The idea of living off dividends in retirement sounds nice, but investors often don’t realize how much money they’ll need invested to generate enough income from dividends to cover lifestyle expenses. Over the last 30 years, the S&P 500’s average dividend yield was 1.98%.¹ So historically, every $1 million invested would yield annual dividend income of $19,800 on average…before tax.

What is a dividend yield?

Yield is a common metric to compare the income streams of different securities. It equals 12 months of income (methods can be trailing or forward expected) divided by the market price of the stock, bond, ETF, or mutual fund.

For example, if a stock issued $4 in dividends over the past 12 months and is trading at $200/share, the dividend yield is 2%. If you own 10,000 shares, you receive $40,000 in dividend income (before taxes) and have a portfolio currently worth $2M.

Yields can be deceptive, though.

Following on the previous example, assume the company maintains its $4 dividend but the stock price falls to $150. The dividend yield is now 2.7%. You’ll receive the same $40,000 in dividend income and the value of your portfolio drops to $1.5M.

When investing in dividend stocks, bonds, or funds, a higher dividend yield may make an asset look more attractive, but this metric alone doesn’t make a worthwhile investment. Dividend paying stocks and funds can be a great addition to a portfolio. But as with any investment, there are always risks. High yields can be a sign of underlying issues with the company that puts principal at risk and endangers the dividend income if the company’s financials cannot support it.

Before you can evaluate stocks or bonds to invest in, you’ll need to develop the metrics you plan to use in the analysis. Some examples include dividend growth and consistency, dividend payout ratio, total returns, volatility, and sensitivity, among others, in addition to regular considerations like diversification, market capitalization, sector exposure, etc.

If you’re not working with a financial advisor, seriously consider your appetite for ongoing portfolio management, fund analysis, rebalancing, etc.

How much money do you need to live off dividends?

You may need more money than you think to retire on dividends.

Passive income from stocks and bonds may not be enough to meet your retirement income needs. Further, dividend payments often fluctuate significantly year after year. One year you may have more than you need (maybe leading to overspending) and the next you’re unable to meet basic living expenses.

Simulated portfolio income using historical dividends

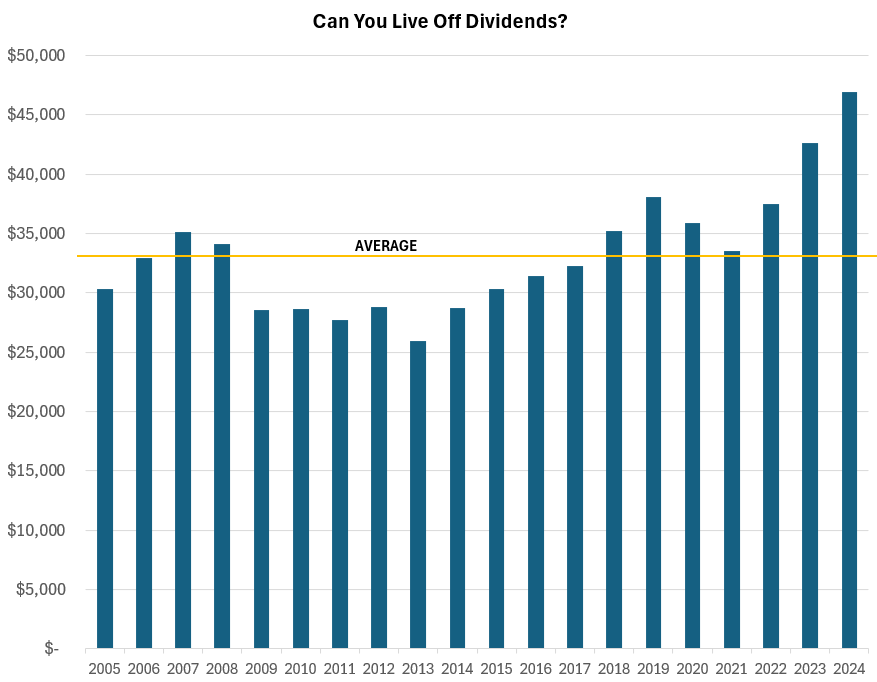

Imagine you invested $1,000,000 on the last day of 2004. Half went into the S&P 500 (SPY) and half into US Aggregate Bonds (AGG). If you never rebalanced, sold principal, or reinvested dividends, your portfolio could have provided roughly $665,000 in pre-tax income over 20 years (about $33,000/year on average).²

