Wealth Management Insights

Sign Up for Weekly Investing Insights

What Does it Mean to Early Exercise Stock Options?

If you work for a private company or startup, you may be able to exercise your stock options early. With an early exercise, employees buy

How to Donate Stock to Charity: Donor-Advised Funds

Giving appreciated stocks can be a great way to maximize your gift to charity and your tax benefits. When you donate cash, you’re giving after-tax

Here’s When You Need a Financial Plan – And When You Don’t

Do you need a financial plan? Maybe not. A full written financial plan is a robust analysis as of one point in time. This differs

5 Stock Option Mistakes to Avoid When Your Company Goes Public

Amidst a flurry of IPOs, many employees are experiencing their first major liquidity event from stock options. Unfortunately, for stock option rookies and veterans alike,

Avoid the Double Tax Trap When Making Non-Deductible IRA Contributions

Updated for 2024. Anyone with earned income can make a non-deductible (after tax) contribution to an IRA and benefit from tax-deferred growth. But it may

Explaining the Backdoor Roth and Mega Backdoor Roth IRA

Updated for 2024. Many individuals have heard of the backdoor Roth before, but the mega backdoor Roth is getting a lot of attention recently. Here

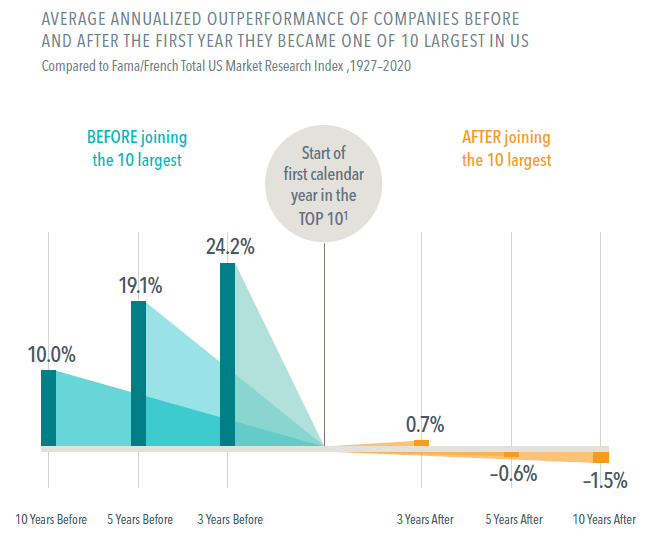

Is Bigger Better? Stocks Tend to Underperform After Joining Top 10

With the dominance of the largest U.S. stocks often occupying headlines, it’s worth remembering that the biggest companies don’t always produce the best returns. In

How to Sell Your Business: What to Do Before, During, and After the Sale

The time has finally come: you’re ready to sell your business. Planning for the sale of a small business may seem daunting. Perhaps you’re not

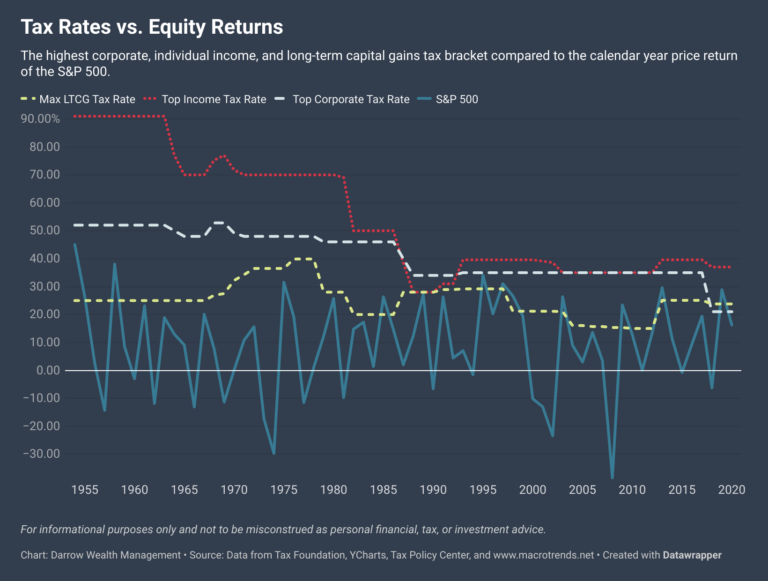

Will Tax Hikes Hurt Stocks? Impact of Tax Rates on the S&P 500

Between the Biden tax plans and other bills already before Congress, it’s likely that some level of tax legislation will make its way into law

Trading vs. Investing: Which Is Better for Long-Term Goals?

Tesla, GameStop, Hertz, Dogecoin: retail traders continue to dominate headlines in the financial news media. Some individuals may be wondering, how is trading different from

What To Do With The Money From The Sale Of Your Business

After selling your business, you may receive a lump sum in cash. Deciding how to allocate and invest the proceeds after selling your business is

What Happens to Stock Options in a SPAC Merger?

Although the most common way for a company to go public is through the traditional initial public offering (IPO) process, it’s not the only method.

Only 27% of Workers Say They’re on Track for Retirement. Where Do You Stand?

According to a recent survey of U.S. households by Schroders, only 27% of respondents who were still working reported ‘very good’ and ‘fully on track’

Managing Stock Options in a Direct Listing – Going Public Without an IPO

What happens to stock options if a company goes public without an IPO? A Direct Public Offering (DPO) or direct listing is a way for

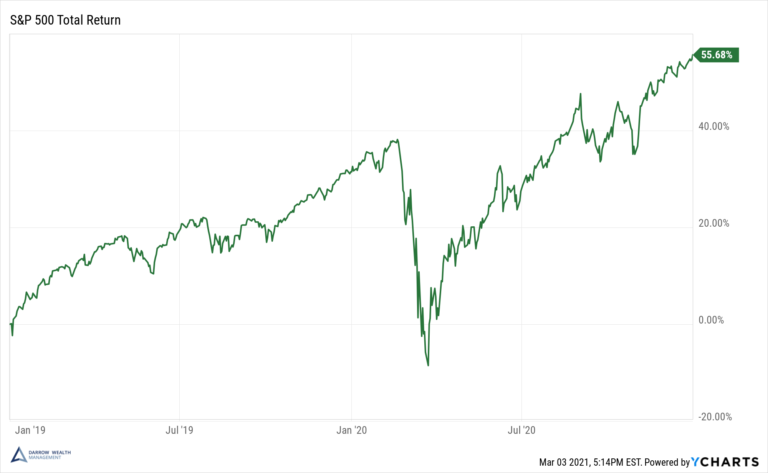

3 Investing Lessons Learned from the 2020 Covid Crash

It was almost a year ago when the Covid-19 induced selloff in the financial markets reached a bottom. The S&P 500 fell from its February

6 Crazy Facts About The Stock Market in 2020

We’re all ready to put 2020 behind us. But before closing the books, it’s worth reflecting on what was a crazy year in the stock

Should I Invest When the Market is High? Dispelling the Buy Low, Sell High Myth

Most investors realize trying to time the market by always buying low and selling high isn’t a realistic endeavor. Yet even with that knowledge, if

What Does an IPO Mean for Employees? What to Do When Your Company Goes Public.

What does an IPO mean for employees? And what should you do when your company is about to go public? For early-stage employees and executives with