Is it always a good idea to max out your 401(k)? For wealthier retirees or individuals with a sizeable pension, you might not want to max out contributions to your 401(k). Here are some situations where maxing out your 401(k) might not make sense.

Should you always max out your 401(k)?

As a CERTIFIED FINANCIAL PLANNER™ professional, I’m often asked the best way to save and invest for retirement. For most people, it begins with maxing out contributions to a 401(k) or 403(b) retirement plan. But should everyone max out their 401(k)? No.

Universal rules are scarce in financial planning is because everyone’s financial circumstances are different. There are many ways one investor’s situation will vary from another’s: amount and type of retirement assets, expectations of a pension, other assets such as real estate or an inheritance, access to different types of retirement plans and ability to contribute, current cash flows, expected income needs in retirement, legacy goals, and so on.

Situations where maxing out your 401(k) might not make sense

There are so many unique situations that could happen, an exhaustive list doesn’t exist. But here are several situations when to consider not maxing out your 401(k):

- If you can’t afford it (obviously)

- Temporarily when cash is tight (putting kids through college, recovering from a recent layoff or furlough, saving for a home, major unexpected costs, etc.)

- If you already have large, mandatory tax-deferred retirement contributions (e.g. partners at law firms often have to make profit-sharing and cash balance contributions)

- You’re planning to retire early, before most retirement money is available at age 59 1/2

- You may need the money for non-retirement goals before retirement (second home, college, boat, car, wedding, etc.)

- If you already have a very large IRA, 401(k), 403(b), inherited retirement account, or pension (very large is relative of course…work with a financial advisor to run the numbers)

- If you are required to make employer-side contributions to a retirement plan and funding at the individual level is optional (more common as a law firm partner or business owner)

Here’s what maxing out your 401(k) could get you in retirement

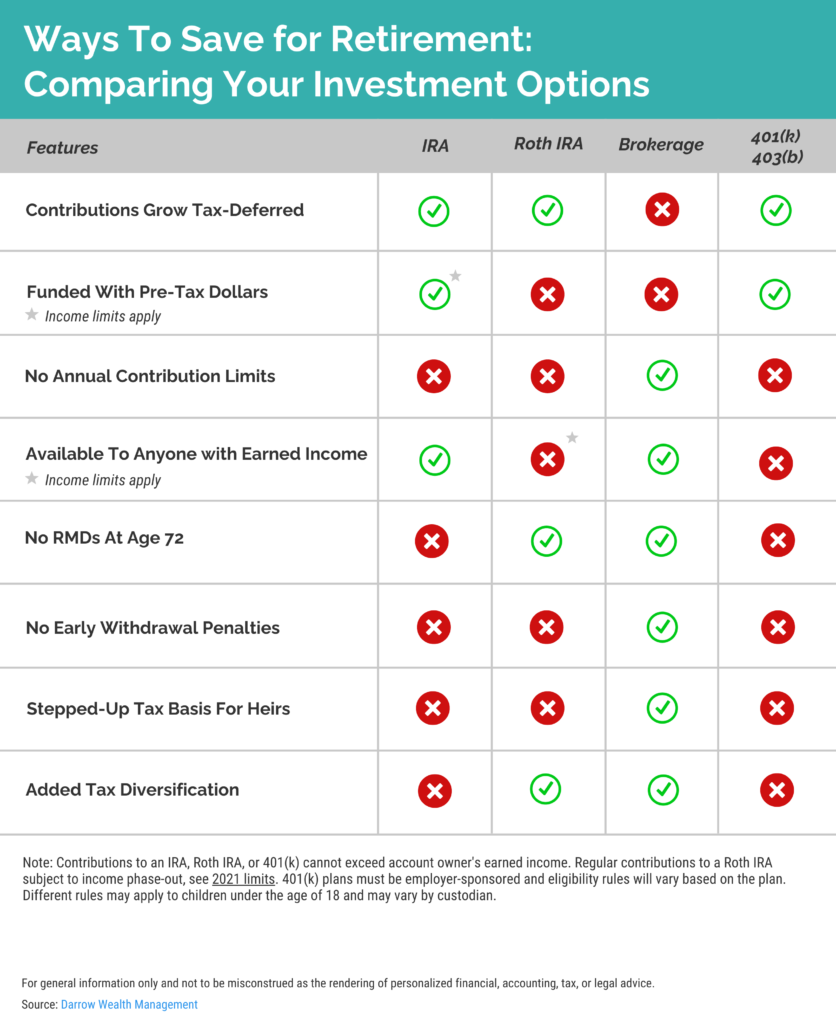

Comparing different types of investment accounts: IRA vs 401(k) vs brokerage account

- 401(k), 403(b), traditional IRA, SEP IRA, SERP: Pre-tax contributions, tax-deferred growth, taxable income in retirement

- Roth IRA or Roth 401(k): After-tax contributions, tax-deferred growth, tax-free in retirement

- Brokerage account: After-tax contributions, taxable growth (which can qualify for favorable long-term capital gains rates)

It doesn’t always make sense to max out your 401(k): the downside of pre-tax retirement accounts

The most notable drawback is the requirement to take distributions from your accounts, called required minimum distributions (RMDs). The Secure Act of 2019 changes the age some retirees will need to begin distributions from tax-deferred retirement accounts.

People born on or before June 30th, 1949 need to start required minimum distributions at age 70 1/2. Investors born on/after July 1st, 1949 have to take RMDs starting at age 72.

