Wealth Management Insights

Sign Up for Weekly Investing Insights

2023 IRS Contribution Limits and Tax Rates

The IRS has released the 2023 contribution limits for retirement plans and other cost-of-living adjustments. The agency also released tax brackets for ordinary income and

What to Do With Cash When Interest Rates Rise

Good news is hard to find in the financial markets this year. But there is one silver lining: cash is worth something again. So if

Should You Pay Off Your Mortgage Before Retirement?

Is retiring with a mortgage a good idea? Most individuals will jump through hoops to live mortgage-free, regardless of whether it makes the most sense

What’s The Best Thing To Do With Inherited Money?

Updated for 2024. There are lots of ways to spend an inheritance. But just because you have options, doesn’t mean they’re all good options. After

9 Charts Every Investor Should See

Investing during periods of volatility can be difficult, especially when markets seem arbitrary. Gaining a historical perspective can help expectations for investors and reframe events

IRS Wants to Change the Inherited IRA Distribution Rules

UPDATE: In April 2024, the IRS again announced final regulations will be forthcoming and will apply (at earliest) to the 2025 distribution year. Individuals affected

Developing an Exit Strategy for Stock Options in a Down Market

Stocks are down this year, pretty much across the board. Unfortunately, there are some companies that won’t survive the downturn. Even for the ones that

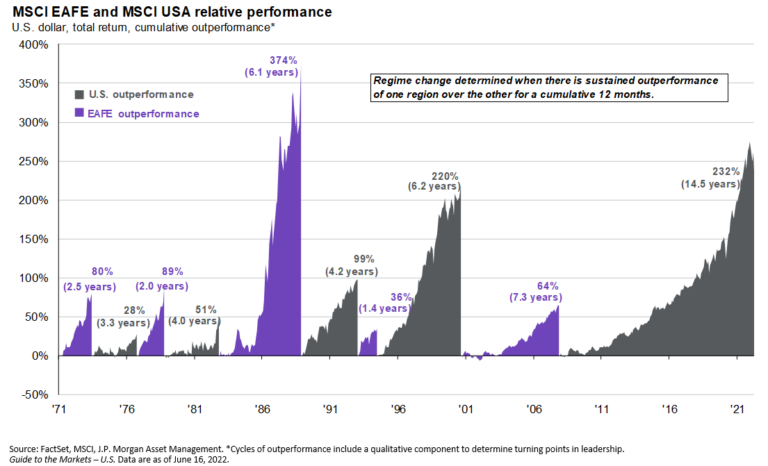

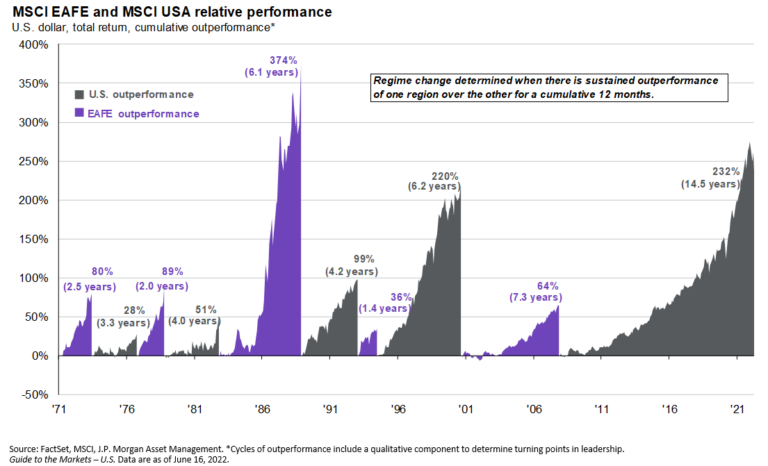

Reasons to Include International Investments in Your Portfolio

The United States currently represents 60% of the global equity market.¹ This means investors with an extreme home bias are ignoring 40% of the equity

Should You Buy Treasuries?

With interest rates going up, Americans are rushing into U.S. Treasuries at a record pace. Wondering if you should buy Treasury notes or bills in

What a Down Round Means for Employees with Stock Options

Quite simply, a down round is when a company raises money at a lower valuation per share relative to earlier financing rounds. A simple example:

