Using a Securities-Backed Line of Credit to Buy a Home

A securities-backed line of credit is like a home equity line of credit in many ways, though with this type of loan, the collateral is

Kristin McKenna, CFP® is frequently published in the national news media. She’s a Senior Contributor at Forbes and has been published by U.S. News & World Report, TheStreet, Business Insider, and the National Association of Personal Financial Advisors Magazine, with quotes in Bloomberg, Kiplinger, MarketWatch, GOLF Magazine, and Huffpost, among others. Kristin has also been invited to be a panelist for several events around stock option financial planning.

A securities-backed line of credit is like a home equity line of credit in many ways, though with this type of loan, the collateral is

The sale of a business marks a major life event. It’s emotional, stressful, and exciting all at the same time. And unfortunately, it’s often a

There are many financial planning considerations before, during, and after a divorce. A key part of the process from a financial standpoint is dividing the

Working for a startup can pay off big financially, but a lot must go right along the way. If you are considering taking a job

The Secure Act 2.0 was signed into law December 29th, 2022, bringing more major changes to tax law. Among the most notable changes include a

Updated for 2023. Planning can help optimize annual required minimum distributions depending on your goals and cash flow needs. After the passing of Secure Act

Updated for 2024. Anyone with earned income can make a non-deductible (after tax) contribution to an IRA and benefit from tax-deferred growth. But it may

Putting extra cash towards your mortgage doesn’t lower your payment If you have extra cash and are considering putting it towards paying down your mortgage

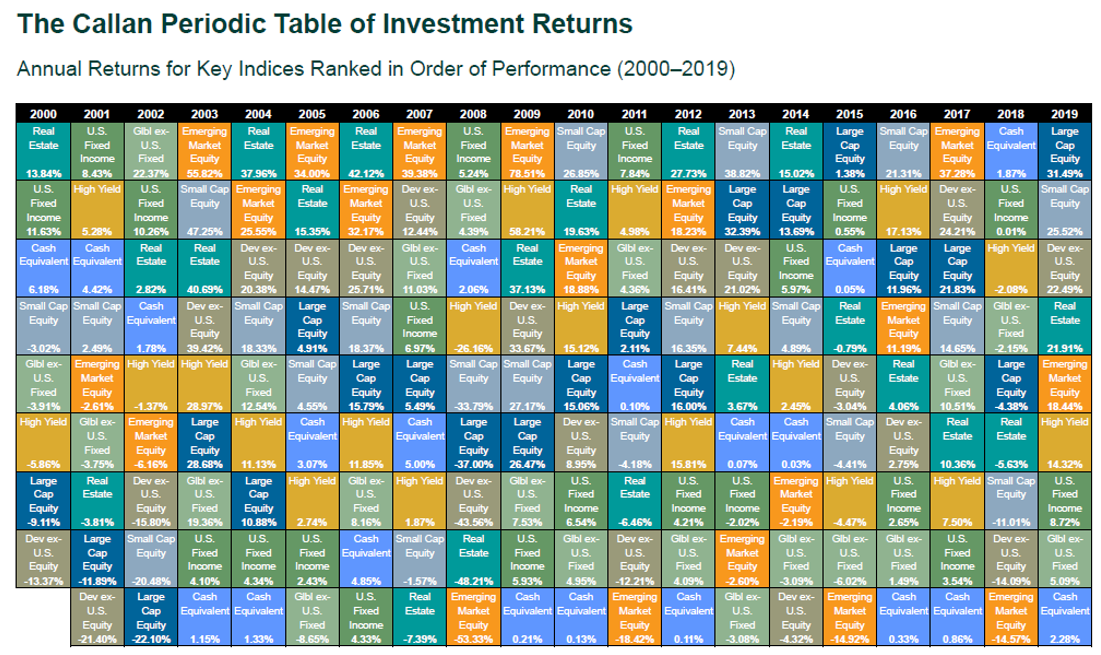

Amidst the vast uncertainty in the markets right now, it’s more important than ever for investors to understand the benefits—and limitations—of diversification. Having the right

This article was written by Darrow advisor Kristin McKenna, CFP® and originally published by Forbes.