Sudden Wealth Financial Advisors

Home » Sudden Wealth Financial Advisors

Sudden Wealth Financial Advisor

Darrow Wealth Management specializes in helping individuals expecting a sudden wealth event or financial windfall. Sudden wealth from stock options following an IPO or acquisition, sale of a business, an inheritance, trust fund distribution, or other major wealth event can happen overnight. We’ll work to help you develop a strategy to make the most of the windfall and navigate other upcoming major financial decisions.

Types of Sudden Wealth and Liquidity Events

Stock Options

Large Inheritance

An unexpected windfall can change your life. If you’re expecting a lump sum from an inheritance, sale of a business, IPO or acquisition, work with a sudden wealth advisor who specializes in helping investors like you.

You can only spend a dollar once, so it’s important to have the support of a fiduciary financial advisor who will prioritize your goals and provide honest advice about what is – and isn’t – financially feasible.

Nationally Recognized Wealth Advisor in Stock Compensation

Selection of media appearances by Kristin McKenna CFP®, President of Darrow Wealth Management and a nationally recognized specialist in employee stock options and equity compensation.

Publications above reflect media organizations that have quoted and/or published articles authored by Kristin McKenna and should not be misconstrued as a current or past endorsement of Kristin McKenna, Darrow Wealth Management, or any of its advisors. Please refer to the media page for more information and links to published works.

Financial Planning and Investing After a Liquidity Event or Sudden Windfall

A major liquidity event can transform your financial life. To maximize the opportunity, it’s critical to get the right team of advisors in place before making an irreversible decision. Through an ongoing advisory relationship, we aim to help ensure you are well-positioned to meet your short and long-term goals.

Ways our sudden wealth financial advisors can work to help you:

Financial planning. Cash flow projections, retirement planning, and development of a comprehensive financial plan

Tax planning. Understand the tax implications of the windfall including options to reduce tax liabilities in coordination with your tax professionals

Investment advisory services. Implement an investment plan based on your risk profile and cash flow needs

Custom investing solutions for liquidity and diversification. Depending on your goals and assets, sudden wealth investors may benefit from an asset-based loan or custom investment management strategies such as the use of options

Goal funding. Discuss your financial goals in light of the sudden wealth event, including planning for generational wealth, education funding, major purchases, ongoing income needs, etc.

Estate planning and gifting. Coordinate approach with your attorney to help ensure strategy is aligned with your post-windfall financial situation and in consideration of federal and state estate tax considerations

Charitable giving. Consider various vehicles to meet charitable giving objectives alongside tax planning considerations

Coordinate with tax and legal advisors. Coordinate approach with your tax preparer and estate planning attorney

Our approach in navigating a sudden wealth event is customized based on your needs and the nature of the windfall. As you might imagine, the planning opportunities and considerations after receiving an inheritance from a parent is usually quite different from an employee with stock options during an IPO.

Sudden Wealth Management: Putting New Wealth to Work

By integrating financial planning with investment management, our goal is to help you build and grow your wealth. Learn more about our Wealth Management Services and how we may be able to help you.

As a financial fiduciary and registered investment advisor, we have a legal duty to act in our clients’ best interest at all times. This is the highest act of loyalty, trust and care as established by law.

Fee-Only Wealth Management

Work with an advisor – not a stock broker. As a client, you will never have to worry that your advisor may try to sell you a financial product for their own personal gain. As a fee-only financial advisor, we do not sell securities, investment products, or receive commissions or compensation from 3rd parties.

Meet the Team of Sudden Wealth Advisors

Our team of advisors have broad and deep experience and education in the fields of investment management and financial planning. Our advisors include a CERTIFIED FINANCIAL PLANNER™ professional, CPA, and Chartered Financial Analyst® designations. Learn more about the Darrow team of financial advisors.

Sudden Wealth Financial Advisors Related Articles

83(b) Election for Stock Options and Restricted Stock

For individuals with stock-based compensation, an 83(b) election has the potential to greatly reduce taxes on stock options or restricted stock. When you purchase unvested stock compensation and make the election, you recognize the taxable gain now (if any), instead of when the shares vest. What is an 83(b) election?

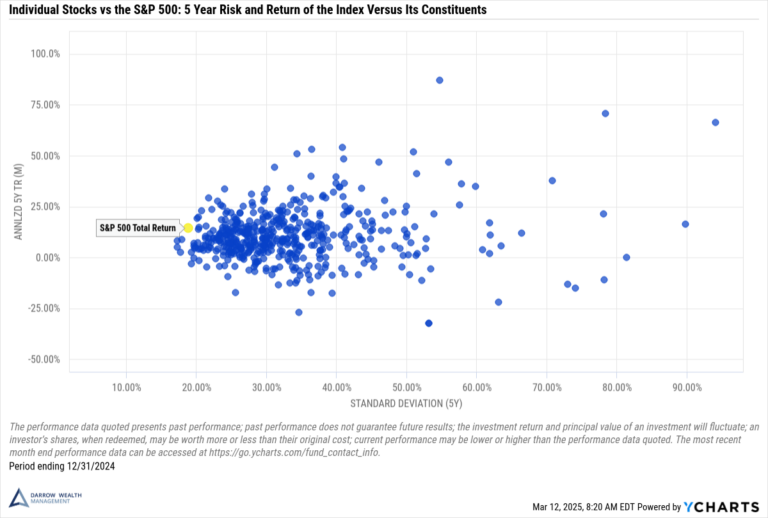

6 Ways to Manage Concentrated Stock Positions

What is a concentrated stock position? If one stock makes up more than 10% of your overall asset allocation, it’s probably too much. A diversified portfolio is the cornerstone of a risk-adjusted investment strategy. Since single stocks don’t move like the broader market, you’re exposed to much greater risk. Whether

What Does an IPO Mean for Stock Options? What Happens to Employees When a Company Goes Public

Whether you work for a private company about to IPO or one that’s recently gone public, you may wonder what that means for employees and their stock options. Financially, what an IPO means for current and former employees mostly depends on when you were hired. For early-stage employees and founders

Qualified Small Business Stock: The Section 1202 Gain Exclusion

If you invested in a startup or small business (founders, employee exercise of stock options, business owner), you need to know about qualified small business stock. If eligible, you may be able to exclude up to 100% of the gain from federal taxes when you sell your shares through the