How to Negotiate Equity in a Private Company or Startup

Working for a startup can pay off big financially, but a lot must go right along the way. If you are considering taking a job

Tax planning and wealth building strategies from Kristin McKenna, CFP®. Tax-conscious wealth planning is critical for any high-income taxpayer: asset location and tax-efficient investing, stock option and equity compensation exercise and sale strategies, qualified small business stock, retirement income tax planning and bucketing strategies, deferred compensation, employer plans for business owners, charitable tax planning and donor-advised funds, reducing taxable income, changes in tax law.

Working for a startup can pay off big financially, but a lot must go right along the way. If you are considering taking a job

The Secure Act 2.0 was signed into law December 29th, 2022, bringing more major changes to tax law. Among the most notable changes include a

Taxachusetts is back. In November 2022, proponents of the Massachusetts ‘millionaires’ tax won their bid to nearly double the income tax rate on individuals with

Updated for 2023. Planning can help optimize annual required minimum distributions depending on your goals and cash flow needs. After the passing of Secure Act

Giving appreciated stocks can be a great way to maximize your gift to charity and your tax benefits. When you donate cash, you’re giving after-tax

Updated for 2024. Anyone with earned income can make a non-deductible (after tax) contribution to an IRA and benefit from tax-deferred growth. But it may

Updated for 2024. Many individuals have heard of the backdoor Roth before, but the mega backdoor Roth is getting a lot of attention recently. Here

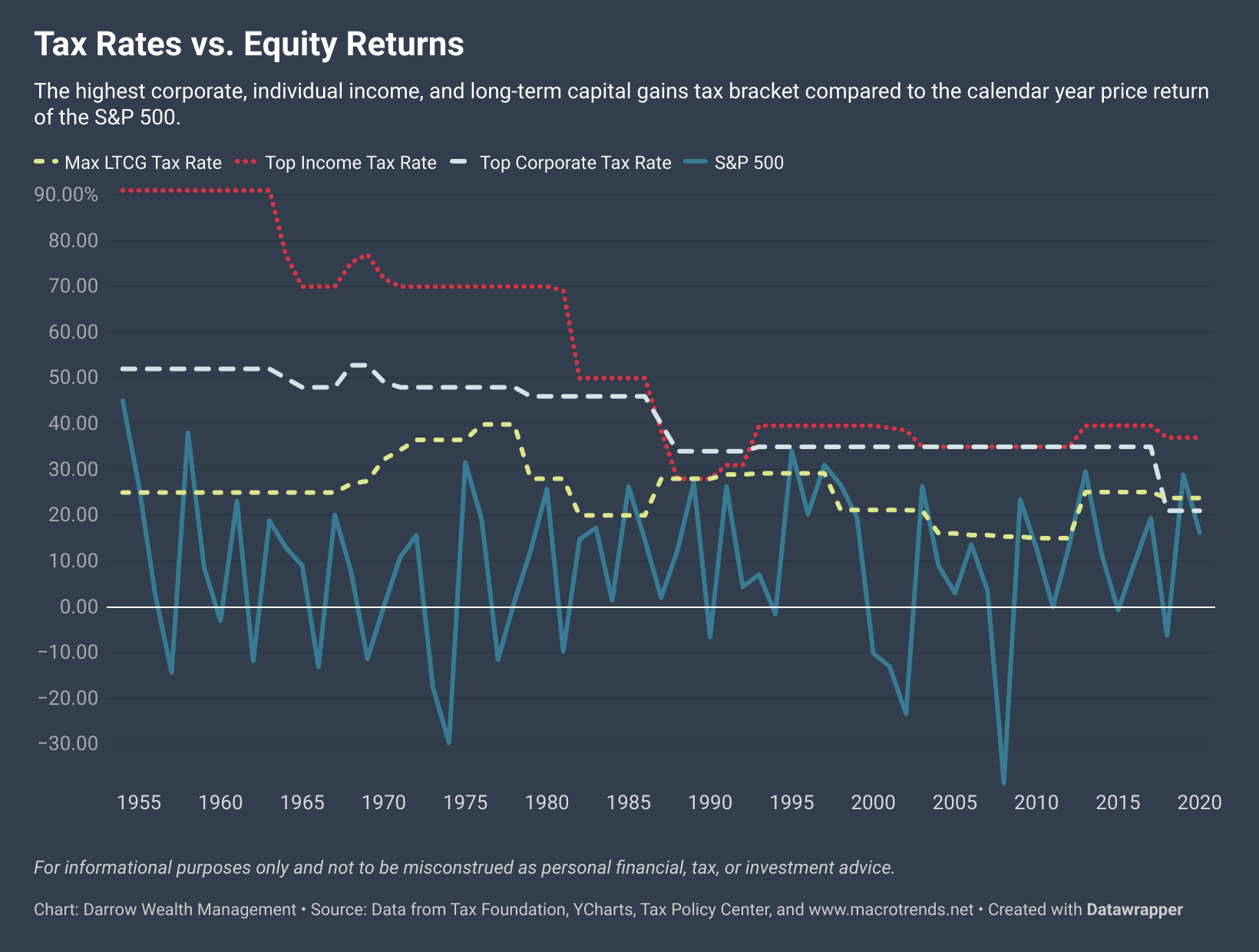

Between the Biden tax plans and other bills already before Congress, it’s likely that some level of tax legislation will make its way into law

Looking for ways to minimize taxes on RMDs? For wealthy retirees, mandatory distributions from retirement accounts can cause taxes to increase sharply. As with all

Tax-loss harvesting is the process of selling an investment that has lost value in your portfolio to ‘realize’ the loss for tax purposes. Investors can