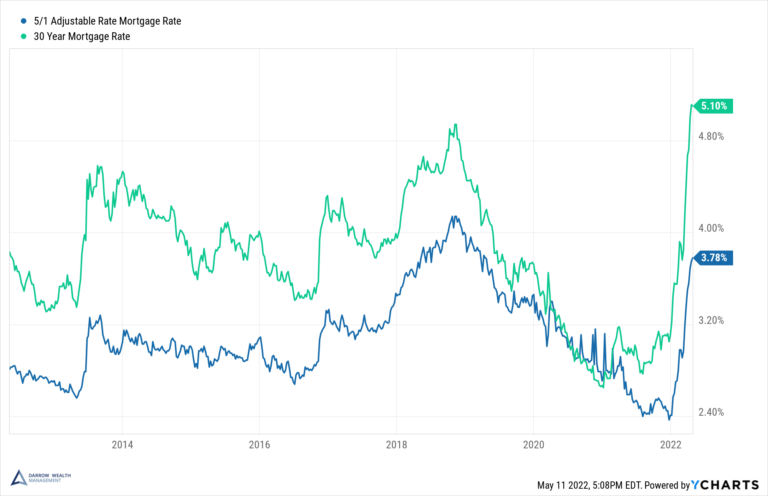

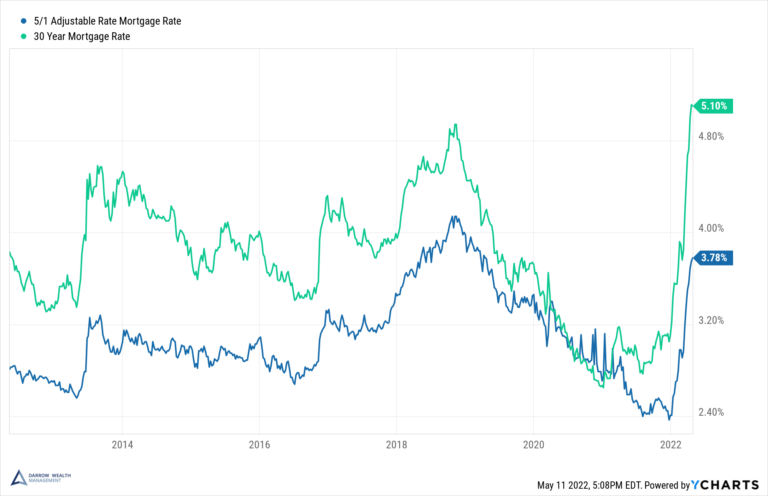

Considering an Adjustable Rate Mortgage (ARM) When Rates Rise

Interest rates are rising, and that’s bad news for homebuyers. The national average rate on a 30-year fixed mortgage is now over 5%. After being

2 Reasons Taming Inflation Won’t Be Easy

Inflation is at 40-year highs. The Federal Reserve has started raising interest rates to cool the economy and tame inflation. But it won’t be easy.

How Stocks Perform Before, During, and After Recessions May Surprise You

No one knows when the U.S. will enter a recession again. And this is precisely why it’s important to always be prepared for an economic

Ways to Prepare Your Finances for Unknowns, Including Recessions or Market Downturns

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves.” – Peter

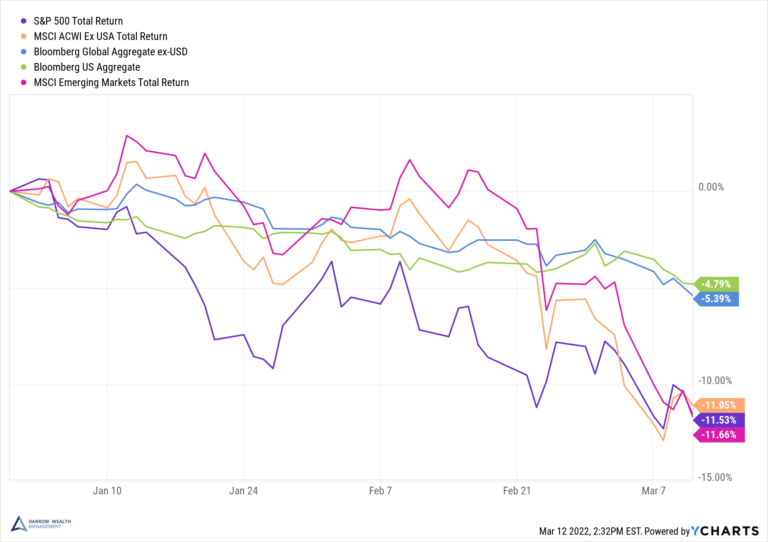

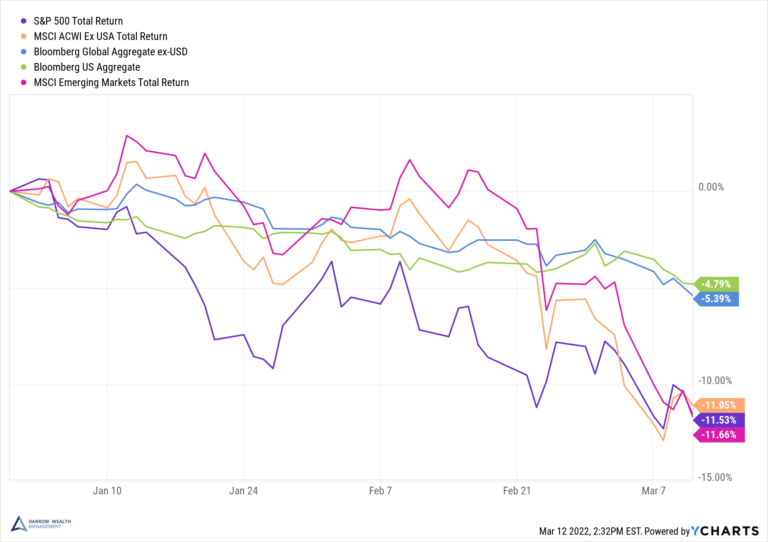

It’s Been One of the Top 5 Worst Starts to a Year for Stocks and Bonds

We all know 2022 hasn’t been kind to investors so far. But according to BlackRock, it’s been one of the worst two months to start

Does the Fed Funds Rate Affect Mortgage Rates and Interest on Cash Savings?

What does it mean for investors, homebuyers, and individuals with short-term cash deposits when the Federal Reserve raises interest rates? While rates don’t move in

3 Biggest Mistakes Investors Make in Volatile Markets

Investing through market volatility can be challenging. Should you go to cash? What investments perform the best during a market selloff? Is it a good

Returns of Stocks and Bonds Before, During, and After Interest Rate Hikes (Charts)

The Federal Reserve is going to be raising interest rates (via the target Federal Funds rate). This is likely to happen next month. Rising interest