Now, even if the average dividend income is what you need to meet your financial goals, in this 20-year time frame, you’d find yourself without enough money over half the time. This is particularly acute during the nine-year period after the Great Financial Crisis when stocks took a beating and portfolio values suffered. And this doesn’t even include the impact inflation has on how much money you need annually in retirement.

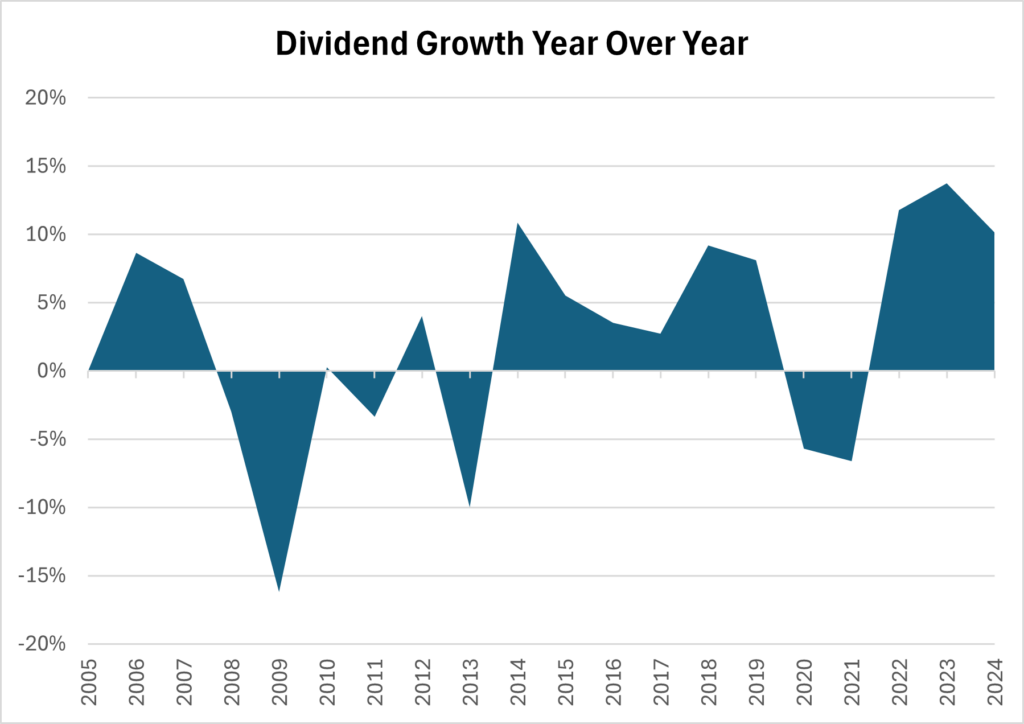

Steady passive income or a bumpy ride?

To illustrate the volatility in annual dividend income, consider the chart below, which reflects the year-over-year change in dividends from the previous analysis. It’s a bumpy ride, and the good (and bad) years tend to cluster together, potentially leaving you no choice but to dip into principal (which really isn’t such a bad thing!).

One very important caveat about this hypothetical example: if this investment portfolio was never rebalanced (which requires selling securities!) then due to the stock market’s moves during this period, the initial allocation of 50% stocks and bonds would have grown to nearly 85% equity. Generally, investors don’t increase their risk profile as they move through retirement. Allocation choices also shouldn’t be based on the notion that dipping into principal derails a financial plan.

