When your paychecks stop, you’ll have to decide where to turn for retirement income. Many individuals have several options: cash savings, IRAs and retirement accounts, Social Security, and taxable brokerage accounts. For years retirees have wondered if they should use retirement accounts to delay Social Security. Now that investors have until age 73 before starting required minimum distributions (RMDs) from retirement accounts, the question is more difficult. Many individuals, particularly early retirees, can’t afford to delay claiming Social Security until 70 and avoid tapping IRAs until 73. And for those who can, it still might not be the best approach.

Should you use money from retirement accounts to delay Social Security?

There’s no one-size fits all way to answer questions about retirement income. But there are numerous situations where it can be better to tap an IRA or 401(k) to delay claiming Social Security.

While the discussion seems straightforward at face value, when you factor in details pertaining to your personal situation, it becomes much more complex. And unfortunately, these ‘details’ are often the drivers of the best approach.

Some of these considerations include: if you’re married, your spouse’s benefits (and age) relative to your own, life expectancy, legacy goals, retirement investments, and other sources of income, such as a pension.

Since so many elements of our financial lives are intertwined, it often makes sense to run the analysis as part of a robust financial model and cash flow simulation. At Darrow Wealth Management, we regularly work to help clients evaluate this trade-off and others like it. Learn more about our Private Wealth Management Services or contact us to schedule a consultation.

Waiting until 70 to take Social Security increases your monthly check – significantly

Few things in life are certain. What changes (if any) might be in store for the Social Security program remain to be seen. For individuals close to full retirement age (FRA) or already receiving benefits, the likelihood of a major reduction to benefits is much less than for younger investors.

Currently, the benefit of delaying Social Security until age 70 is one of the most quantifiable aspects of retirement planning. After reaching FRA, Social Security benefits increase 8% per year until you turn 70. There’s simply no way to beat that return invested in the market on a risk-adjusted basis. This is the primary reason to consider tapping retirement accounts before Social Security.

But delaying distributions from retirement accounts can be beneficial, too

Tax-deferred retirement accounts are true to their name: they allow investors to defer paying tax on invested dollars. With the exception of the Roth IRA, Roth 401(k) and your original non-deductible IRA contributions, once the funds are withdrawn the entire amount is taxable as regular income.

All else equal, money in a retirement account will grow faster than money in a taxable brokerage account. Why? Assuming the brokerage account pays its own way, investors need to sell a bit of their investments to pay capital gains tax. This leaves fewer dollars invested to benefit from future compounded growth.

Reasons to consider using an IRA to delay Social Security

1. Increases to Social Security benefits are guaranteed. Investment returns aren’t.

In a vacuum, the advantages of putting off retirement distributions usually don’t outweigh the growth in Social Security benefits in most cases. While it’s certainly possible for your investments to grow more than 8% per year, it’s not riskless. Delaying Social Security effectively is…assuming you live long enough to collect benefits at 70.

2. More control over taxes

Considering how required minimum distributions (RMDs) are calculated, it’s not always a good thing to wait as long as possible to take money from retirement accounts. To calculate RMDs, you’ll use the IRS’ Uniform Lifetime Table and your account balance from 12/31 of the prior year. Your mandatory withdrawal is your account balance divided by your life expectancy from the table, which is based on your age.

For wealthier retirees, RMDs can push you into a much higher tax bracket. And depending on your income beforehand, you could have missed opportunities to utilize the lowest tax brackets.

It can often make sense to blend withdrawals from retirement accounts with taxable accounts to capitalize on the 0% tax rate for long-term capital gains.

Deciding when to take Social Security and retirement distributions is more complicated in reality

Deciding to tap an IRA in favor of delaying Social Security benefits seems pretty simplistic on paper. But in reality, the analysis will likely need to be more sophisticated. Here are some of the factors to consider:

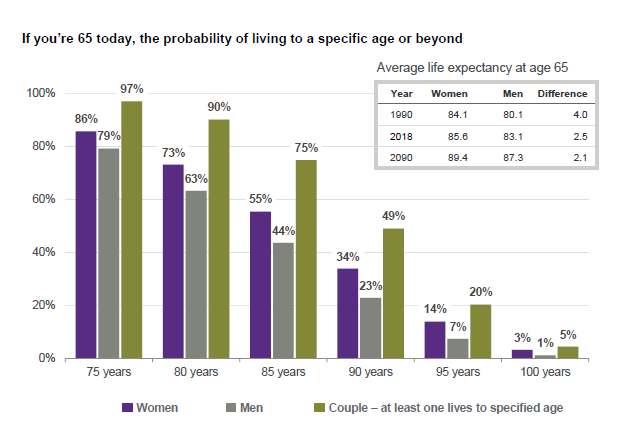

Life expectancy and breakeven age

One of the hardest parts in determining the optimal strategy is we don’t know how long we’ll live. If you don’t live much past 70, you probably won’t make up for benefits you could have been receiving in your 60s.

Source: J.P. Morgan

Again, assuming you either need to take Social Security or use your retirement savings, longevity is a key factor. If you don’t end up breaking even by claiming later, you’re leaving Social Security dollars on the table. But remember, you’re also dipping into your retirement savings to delay. This means a smaller inheritance for your spouse, children, and/or family and friends.

You can run the numbers all you want, but there’s just no way to control if you’re going to live past the breakeven age.

Spousal benefits

Spousal benefits are another complex part of the trade-off analysis. For married couples, it can be advantageous for the spouse with the lower benefit to file early. But claiming benefits early can also reduce spousal benefits. This may be especially important if one spouse isn’t eligible for benefits on their own work record.

If there’s a big age gap between spouses, this could be a moot point if the surviving spouse won’t reach age 60 and become eligible for widower benefits. Of course, this would significantly change the analysis, as RMDs would be calculated differently among other considerations.

There are so many different variables here that are family-specific, it really requires an individualized analysis.

Legacy goals

Is your main goal leaving as much as possible to your family after you pass away? If so, it may not make sense to use retirement savings before it’s necessary. In this situation, you may want to consider taking Social Security before 70 to preserve retirement assets.

It’s worth noting that after the passing of the Secure Act, leaving adult children an inherited retirement account is less advantageous. Most non-spouses now need to take their entire retirement inheritance in 10 years.

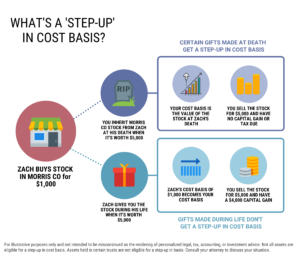

Again, if your main objective is leaving a legacy with the most flexibility, you could consider reinvesting retirement funds or extra Social Security income in a brokerage account to receive a tax-advantaged step-up in basis after you pass away.

Considering your whole retirement picture with a financial plan

As you can see, the various tax, estate planning, investment, and income issues at play are rather complex. Given how linked the factors often are, it may make sense to consider developing a detailed retirement plan. We all want to maximize the Social Security benefits we’ve earned, but it’s important not to lose sight of the risks. Using retirement accounts to delay Social Security doesn’t make sense if it requires you to risk running out of money to do it.