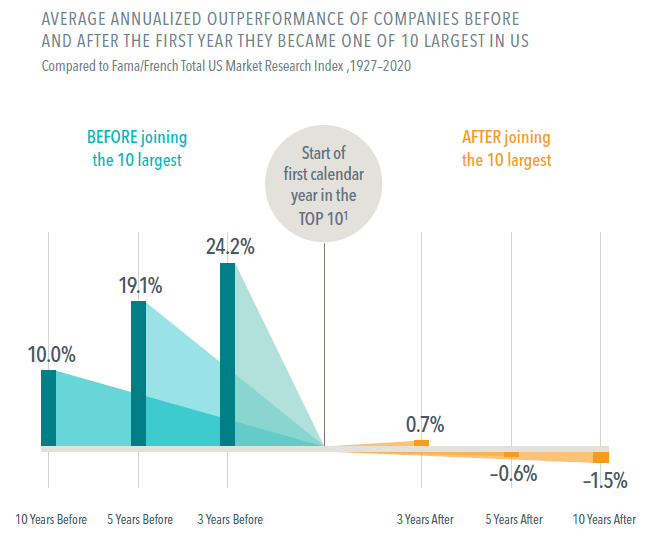

With the dominance of the largest U.S. stocks often occupying headlines, it’s worth remembering that the biggest companies don’t always produce the best returns. In fact, according to research from Dimensional Fund Advisors, historically, stocks tend to underperform after entering the top 10 largest stocks by market capitalization. On average, large cap stocks hit peak outperformance relative to the broad-based market¹ in the years right before becoming one of the biggest companies in America. When investing, it’s key to consider the benefits of diversification and remember that past performance doesn’t always resemble future results.

Returns before and after a stock enters the top 10 by market cap

Data shows that over time, stocks tend to perform worse than the market in the years after becoming one of the largest public companies. For example, Intel was outperforming the market annually by 29% on average prior to entering the top 10. But for the next decade, the company underperformed by about 6% per year…a 35% average swing.

Data on historical trends doesn’t always translate to specific stocks, of course. And there’s no way of knowing when or if a big company might enter the top 10 and whether past trends will materialize. This is the value of diversification: because market timing is impossible to do with regularity.

Stocks don’t only go up

2020 was an incredible year for many areas of the stock market. The top five biggest companies by market cap all outperformed the S&P 500. Apple and Amazon had total returns over 75%! During such a strong year, it can be tempting to pile into hot stocks. This is trading on momentum.

But 2021 year to date (to 5/18), Apple and Amazon are down on the year, marking a huge year-over-year swing. Tesla’s trajectory is even more eye-popping. The company began 2020 well outside the top 10 largest stocks, but by January 2021 had become the sixth largest after notching a stunning 743% return. But despite starting the year well inside the top 10, Tesla is down over 18% year to date.

Of course, altogether, the performance of these single stocks has beat the S&P 500 over the short ~17 month timeframe. But we only know this in hindsight – and as of today. It’s critical to remember that momentum in the markets can shift quickly and there’s no telling what returns will be going forward.

Shift in momentum: 2020 vs 2021 returns for the largest US stocks

Another notable stock is J.P. Morgan. The big bank began 2020 inside the top 10, but fell off after a disappointing -5.5% return in 2020. Yet the stock is up almost 30% year to date, despite starting the year outside of the top 10.

The momentum factor, the idea that the best performing stocks will continue to do so, was the leader in 2020 relative to many other popular factors, like value or cyclicals. But factors often rotate as they have in 2021. As of the writing of this article, momentum and value have traded places, going from first to last and vice-versa.

Many drivers of equity returns

At the most basic level, the value of a stock is based on the present value of its future cash flows (numerator), discounted by interest rates (denominator). But there are a lot of other factors that affect a stock’s price and relative value. Many of these factors help explain the astronomical returns from 2020 and also why stock picking is so unreliable. Further, other factors that investors may assume would significantly impact stocks – like the possibility of rising tax rates – typically haven’t.

For example, in 2020, technology stocks soared as the world went virtual. Tech stocks, which typically don’t pay dividends and primary value is mostly in distant price appreciation, benefit from interest rates near zero as it reduces the cost of trading future upside for cash flows now. Low bond yields also contributed to broad support of equities.

Also consider economic cycles. Value stocks, like financials (e.g. J.P. Morgan) tend to perform well in an economic recovery. Banks were particularly hard-hit in 2020 by pandemic-related reserves for deep losses that didn’t fully materialize. As stimulus payments flow in 2021 and trading activity remains high, banks and investment managers are likely to benefit. Tesla has long been a retail favorite. In 2020, revenues kept climbing, idle consumers were spending, and the stock was added to the S&P 500.

Other factors that can affect asset prices include geopolitical tensions, terrorism, inflation, health of the economy, current monetary and fiscal policy and future expectations. Financial markets look ahead, so forward expectations relative to current conditions is very important.

The case for diversification

Today, it’s practically impossible to envision a world without companies like Amazon and Apple reigning supreme. But that doesn’t mean it’s not going to happen. Except for one year, General Motors was the largest company in the S&P 500 from 1955 to the mid -1970s. It’s now 104th. IBM took over and had a similar reign until the late 1980s. IBM is now ranked 64th. GE led the pack between the early 1990s and mid-200s, though was edged out by Microsoft a few times. GE is now ranked 70th and Microsoft 2nd. Since 2012, Apple has kept the top spot (except one year).

The purpose of diversification is because like broad-based market moves, there’s no way to know when certain sectors, styles, or factors are going to outperform and for how long. So by holding a diverse mix of asset classes, factors, styles, geographies, etc., there’s a good chance that some part of your portfolio will be underperforming at any point in time. And that’s ok.

The goal of diversification is to help improve the probability that during a downturn, your portfolio won’t decline in value as much as a concentrated allocation would. But investors can’t have their cake and eat it too. The tradeoff is that a diversified asset mix likely won’t outperform a concentrated bet in one area of the market when it happens to be outperforming…like Tesla and technology stocks in 2020.

Investment professionals don’t have a crystal ball. Historical data is helpful to assess a likely range of possible outcomes, but there are so many factors which can drastically alter the outcome for a single stock or markets in general. Many of these lessons played out during the Covid-19 crash and subsequent recovery.

For long-term investors, it’s important to know when to take profits. The fear of missing out (FOMO) makes it hard to diversify when you have big gains in a concentrated stock position. Of course, it’s also often the best time to do it.

This article was written by Darrow Advisor Kristin McKenna, CFP® and originally appeared on Forbes.

Disclosures

¹ Fama/French Total US Market Research Index: The value-weighed US market index is constructed every month, using all issues listed on the NYSE, AMEX, or Nasdaq with available outstanding shares and valid prices for that month and the month before. Exclusions: American Depositary Receipts. Sources: CRSP for value-weighted US market return. Rebalancing: Monthly. Dividends: Reinvested in the paying company until the portfolio is rebalanced.

Examples in this article are generic and for illustration purposes only. Past performance is not indicative of future results. This is a general communication for informational and educational purposes only and not to be misinterpreted as personal advice or a recommendation for any specific investment product, strategy, or financial decision. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. If you have questions about your personal financial situation, consider speaking with a financial advisor.

All indexes are unmanaged and an individual cannot invest directly in an index. Index returns do not include fees or expenses. Past performance is not indicative of future results.