Living off dividends in retirement: hypothetical income today for portfolios between $2M and $15M

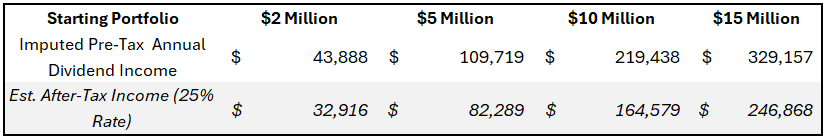

Investors may wonder how much money they could expect in dividend income annually given today’s market. As of January 31st, 2025, the dividend yield on US Aggregate bonds (AGG ETF) was 3.73% and the S&P 500 (SPY ETF) was 1.17%. In another words, if your asset allocation is 60% stocks and 40% bonds, the current weighted average yield is 2.19%.

So if you’ve experienced a sudden wealth event and are hoping to invest cash and then retire on dividends, the table below reflects hypothetical dividend income in retirement for different portfolio sizes.

Retire on dividends? Passive income for a 60/40 portfolio today

Need more income? Here’s what the same portfolios could provide in retirement if withdrawals include principal too.

Other considerations for income-focused investors

Taxes

For simplicity, a flat 25% tax rate is used above. But in practice, when trying to determine whether to invest in dividend paying stocks and what’s needed to retire, note dividends are taxed as ordinary income unless deemed a qualified dividend. If qualified, the IRS uses more favorable long-term capital gains tax rates. Also consider state tax implications.

If you have assets in a brokerage account, taxes are another reason to consider a principal and income withdrawal strategy. Over time, the goal is for investments to appreciate in value. If that happens, unrealized gains continue to grow. Down the road, if the portfolio needs rebalancing or if additional liquidity is needed beyond investment income, it may trigger a huge tax bill. Periodically resetting cost basis can provide more optionality later and help ensure you’re taking advantage of the 0% bracket for capital gains.

Asset allocation

Generally, dividend stocks tend to be older, more mature companies. Certain sectors also typically have higher dividend yields than others which can lead to concentration. Examples include real estate, financials, and utilities. Even if your focus is on dividend investing, it’s important not to get tunnel vision as there are lots of factors to consider when constructing an asset allocation.

For example, consider two stocks: Exxon Mobil (XOM) and Tesla (TSLA). As of 1/31/2025, Exxon’s dividend yield was 3.59% and its 10-year annualized total return (which includes dividends) was 6.6%. Tesla on the other hand doesn’t pay a dividend, but its 10-year annualized total return was a whopping 40.4%.

If investment decisions are only based on income, you may miss other areas of the market that can provide opportunities for growth from price appreciation. When investing, it’s always important to strike a balance.

The same relationship applies to more diversified allocations of stocks and bonds. Recall the dividend yields mentioned earlier for the S&P 500 and US Aggregate bonds (1.17% and 3.73% respectively). Again, if solely income-focused, comparatively, bonds generate a higher level of retirement income. But if we consider total returns, having some level of stock exposure is key. As of 1/31/2025, the 10-year annualized total return for the S&P 500 (SPY) was 13.6% versus 1.1% for US bonds (AGG).

Before making any investment decisions, consider all the factors as well as your personal risk tolerance and retirement income needs.

Final word on dividend investing

Living off dividends may be feasible depending on your expenses, income needs, and asset level. However, it’s essential not to let dividends drive your entire asset allocation strategy. Doing so could not only jeopardize your income stream, but also your entire portfolio. As you evaluate how to retire comfortably or achieve financial flexibility, (re)consider the importance of living off dividends in your financial plan. It may not be as essential as you think.

Important disclosure

This is a general communication for informational and educational purposes only. This article should not be misinterpreted as personalized advice or a recommendation for any specific investment product, strategy, or financial decision. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. If you have questions about your personal financial situation, consider speaking with a financial advisor.

¹ Source: J.P. Morgan Guide to the Markets, as of 1/31/2025

² Assumes shares purchased 12/31/2004 and analysis ends 12/31/2024. Dividend income annually is based on the record date, not pay date. Assumes no rebalancing or dividend reinvestment. No other cash flows in the account. Excludes taxes, fund expenses, transaction costs, advisory fees, account or custodial fees, etc. Past performance is not indicative of future results.