How RMDs are calculated

At a high level, the amount you’ll need to withdraw annually equals the balances of traditional IRAs and tax-deferred retirement accounts divided by the life expectancy factor listed in the IRS’ Uniform Lifetime Table, which is based on your age. (This article has more on RMDs and how they’re calculated.)

Of course, as your pre-tax savings grow, the amount you’ll need to withdraw will also increase. Required minimum distributions are taxed as ordinary income. This can push wealthier retirees into a higher tax bracket. This is particularly true when considering how other aspects of your tax situation may change in retirement.

For example, during working years many individuals have various pre-tax deductions from their paycheck: retirement contributions, additions to a health savings account or flexible spending account, or contributions to a deferred compensation plan or SERP. In retirement, these ways to reduce your taxable income disappear.

After considering the impact of social security income and whether you’re able to continue itemizing your deductions, retirees may find themselves with tax planning options. This is especially true if you paid off your mortgage.

Investing outside of tax-deferred retirement accounts

No limits or penalties

A brokerage account allows investors complete flexibility: there are no contribution limits, eligibility criteria, or rules about when you may access the funds. There are, however, no tax benefits associated with this type of investment account. A brokerage account is taxable annually, including any dividends you receive and if you incur taxable capital gains (or losses) throughout the year.

The capital gains tax rate will depend on your holding period. Long-term gains are taxed more favorably than short-term, where the tax rates are the same as ordinary income.

A brokerage account helps fund an early retirement

Investing outside of retirement with a brokerage account can serve a variety of purposes. This is especially true for high-earning investors with a high savings rate. In exchange for the loss of tax-deferred growth, a brokerage account can be a great way to help bridge the income gap early on in retirement.

Leaving an inheritance with tax benefits

If you want to leave an inheritance to your children, a brokerage account can offer unique tax benefits from an estate planning perspective.

Assets in a brokerage account will receive “stepped-up” cost basis when passed to heirs. This means securities in the account are valued as of the date of death instead of your cost basis. Assets receiving this “step-up” treatment are taxed as long-term capital gains, regardless of the actual holding period. As this is not a type of retirement account, there are no requirements for you – or your heirs – to take distributions.

Control taxes in retirement

By shifting retirement assets from fully concentrated holdings in tax-deferred accounts to being more evenly distributed among taxable and/or tax-free accounts, retirees may be able to have more control over their tax situation in retirement.

Should you invest with a tax-free Roth IRA or Roth 401(k) instead of a brokerage account?

Roth IRAs aren’t taxed annually and withdrawals in retirement can be tax-free. To qualify, at least 5 years must have passed since your first Roth contribution was made and you’re at least 59 1/2. Another benefit is that there are no required minimum distributions on Roth IRAs.

Income limits prevent high-earners from making regular contributions

In 2021, the income phase-out range for single filers is between $125,000 – $140,000 and $198,000 – $208,000 for married couples. If you are under these limits, the contribution limit is still relatively low. In 2021, the limit is $6,000 for Roth IRA contributions for individuals under age 50. People 50+ can make an additional $1,000 catch up contribution.

Roth IRAs may not make sense for high income workers anyways

The main reason to consider a Roth is the belief that you’ll be in a higher tax rate in retirement than you are today. If you have a high income, that might not be true.

Regardless of income, any taxpayer can make one Roth IRA conversion per year. If you’re in the middle of a job transition, it may be the right time to discuss your options for your old 401(k) plan and whether a full or partial Roth conversion makes sense.

Some employers also offer a Roth 401(k) in addition to their traditional 401(k). With a Roth 401(k), investors at any income level are able to make after-tax contributions up to the IRS annual limit, $19,500 in 2021 (if under age 50).

Also, if you’re currently in the highest tax bracket or do not expect to stick with the strategy long enough to make Roth assets a meaningful part of your overall portfolio, the strategy may not be worth it.

Other complexities when considering if you should max out your 401(k)

Landing at the best retirement saving strategy may require more complex planning. Multi-year projections require assumptions on income, expenses, tax laws, goals, family situation, and so forth. Further, the strategy that provides the best financial result may not be the best way to accomplish your goals. This is particularly true for philanthropic wishes and lifetime giving.

In most situations, it will be beneficial to max out a 401(k) retirement account and save in another type of investment account. However, there are circumstances where it may be worth considering other avenues outside of traditional pre-tax deferrals, especially if you expect pension income or have access to a deferred compensation plan.

Retirement + tax + investment planning

For individuals with the means to diversify their retirement savings, it may be advantageous to consider a comprehensive financial plan to incorporate all of your goals, the particulars of your finances, and what-if scenarios to compare one strategy over another. For example, here are a few other considerations we’ll discuss with clients during this process:

- Matching contributions. If eligible to receive matching contributions, determine how contributing enough to receive the full match may impact projections.

- Saving style. Keeping lifestyle spending in check isn’t easy for everyone. If you have a propensity to overspend, it may be in your best interest to keep automatic 401(k) deductions.

- Before-tax vs after-tax ability to save. Depending on your tax situation, it may cost you significantly more to save on an after-tax basis. Whether considering ongoing after-tax contributions or one Roth conversion, if your cash flows are too tight, it may not be worthwhile.

- Other alternatives. Depending on your objectives, there may be other ways to achieve your goals. For example, if you’re charitably inclined, you may wish to consider a qualified charitable distribution from an IRA if you are over age 70 1/2.

To learn more about what retirement planning strategy may be best for you and your individual situation, please contact us to speak with an advisor.