Just inherited an IRA from a parent? Here are the distribution rules.

If you’ve just inherited a retirement account like an IRA or 401(k) from a parent, sibling, or relative, you may be unsure about what your options are and what to do next. Most non-spouse beneficiaries inheriting an IRA, 401(k), or retirement account from the original account owner must take the money in 10 years.

Note that successor beneficiaries, e.g. people that inherit an IRA from someone other than the original IRA owner, may have different rules, which is outside the scope of this article. So it’s important to consult a financial advisor and attorney to discuss your situation. For more information on what to do after receiving an inheritance, contact us today to schedule a consultation.

New rules for required distributions from inherited retirement accounts

Starting in 2020, following the passing of the Secure Act, most beneficiaries who inherit a retirement account from a parent or relative can no longer ‘stretch’ the distributions over their lifetime by taking required minimum distributions (RMDs).

Instead, they must to take the funds in 10 years – or earlier. The change won’t impact anyone who inherited a retirement account during 2019 or years prior.

Non-spouse beneficiaries now fall into two groups:

- Eligible designated beneficiaries (not subject to the 10-year rule)

- Non-eligible designated beneficiaries (subject to the 10-year rule, which may include RMDs – this article focuses on these beneficiaries)

Who are eligible designated beneficiaries?

Other than surviving spouses, are three exceptions to the 10-year rule for eligible designated beneficiaries:

- Minor beneficiaries have until they reach the age of majority (21) before the 10-year payout period begins

- Beneficiaries less than 10 years younger than the decedent, or

- If the beneficiary is disabled (strict definition applies)

Beneficiaries qualifying for exception #2 or #3 can take the funds over their lifetime, typically using the old required minimum distribution rules (also called a stretch IRA).

This article focuses on the distribution rules for non-eligible designated beneficiaries as that is most common.

Inherited IRA distributions for non-eligible designated beneficiaries

Remember, unless you meet one of the three exceptions above, you’re considered a non-eligible designated beneficiary, subject to the 10-year rule, and potentially annual required minimum distributions too.

10-year rule

As the name implies, non-eligible designated beneficiaries must distribute all the money in an inherited IRA by the end of the 10th year after the year of the owner’s death.

Example:

Marlow died in 2023 and left his traditional IRA to his daughter, Scottie. She is a non-spouse beneficiary and doesn’t meet any of the eligible designated beneficiary exceptions, so she’s a non-eligible designated beneficiary. Scottie sets up an inherited IRA account. She’ll be required to take all the money from her inherited IRA by December 31st, 2033.

Which non-eligible designated beneficiaries have required minimum distributions?

Again, all non-eligible designated beneficiaries inheriting an IRA or retirement account from the original account owner needs to follow the 10-year rule. Now the question is: which beneficiaries are also subject to required minimum distributions?

When IRA beneficiaries MUST take RMDs

If the account owner was taking required minimum distributions (RMDs) when they died, then the beneficiary must too.

The concept centers around whether your parent or relative reached their required beginning date (RBD). If they had, distributions are required in years one through nine in addition to taking the remaining lump sum in year 10.

Distributions during the 10-year window are based on the beneficiary’s own life expectancy according to the the IRS Single Life Table, reduced by one each year.

Important note: if the deceased account owner did not take their full RMD in the year of death, it must be satisfied by the beneficiaries by the end of the year.

Required beginning dates for IRAs

For IRAs (other than Roth IRAs), the required beginning date (RBD) is April 1 of the year after the calendar year in which you reach your RMD age. The required beginning date (RBD) is April 1 of the year after the year you turned 70 1/2 if you were born before 7/1/49; 72 if you were born on or after 7/1/49 or in 1950; 73 if born between 1951 and 1958; 75 if born in 1960 or later. If you were born in 1959, there’s an issue with the writing of the law and federal guidance is needed to determine if the RBD is 73 or 75.

When withdrawals from inherited IRAs are NOT required during the 10-year window

Beneficiaries who inherited an IRA from a parent who hadn’t reached their required beginning date only need to follow the 10-year rule. That said, for tax purposes, taking a large lump sum in year 10 should generally be avoided. More planning strategies and tax implications below.

Special rules for Roth IRAs

Required minimum distributions are not required for Roth IRAs – regardless of the account owner’s age at death. Roth 401(k)s can only bypass annual distributions if 100% of the retirement plan was in a Roth account. If there’s a mix of pre-tax and Roth funds, RMDs will apply.

What to Do When a Parent Dies and You’re the Executor

FAQ: inherited IRA rules for non-spouse beneficiaries

- My parent died a few years ago and I’ve skipped RMDs until now – what do I do?

