circumstances may require us to coordinate with your qualified tax and/or legal advisor.

In 1987, we began helping individuals and families invest in their future. Now a second generation family business, we are proud to have the opportunity to help multiple generations of families in the community achieve their wealth goals.

As a SEC-registered investment advisor, we offer comprehensive financial planning and investment management for clients locally in greater Boston and across the country, from Florida to California.

This often enables us to maintain our longstanding relationships as clients move or retire. To learn more about our asset management and financial planning services, please contact us today.

What is a capital gains tax? When you sell an asset like a stock or a home, your gain could be taxable. The tax rate

Losing a spouse is a difficult time, and navigating the complexities of inherited assets can feel overwhelming. If your spouse named you as the sole

Why own a home in a revocable trust? There is one main reason to consider putting a house in trust: to avoid probate court. Although