How to Apply an Asset Allocation to Multiple Investment Accounts

Whether you’re managing your own investments or working with a financial advisor, setting the right asset allocation is key. But what’s the best way to

Whether you’re managing your own investments or working with a financial advisor, setting the right asset allocation is key. But what’s the best way to

Updated for 2025. What should you do with excess cash? If you are holding too much cash, consider how to use the extra money to

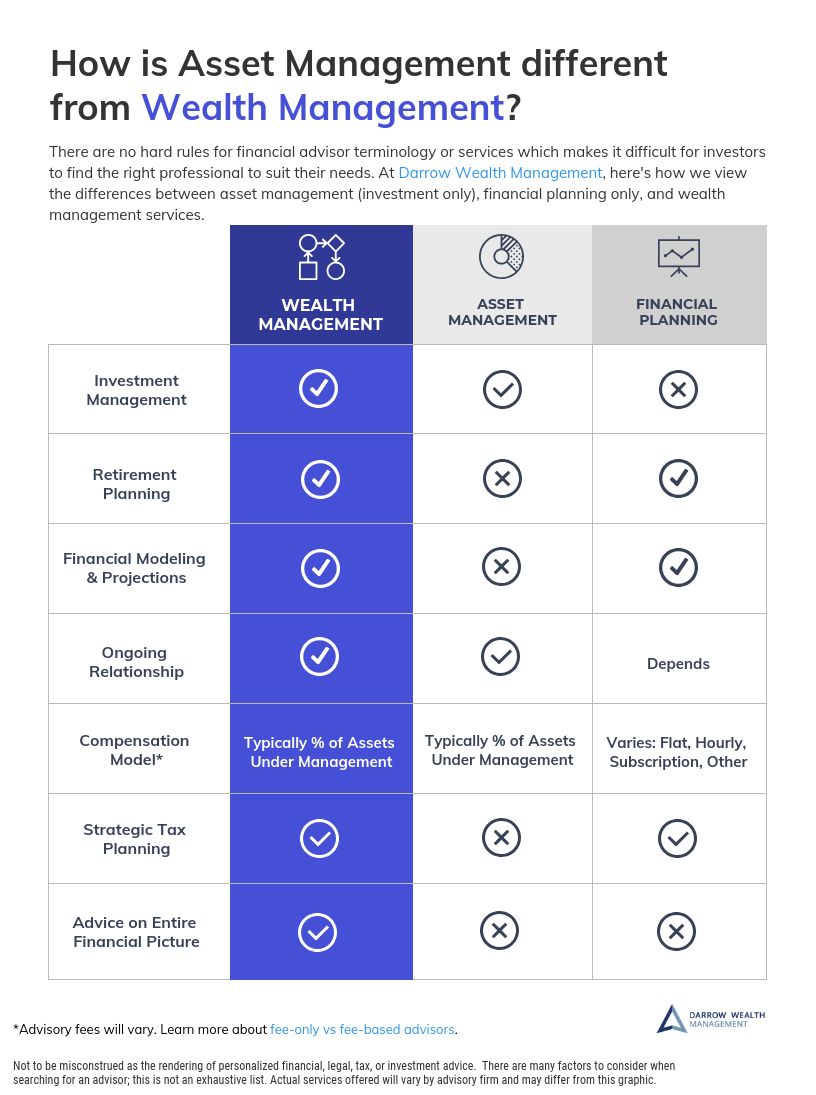

Asset Management vs Wealth Management When searching for a financial professional, you may wonder whether you need asset management vs wealth management. How are they

How much charitable giving will reduce taxes depends on what you donate. The tax deductions for charitable giving will vary for donations of cash, stock,

If you’ve ever heard excerpts from the latest Apple earnings report, you may have thought, ‘so what?’ Well, for many investors, Apple’s relative performance could

How should couples file for Social Security benefits if they have unequal incomes? It isn’t always advantageous to wait until age 70 to file for

Updated for 2022. Business owners have several retirement plans to choose from. For small companies, the SEP IRA and Solo 401(k) are the most common.

How is a brokerage account taxed? Brokerage accounts (also called non-qualified accounts) are taxed differently than qualified retirement plans like a 401(k) or a 403(b).