- There’s no forced ‘catch up’ and RMDs are not technically needed before 2025. However, this does NOT extend the 10-year window.

- How does the 10-year rule work?

- In the 10th year after death, the beneficiary IRA must be fully distributed. So, if you inherited an IRA from a parent in 2021, the account must be emptied by 12/31/2031.

- How are RMDs calculated?

- The numerator is the 12/31 account value from the prior year. The denominator is the greater of the beneficiary’s life expectancy in the year of death or the decedent’s. Both use the IRS’ Single Life Expectancy table. In each subsequent year, the denominator is reduced by one. RMDs must begin the year after death(year one) and continue through year nine. There’s no required minimum distribution in year 10 because the balance must be taken as a lump sum distribution.

Tax treatment of an inherited IRA or retirement account

Most retirement accounts are funded with pre-tax dollars so distributions are fully taxable to you, the beneficiary, as regular income.

As a result, tax planning is critical, particularly if you’ve inherited a large 401(k) or IRA. Consider working with your financial and tax advisor to develop a strategy to minimize taxes and ensure the approach aligns with the rest of your financial situation.

Your financial advisor can also manage the IRA assets so your inherited IRA can continues to grow tax-deferred until the distribution rules apply.

Do you have to pay taxes on Roth IRAs or after-tax contributions?

The rules for inherited Roth IRAs are a bit different. If it’s been at least five years since the original account owner first funded the Roth IRA, distributions will be tax-free. The funds are still subject to the 10-year rule.

If the decedent made after-tax non-Roth contributions to an IRA, you’ll need to find the records to prove it in order to exclude withdrawals from your taxable income on a pro-rata basis. If you can’t locate the records (or if they don’t exist), you’ll have to pay taxes on the income (double taxation).

Inheriting a Trust Fund: Distributions to Beneficiaries

Open an inherited IRA

When you inherit a retirement account from a parent, you’ll need to open an inherited IRA. You can open an inherited IRA at the financial institution of your choosing. If you’re working with a fee-only financial advisor, they can help you coordinate this process.

Financial and tax planning strategies for your inherited IRA

Tax strategies to optimize your inherited IRA

Inherited IRAs require a lot of planning to avoid negative tax consequences and take advantage of tax-saving opportunities. After all, most distributions from an inherited retirement account will be taxable as ordinary income.

Some tax planning strategies include:

- Accelerating inherited IRA distributions during low income years

- Deferring withdrawals or only taking minimum required distributions during high income years

- State tax considerations and residency changes

- Planning distributions around an expected windfall or sudden liquidity event

- Considering the possible impact on college financial aid eligibility or Medicare premiums. Both use tax returns from two years ago (prior-prior year). Even a $1 increase in your MAGI can cause Medicare part B and D premiums to increase substantially. According to a Medicare.gov calculator, a married couple filing jointly would pay an estimated $1,678 more per year (combined) for Medicare Part B premiums in 2024 if their income increased from $206,000 to $206,001

Even if you don’t have any major events on the horizon, it still makes sense to do additional planning. Balance the benefits of continued tax-deferred growth with the downsides of triggering the 3.8% Medicare surtax or loss of other tax deductions due to income. Non-spouse beneficiaries cannot convert an inherited retirement account to a Roth IRA.

Financial planning and investing strategies after receiving an inheritance

Reinvesting distributions from an inherited IRAs

After-tax proceeds can be reinvested in a brokerage account and used for long-term financial goals. Unlike retirement accounts, which have specific rules on when you can – or must – take money out, a brokerage account is completely flexible.

And thanks to more favorable long-term capital gains tax rates, it can add tax-efficiency to your financial situation.

Coordinate your approach with any other assets you inherit

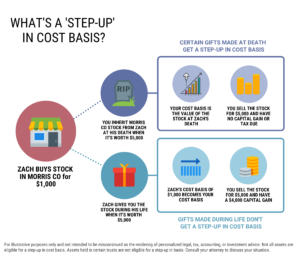

When deciding when to take money from an inherited 401(k) or IRA, consider the other assets you inherit. The tax treatment of an inheritance depends on the type of asset you inherit. For example, an inherited IRA is taxed differently than an inherited home or brokerage account, which receive a step-up in basis.

Help managing an inheritance

There’s a lot to consider after inheriting an IRA from a parent and this article is only the tip of the iceberg. For help navigating options on your inheritance, please schedule a consultation with an advisor.

Darrow Wealth Management is a fee-only wealth management firm and fiduciary specializing in helping individuals who experience a large windfall from an inheritance.

For more information on what to do after receiving an inheritance, contact us today to schedule a consultation.

Last reviewed January 2025