Stock Option and Pre-IPO Planning

Home » Stock Option and Pre-IPO Planning

Stock Option and Pre-IPO Planning

Darrow Wealth Management specializes in helping individuals at public and private companies with their stock options and equity compensation. If you’re an employee (or former employee) at a pre-IPO company going public, merging, or getting bought out, work with an advisor experienced with strategic stock option planning, tax implications, and strategies to best manage sudden wealth.

Clients include executives and founders who have a variety of equity compensation, including:

- Incentive stock options (ISOs)

- Nonqualified stock options (NQSOs)

- Restricted stock awards (RSAs)

- Restricted stock units (RSUs)

- Founders shares

- Profits interests

- Employee stock purchase plans (ESPPs)

Many clients have a combination of common shares, exercisable options, and equity subject to vesting. Through our ongoing advisory relationship, we’re able to help clients with the entire equity compensation lifecycle from even before a grant to long after the sale.

Nationally Recognized Wealth Advisor in Stock Compensation

Selection of media appearances by Kristin McKenna CFP®, President of Darrow Wealth Management and a nationally recognized specialist in employee stock options and equity compensation.

Publications above reflect media organizations that have quoted and/or published articles authored by Kristin McKenna and should not be misconstrued as a current or past endorsement of Kristin McKenna, Darrow Wealth Management, or any of its advisors. Please refer to the media page for more information and links to published works.

Financial Advisor for Employee Stock Options

Especially for founders and early employees, stock options can create a major liquidity event that transforms your financial life. To maximize the opportunity, it’s critical to get the right team of advisors in place before making irreversible decisions with your shares.

Our team of stock option advisors can work to help current and former employees and shareholders of public or pre-IPO companies:

- Plan for an IPO (or SPAC and direct listing) or acquisition (pre-IPO tax planning and exercise strategies, public or private acquisition planning)

- Develop an exercise strategy to balance potential tax benefits with risks of holding a concentrated stock position

- Assist with identifying and tracking shares likely to qualify for the tax-free sale of qualified small business stock

- Plan a tax-conscious liquidation strategy, considering different grants, holding periods, and outside cash needs

- Plan and execute a trading strategy including price targets, market vs limit orders, using options for long shares, considering liquidity constraints due to trading volume, liquidation order, and so on

- Assess ways to hedge the risks of a concentrated holding in publicly-traded stock, such as the use of call options on long shares, if permitted

- Assist in the drafting of 10b5-1 plan provisions

- Decide on a strategy to best use the proceeds, including funding multiple goals and investment management services to help you diversify sudden wealth

- Understand how vested and unvested stock options may be treated if you leave the company or retire

- Explore cashless or sell-to-cover exercises of stock options

- Approach employment negotiations around stock options and equity compensation

- Implement a multi-year diversification strategy through an ongoing wealth management advisory relationship

- Consider ways to further your charitable or legacy goals through different investment or trust vehicles

- Coordinate the approach with your tax advisor and estate planning attorney

Wealth Management Services

Darrow Wealth Management is a fee-only financial advisory firm and full-time fiduciary.

The Darrow Private Wealth Management Program offers clients a complete solution to their asset management and comprehensive financial planning needs.

Stock Option and Pre-IPO Planning Related Articles

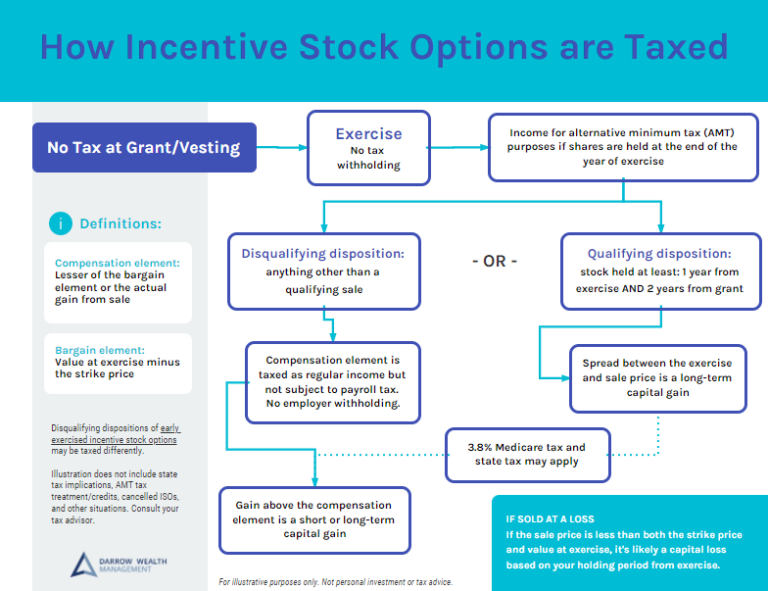

Incentive Stock Options: Navigating AMT and AMT Credits

If you have incentive stock options, you’ve probably heard of the alternative minimum tax (AMT). Essentially, the alternative minimum tax is a prepayment of taxes. In years when not subject to the AMT, you can receive an AMT credit. The credit reduces your tax liability to reflect prepaid tax. Here’s

6 Tax Strategies for Incentive Stock Options and AMT

6 tax strategies for incentive stock options and AMT Triggering the alternative minimum tax isn’t the end of the world, but you don’t want to do it by accident. Here are six tax planning strategies to consider when exercising and selling ISOs in 2025: Exercise early in the year Exercise

Should You Exercise Stock Options During a Pre-IPO Window?

Is exercising stock options right before a company goes public a good idea? Employees with pre-IPO incentive or non-qualified stock options often wonder if they should exercise before the company goes public (perhaps during a final open window) or wait until after the IPO. Assuming you have the cash on

How to Negotiate Equity in a Private Company or Startup

Working for a startup can pay off big financially, but a lot must go right along the way. If you are considering taking a job at a startup or private company with plans for an exit, there’s a lot to consider before accepting an offer. Depending on your life stage