How is a brokerage account taxed?

Brokerage accounts (also called non-qualified accounts) are taxed differently than qualified retirement plans like a 401(k) or a 403(b). Even without taking money from the account, your brokerage account will be subject to tax each year. Here is a specific example of how a brokerage account is taxed and when taxpayers may span multiple long-term capital gains tax brackets.

How your brokerage account is taxed depends on if you have a short or long-term capital gain

Capital gains tax is considered either short or long-term. In most cases, your holding period (how long you own the asset) will determine whether the gain or loss is classified as short or long-term for tax purposes. Holding period matters a lot as it’s a major factor in your capital gains tax rate. The tax code favors long-term ownership.

Calculating your holding period

In general, if you hold an asset for one year or less, your capital gain (or loss) is short-term. If your holding period is more than one year, your capital gain or loss is long-term. To calculate your holding period, you start counting beginning the day after you purchase or acquire an asset. The day you sell the asset will count towards your holding period.

Short-term vs long-term capital gains tax rates

As previously mentioned, the long-term capital gains tax rate is much more favorable than the short-term rate. If you have a short-term capital gain, the tax rate is the same as your regular income tax rate.

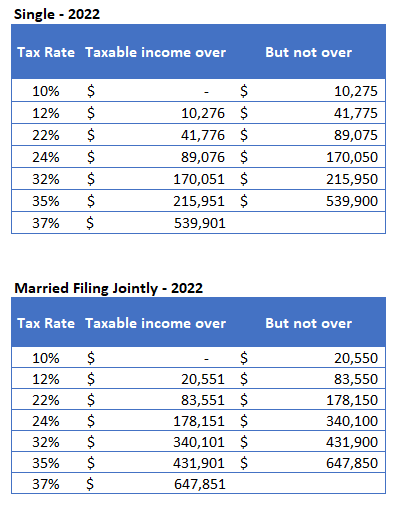

Regular tax rates are graduated. Here’s a simple example: if you’re single and have taxable income of $115,000, a portion of your income will be taxed at 10%, 12%, 22%, and 24% as you move through the bands. So you may be in the 24% marginal tax bracket, but your effective tax rate would be closer to 18%.

2022 Tax Brackets for Regular Taxable Income (e.g. Wages) and Ordinary Dividends

Long-term capital gains rates are lower than ordinary income tax rates. The tax rates are based on taxable income and don’t correspond exactly to regular income rates.

Long-term capital gains rates are lower than ordinary income tax rates. The tax rates are based on taxable income and don’t correspond exactly to regular income rates.

To determine your long-term capital gain tax rate, you’ll stack your long-term capital gain on top of your regular taxable income. The combined total determines the tax bracket(s) the gain falls in.

2022 Tax Rates for Long-Term Capital Gains and Qualified Dividends

(Based on Taxable Income)

How to determine your tax bracket for long-term capital gains

For illustrative purposes, it may be helpful to know how long-term gains integrate with your regular income. In practice, it’s more complicated than this. So you’ll want to work with a CPA or use tax preparation software to calculate your taxable gain and the impact on your entire tax situation.

Detailed Look: What you need to know about capital gains tax

Example #1: if long-term taxable gains fall into one tax bracket

Married couple filing jointly with taxable regular income of $210,000 and a long-term capital gain of $30,000. Assume the couple takes the standard deduction, $25,900 in 2022, and has no other credits/deductions.

For ordinary income, the couple has reached the 24% tax bracket with net taxable income of $184,100 ($210,000 – $25,900).

For long-term capital gains, this puts the couple in the 15% tax bracket with plenty of room before the next tax rate increase. To estimate the tax due, multiple $30,000 * 15%.

Example #2: what happens when long-term gains span two tax brackets?

Assume the same facts as the previous example, only the couple’s regular taxable income is $100,000. After the standard deduction, the remaining taxable income is $74,100. This is $9,250 below the threshold for the 15% tax rate on long-term capital gains.

The couple now falls into two tax brackets for long-term capital gains. There is $9,250 ‘left’ in the 0% tax rate before triggering the next tax bracket. So of the $30,000 long-term gain, $9,250 is taxed at 0% and $20,750 is taxed at 15%.

How to net capital gains and losses

If you have capital losses and gains, you will need to find the net gain or loss before you can determine the impact to your tax situation. The process for netting capital gains first applies to gains and losses of the same holding period. For example, long-term gains and losses are netted against each other, and separately, short-term losses reduce short-term gains.

If the resulting short-term and long-term figures involve a gain and a loss, they are netted again.

Example: netting gains and losses

Short-term calculation

AAA ETF = $40

BBB ETF = ($50)

Total short-term loss = ($10)

Long-term calculation

CCC Mutual Fund = $5

DDD ETF = $10

Total long-term gain = $15

The short-term loss ($10) is netted against the long-term gain of $15 to result in a net long-term gain of $5 and no short-term gain. If the long-term figure above been a loss instead of a gain, the taxpayer would have had both a short and a long-term loss.

Net losses can potentially reduce ordinary income by up to $3,000 in the current tax year. The remainder (if any) can be carried forward as a deduction in future years.

Note that this is a highly simplified example and on your tax return, gains and losses from most other asset types are included in the calculation, not just assets in your brokerage account.

How a brokerage account can provide tax planning opportunities in retirement

There is a common misconception that retirees will invariably be in a lower tax bracket than they were during working years. Although this can certainly be the case, some retirees with a significant portion of assets in tax-deferred accounts (like a 401(k)) find themselves in a much higher tax bracket once Required Minimum Distributions begin at age 72.

Withdrawals from a tax-deferred retirement plan are taxed as ordinary income, which can be problematic when you have fewer options to reduce your taxable income, as many retirees later find out. A brokerage account isn’t the only option for investors, however. At any income, individuals can make one Roth IRA conversion each year. A Roth IRA can also help retirees with tax planning alternatives, potentially avoiding the retirement tax cliff altogether. Discuss your personal financial situation with your financial or tax advisor.

If you aren’t sure what to do with extra savings each month or have already maxed out your 401(k) and want another way to invest, consider using a brokerage account.

Long-term capital gains rates are lower than ordinary income tax rates. The tax rates are based on taxable income and don’t correspond exactly to regular income rates.

Long-term capital gains rates are lower than ordinary income tax rates. The tax rates are based on taxable income and don’t correspond exactly to regular income rates.