A step-up in basis is a tax advantage for individuals who inherit stocks or other assets, like a home. A stepped up basis can apply to stocks held individually, jointly, or in certain types of trusts, like a revocable trust. Here’s how stepped up cost basis works on stock and other assets at death.

Understanding step-up in basis at death

If you’ve received an inheritance you may have questions about the tax treatment of certain assets. Step-up in basis is a tax provision allowing the value of inherited assets to increase to fair market value on the decedent’s date of death. This increases the tax basis, which determines capital gains or losses when the asset is sold.

In addition, assets receiving this favorable taxation are always given a long-term capital gains holding period. This happens regardless of the actual holding period at the decedent’s death.

Various types of assets can qualify for a stepped up basis, including real estate, stocks, bonds, ETFs and mutual funds. Especially for taxpayers who die with significant unrealized taxable gains, this can reduce if not eliminate the capital gains tax liability for the beneficiary.

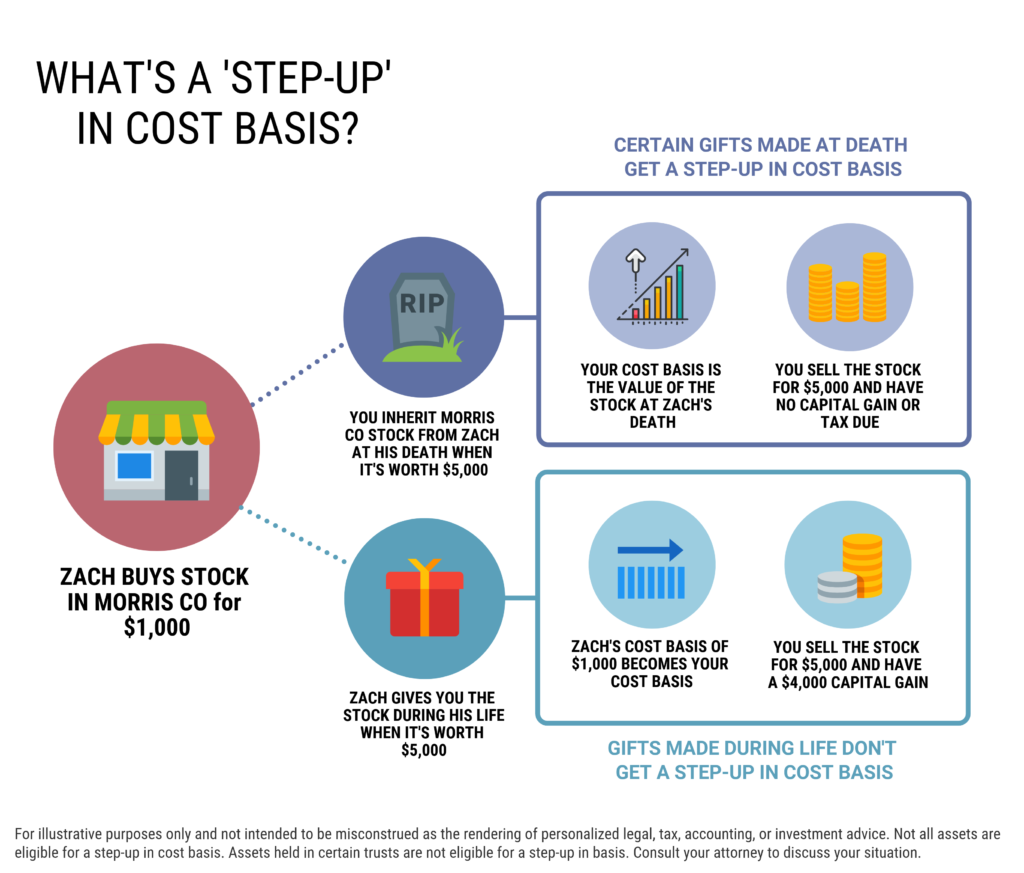

Example of how the step-up in basis works

The step-up in basis provision works by resetting the cost basis of an inherited asset from its original purchase price to its fair market value at the time of the owner’s death. For example, assume an individual originally purchased stock for $100 and it is worth $500 at the time of their death. The beneficiary’s cost basis is now $500, not $100.

This means that if the beneficiary taxpayer sells the stock for $650, they’d only pay long-term capital gains tax on a $150 gain, rather than $550. Conversely, if the original account owner gifted the stock while living, the recipient retains purchaser’s carryover basis and holding period ($100 in this example).

The tax benefits of the step-up in basis provision cannot be understated.

Example of a step-up in tax basis on stocks inherited at death

What types of assets are eligible for a step-up?

Non-retirement assets like stocks in a brokerage account, inherited home, antiques/art/collectables, or other real estate, are generally eligible for a step-up in cost basis.

