The Instacart IPO is on hold…again. What should employees with stock options do when their employer’s IPO stalls? In truth, best practices around an IPO are sometimes skewed towards what not to do. If you have stock or options from a company that’s about to go public, there may be a temptation to include a future sudden wealth event into current financial decisions. But pre-spending an expected windfall before it actually happens is a dangerous game. The freeze in the IPO market this year also highlights the risks of exercising stock options before an IPO.

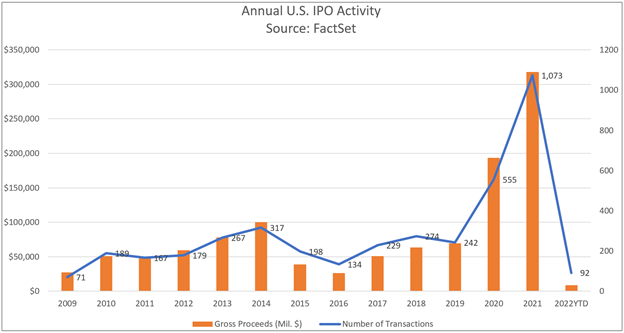

IPO market stalls

According to data from FactSet, 1073 companies went public in 2021. In the first half of 2022, only 92 companies IPO’d. The freeze in the IPO market highlights the difficulties investors face when trying to find the optimal time to exercise. Due to tax implications, liquidity issues, and periods of heightened market volatility, exercising options before an anticipated initial public offering may not be worth the risk.

Risks of exercising before an IPO

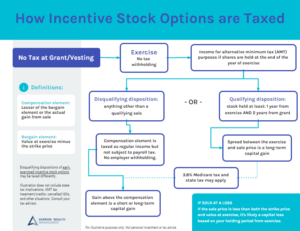

At exercise, the taxable spread is the difference between the strike price and the fair market value at exercise (either ordinary income for non-qualified stock options or the alternative minimum tax calculation for incentive stock options). In any option exercise strategy, one of the primary goals is to reduce this spread.

Although down markets can potentially pose a tax-advantaged time to exercise, this year‘s freeze in initial public offerings highlights the possible dangers of focusing too heavily on tax savings. One of the top risks for people with incentive stock options (ISOs) is not having cash to pay the taxes due from the exercise.

Exercising ISOs isn’t a taxable event for the regular income tax calculation, but it is for the alternative minimum tax. The AMT isn’t triggered with every ISO exercise. But it can arise if the spread is wide enough and if the shares aren’t sold by year-end.

Further, if the stock continues to fall, employees may end up with a taxable spread (calculated at exercise) that exceeds the value of the shares, either when the tax is due or there’s liquidity. This exact situation happened last year, even when the company did go public. Many shareholders at newly public companies found themselves helpless when the stock price was falling but they were still in a post-IPO lockup.

Here’s an example

Assume an employee exercises ISOs in January, expecting the company to go public in March. With a standard six-month lockup, the individual would have liquidity to sell shares in September. Selling shares could prevent triggering the AMT altogether, reduce the AMT burden, or raise cash to pay any tax due. If you exercise, but the company doesn’t go public, the risk is triggering the AMT without liquidity to pay tax.

Instacart, where the valuation is down almost 40% this year, is highly likely to create issues for employees who exercised, and may have to pay tax, using much higher valuations. Instacart isn’t alone. Chobani previously put its IPO on hold before withdrawing it entirely. There are plenty of other examples of high-profile IPOs that have been derailed this year.

Don’t pre-spend your windfall

Price volatility and the uncertain liquidity timeline are major reasons to avoid pre-spending paper profits. Locking in higher lifestyle expenses, like buying a new house for example, with the expectation that it’ll be affordable after a sudden wealth event, can put you in a precarious financial situation. There are just too many unknowns.

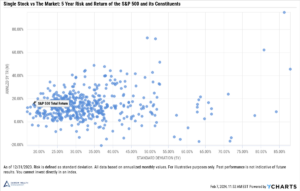

Volatile markets also make deciding when to exit a concentrated stock position even harder. Deciding when to take profits is often difficult for investors with company stock, even those with massive embedded gains. Even if you can’t sell yet, it’s important to be realistic about price targets, range of outcomes, and what you can (and can’t) control.

Planning your exit

One approach for planning to exit employer stock is to consider the base, best, and worst-case scenarios and assign a probability to each. Often, investors find the current price more attractive than they thought. Further, taking some risk off the table doesn’t mean selling 100% of the position immediately. Diversification strategies may include dollar-cost averaging, limit orders, or even using options on your options (such as a cashless collar).

There are many factors employees can’t control during an IPO. But how to allocate a windfall, when to exercise, and the approach to diversifying aren’t fully uncontrollable.

For employees with stock options, the best approach is often to stay vigilant and monitor what changes may occur. Weigh risk-adjusted opportunities to exercise. And try not to make any major changes to your financial situation before your financial situation actually changes.

If you need help managing stock options before an IPO or acquisition, please contact us today to schedule a consultation.