Financial Planning + Asset Management= Wealth Management

Plan for Sudden Wealth with a

CERTIFIED FINANCIAL PLANNER™ professional.

Sudden Wealth Advisors

Darrow Wealth Management specializes in planning for a sudden liquidity event or windfall, typically from stock options after an IPO, inheritance, or selling a business. If your financial situation has changed dramatically, you may need help developing a financial and investment strategy from the ground up.

While this may be the first (or only) time you’ll need to plan for a large windfall, it’s not ours. We have the experience to help guide you to – and through – a sudden wealth event.

Wealth Management = Investment Management + Financial Planning

Because our goal is to offer clients a complete solution to their asset management and financial planning needs, we offer one service: wealth management. In working with clients, we believe that to get the best outcome, financial decisions shouldn’t be made in a vacuum, which requires a deep understanding of your financial situation and goals.

That’s why our wealth management services are centered around ongoing investment management and financial planning support. Because without a continued relationship, proactive planning opportunities are often lost.

Book a Consultation

We are accepting new clients with a minimum of $2M in investable assets¹ (including liquidity events in the next 12 months).

Speak with an Advisor

Wealth Management and Financial Planning Services

Fee-Only Financial Advisor and Fiduciary

The nature of the advice and support we provide typically evolves over the course of a long-term partnership with our clients, as their financial situation, life stage, and goals inevitably change.

Fee-Only Advisors Don’t Earn Commissions or Sell Products

Work with an advisor – not a salesperson. As a client, you will never have to worry that your advisor may try to sell you a financial product for their own personal gain. Why? As a fee-only financial advisor, we do not sell securities, investment or insurance products. We also don’t receive commissions or compensation from third parties.

Acting in Your Best Interest as a Fiduciary Investment Advisor

Founded in 1987, Darrow Wealth Management is now a second-generation family business. As an independent registered investment advisor, we are a financial fiduciary, required to act – at all times – for the sole benefit and interest of our clients. A fiduciary duty is the highest act of loyalty, trust and care as established by law. Unfortunately, not all financial advisors are obligated to put your best interest ahead of their own.

Media appearances by Kristin McKenna CFP®, President, Darrow Wealth Management

Wealth Management in Boston and Beyond

Darrow Wealth Management is an asset management and financial planning firm and SEC-registered investment advisor. We have offices in Boston, MA and Needham, MA but our clients live around the country.

Unfortunately, investors tend to prioritize the financial advisor near me search when looking for a wealth manager. When looking for a fiduciary financial advisor, consider prioritizing the right complete fit over an office location near you.

Who We Help

Although there are many different paths to wealth, most of our wealth management clients are:

- Early Employees, Founders, and Executives with Stock Options and Equity Compensation Expecting a Windfall from an IPO or Acquisition

- Business Owners Exiting a Privately-held Company

- Individuals Planning for Sudden Wealth After Receiving an Inheritance or Trust Distribution

- Other Types of Liquidity Events (Settlement, Divorce, etc.)

Advisory Team

Our team of advisors have broad and deep experience and education in the fields of investment management, financial planning, and tax, including the CERTIFIED FINANCIAL PLANNER™ designation, CFA, and CPA professionals. Learn more about the Darrow team of financial advisors.

Recent Wealth Managment Articles

Options and Rules When Inheriting an IRA From a Parent

What to do after inheriting an IRA from a parent If you’ve inherited an IRA from a parent, you may be wondering what your options are. Though there are some

Should You Take a Pension or a Lump Sum?

Should You Take a Pension or a Lump Sum? Deciding between a lump sum or receiving pension benefits monthly requires careful planning and consideration. Though your personal situation and circumstance

7 Ways to Manage Concentrated Stock Positions

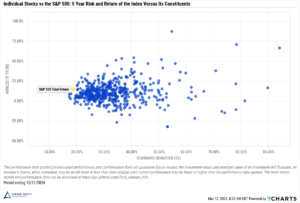

What is a concentrated stock position? If one stock makes up more than 10% of your overall asset allocation, it’s probably too much. A diversified portfolio is the cornerstone of