Wealth Management Insights

Sign Up for Weekly Investing Insights

Selling a Business? Brokers Share Tips on How to Maximize the Sale Price

The sale of a business marks a major life event. It’s emotional, stressful, and exciting all at the same time. And unfortunately, it’s often a

Planning to Retire Early? Now You Need to Figure Out What to Do Next.

Who doesn’t love the sound of an early retirement? For many busy executives and business owners, slowing down and enjoying your financial success early in

Beneficiaries of Inherited IRAs Get More RMD Relief — For Now

A few years ago, if you inherited an IRA from a parent, the distribution rules were simple: you could stretch withdrawals over your life expectancy.

True Cost of Owning a Second Home

Owning a second home or vacation property can sound enticing. But it can also be very expensive, both in terms of time and money. There

4 Key Steps in Managing Sudden Wealth

There are many ways individuals become suddenly wealthy. Depending on the nature of the windfall, planning opportunities and considerations will vary. For example, the tax

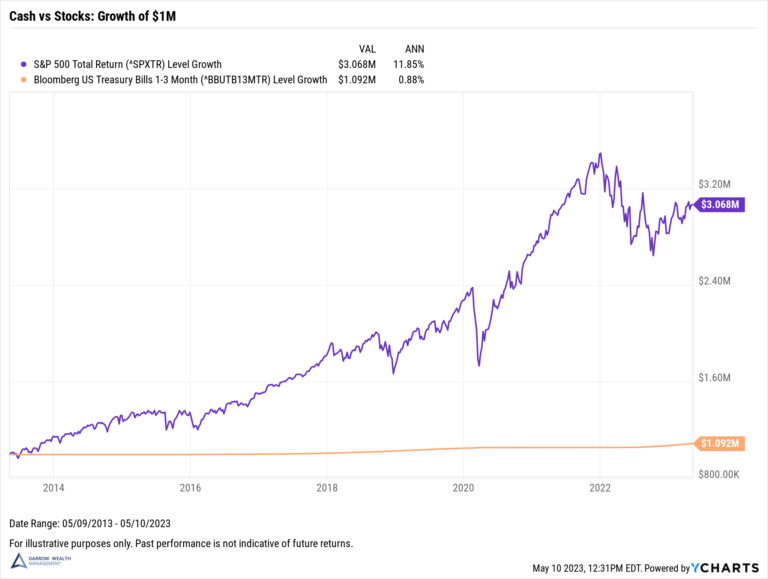

Hold Cash or Invest? History Shows Cash Isn’t King for Long

Should you hold cash or invest in the market? Attractive yields on savings and cash-like investments can make it tempting to hold cash instead of

What to do After the Death of a Spouse

Losing a spouse can be an overwhelming and emotional experience. While it’s possible to organize financial documents ahead of time, there’s no way to truly

Financial Planning for a Divorce

There are many financial planning considerations before, during, and after a divorce. A key part of the process from a financial standpoint is dividing the

Market Outlook: 3 Reasons Long-Term Investors Should Be Optimistic

It seems like bad news is inescapable these days. For much of last year, even good news about the economy was bad news for markets.

How to Negotiate Equity in a Private Company or Startup

Working for a startup can pay off big financially, but a lot must go right along the way. If you are considering taking a job

You Shouldn’t Always Delay IRA Distributions

The Secure Act 2.0 just upended retirement planning…again. The age when retirees must begin drawing from non-Roth retirement accounts increases to 73 in 2023, then

5 Big Changes to Roth Accounts in Secure Act 2.0

The Secure Act 2.0 was signed into law December 29th, 2022, bringing more major changes to tax law. Among the most notable changes include a

Secure Act 2.0 to Bring Sweeping Changes to Retirement Rules

Congress is once again poised to make sweeping changes to the retirement and tax rules in the last two weeks of the year. The Secure

Donating Stock to Charity

Donating appreciated stock to charity can be a great way to give back and reduce your tax bill. Taxpayers who itemize get a tax deduction

Massachusetts ‘Millionaires’ Tax Applies to Sudden Wealth Events

Taxachusetts is back. In November 2022, proponents of the Massachusetts ‘millionaires’ tax (question 1) won their bid to nearly double the income tax rate on

Avoid Self-Inflicted Losses in a Down Market

Declines in the financial markets are an uncomfortable part of investing. Taking steps to plan ahead of a market decline is best, though what you

Frozen IPO Market Reveals Dangers of Pre-IPO Exercising & Pre-Spending a Windfall

The Instacart IPO is on hold…again. What should employees with stock options do when their employer’s IPO stalls? In truth, best practices around an IPO

The Best Way to Take Required Minimum Distributions (RMDs)

Updated for 2023. Planning can help optimize annual required minimum distributions depending on your goals and cash flow needs. After the passing of Secure Act