Retirement accounts and IRAs do not receive a stepped up basis. Instead, the taxpayers who inherit these accounts will have the same income tax treatment as the prior owner. Withdrawals from retirement accounts are never taxed as capital gains, rather ordinary income (or if a Roth account meeting the requirements, tax free). This is why sometimes it’s more advantageous to leave a brokerage account to heirs instead of a retirement account.

It’s also worth noting that the step-up in basis doesn’t just happen automatically. You’ll need to fill out paperwork with the custodian if there isn’t a financial advisor managing the accounts. Inherited real property, like a house, will need to be appraised by a professional. Similarly, interests in a closely-held business will also need a professional valuation.

Eligibility for a stepped-up cost basis involves the type of asset inherited, ownership at death, and state laws. Whether the decedent was your spouse, parent, or other type of non-spouse doesn’t really matter. As noted below, community property states are an exception.

Inheriting a Trust Fund: Distributions to Beneficiaries

Do You Pay Tax on an Inheritance?

Do assets owned in a trust receive a step-up in basis?

Yes and no. If the asset was held in a revocable (or living) trust before the owner died, it will likely be eligible for a step-up in cost basis. Financial accounts aren’t the only assets that can be held in trust. A house can be put in trust and other types of real property as well.

Beneficiaries of an irrevocable trust likely won’t receive a step-up in basis. At a high level, if the asset is part of the decedent’s estate it’s typically eligible for a step-up. This can get very tricky so it’s important to work with the estate planning attorney settling the estate. Assets that bypass the estate through a trust or another mechanism are usually not eligible.

Surviving spouses: common law versus community property states

Common law

For married couples, state law is very important in determining cost basis. These rules can be very complex and nuanced so it’s essential to consult with a tax professional and trust and estates attorney to understand the specific rules and current law in your state. Darrow Wealth Management does not provide tax or legal advice.

At a very high level, in common law (separate property) states, surviving spouses that owned property jointly with their late spouse generally receive a step-up in basis on 50% of the joint asset. Note that anyone owning an asset jointly with the decedent would be eligible for the same treatment for tax purposes in this example, it doesn’t have to be a spouse.

For example, a couple owns a home they bought for $400,000. It’s worth $1,000,000 when one spouse dies. The surviving spouse’s basis would be adjusted to $700,000 ($500,000 + $200,000).

Now, if the home was owned solely by the deceased spouse, the survivor’s basis would be $1M. Conversely, if the survivor owned the home alone, there’d be no adjustment to cost basis when the first spouse died.

Community property

In community property states (Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin), the basis rules are different. Though there can be exceptions (again consult a tax advisor and attorney!), in general, assets in these states are considered to be owned 100% by each spouse, regardless of how the account/asset is titled.

In the previous example, different forms of ownership led to three different cost basis outcomes. But in a community property state, regardless of which spouse survives, for tax purposes, he or she would (likely) have a stepped up basis of $1M in the home. In another words, even a survivor without prior ownership in the inherited property could sell without paying a dollar in capital gains tax.

What’s The Best Thing To Do With Inherited Money?

Can stocks get stepped up twice? Explaining the double step-up

Yes, depending on how your estate plan is structured. But it’s possible to get a step-up at the first death, then another when the survivor dies. Keep in mind, that can also mean paying estate tax on the assets eligible for the second step-up.

As with anything, this is a trade-off. A credit shelter trust only receives the first step up, but it can avoid state or federal estate tax. Therefore, it isn’t just about considering assets at their current value, but also which assets are likely to appreciate and the best vehicle to achieve legacy goals.

What happens if the asset’s basis is greater than the current market value?

Stocks don’t always go up. So what happens if the asset’s purchase price is greater than the current value? Then it’s a step-down in tax basis to the date of death value.

If you sell at a loss, you can offset other investment gains plus an additional $3,000 against other taxable income in 2025. If your loss is greater than this amount, you can carry it forward to future tax years. Again, the holding period for inherited securities is always considered long-term, regardless of when it was purchased by the decedent.

Planning after sudden wealth from an inheritance

For help integrating an inheritance into your financial situation, contact a wealth advisor today. A large inheritance can significantly change your financial situation and make financial goals more attainable.

Darrow Wealth Management is a fee-only financial advisory firm and full-time fiduciary. We specialize in helping individuals manage sudden wealth events. By integrating financial planning with investment management, our goal is to help you build and grow your wealth. Learn more about our Wealth Management Services and how we may be able to help you.

The material in this article is intended to provide generalized information only as to some of the financial planning considerations of joint or separate trusts and should not be misconstrued as the rendering of personalized legal or tax advice. We strongly recommend you consult an estate planning attorney in your state to discuss your personal situation and estate planning needs.