Wealth Management Insights

Sign Up for Weekly Investing Insights

Why is the Bond Market Down?

As a lifelong Patriots fan, I subscribe to the do your job mantra. In a portfolio, every asset class has a job to do. For

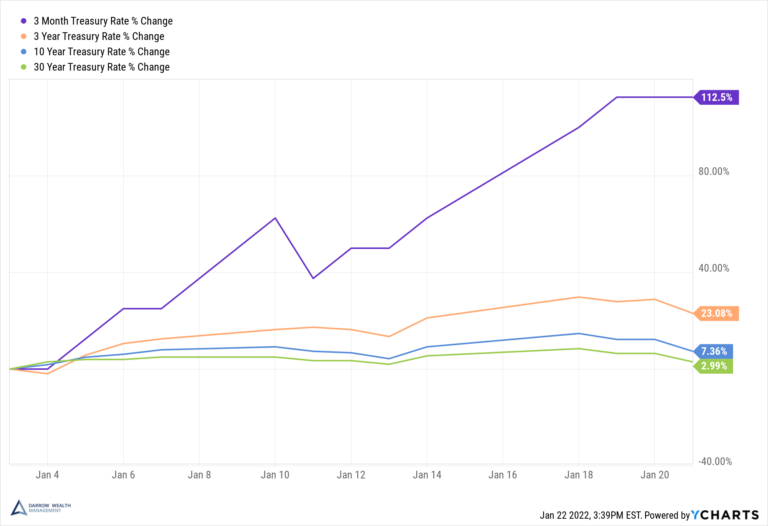

How Do Stocks Perform When Interest Rates Rise?

The Federal Reserve is planning to raise interest rates (the Federal Funds rate) earlier than expected to cool down the hot economy. The stock market

The Stock is Down, But You’re in a Post-IPO Lock-up

More companies entered the public markets in 2021 than any other year on record. From traditional IPOs or SPACs, and even direct listings, it was a banner

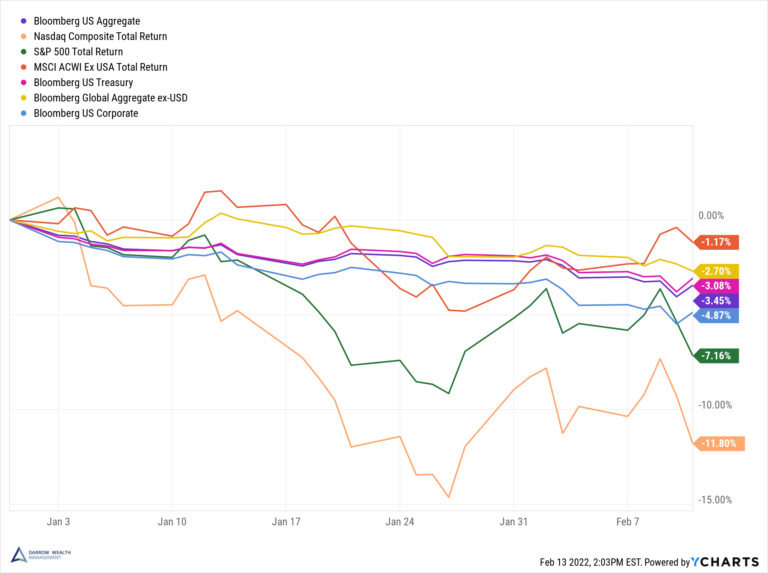

Stocks Down, Yields Up: Looming Rate Hikes Bring Market Volatility

The Federal Reserve plans to raise interest rates more quickly than the market expected a couple of months ago. This is sending shock waves into

Is 10 Million Enough to Retire?

Can you retire on 10 million dollars? For many Americans, this hefty sum would far exceed retirement needs and may even lead to generational wealth.

Qualified Small Business Stock Gain Exclusion (Section 1202)

If you invested in a startup or small business (founders, employee exercise of stock options, business owner), you need to know about qualified small business

When to Exercise Stock Options

When should you exercise stock options? With stock options, employees have the right (not obligation) to buy the shares (called exercising). Vesting is often the

When to Use Pre-Tax vs Roth 401(k) Contributions

Should you make after-tax Roth or pre-tax contributions to your 401(k)? Roth accounts can be powerful wealth-building tools. But paying tax early doesn’t always make

Here’s Why it Might be a Good Time to Rebalance Your Portfolio

Rebalancing your portfolio is an important part of managing your money. Rebalancing means buying and selling positions in your portfolio to get back to your

Expecting a Windfall from Stock Options or Selling a Business? New Tax Proposals May Cost You.

Tax planning for a sudden liquidity event just got more complicated. If you’re expecting a big windfall from selling a business or employee stock options

The S&P 500 Is Up 97% Since 2019. What’s The Market Outlook In 2022 And Beyond?

Since 2019, the total return on the S&P 500 is nearly 97% (almost 27% on an average annualized basis).¹ This outperformance is leaving many investors

Worried About Taxes Going Up? 9 Ways To Reduce Tax

While there likely isn’t a magic bullet to wipe out your tax bill, there are ways to layer tax-efficiency into your plan. If you’re concerned

What the 4% Rule Gets Wrong About Retirement Income

The 4% rule is one of the most well-known rules of thumb in personal finance. The premise is simple: retirees can withdraw 4% of their

What is a Fiduciary Financial Advisor?

What is a fiduciary financial advisor and why do you need one? A full-time fiduciary financial advisor has a legal obligation to act in the

Living Off Dividends: Another Retirement Myth?

The idea of living off dividends in retirement sounds nice, but it’s challenging. What investors don’t always realize is how much money they’ll need invested

Should You Change Your Asset Allocation in Retirement?

If you recently retired or are planning to, you likely have questions about how to position your investments going forward. Conventional wisdom suggests investors should

Net Unrealized Appreciation Rules for Company Stock in a 401(k)

If you have company stock in your 401(k), consider the pros and cons of net unrealized appreciation at retirement. Under the net unrealized appreciation rules,

How to Donate Your RMD Using Qualified Charitable Distributions

Updated for 2024. Can you give money to charity using your IRA? For individuals 70 1/2 or older – the answer is usually yes. What