Managing Inherited Wealth

Home » Who We Help » Managing Inherited Wealth

Wondering What to do with an Inheritance?

Darrow Wealth Management regularly works with individuals who experience a sudden liquidity event after inheriting a retirement account, a trust fund, property, and other assets. If a loved one has passed and you’re expecting to receive an inheritance, you may have a number of questions about the process and tax implications. Whether an inheritance is taxable to you, the beneficiary, will depend on what type of asset you inherited and how it was passed down.

Determining the best use of inherited money requires financial planning. We help you evaluate your goals, priorities, and analyze possible trade-offs. It’s also essential that your new investment plan suits your needs and time horizon. This is especially important after inheriting wealth from an elderly parent or relative, as your risk profile may be quite different.

From a logistical standpoint, receiving an inheritance can be overwhelming for individuals not working with an advisor. We’ll assist you in navigating the complex distribution process, working to help ensure inherited investment accounts are properly set up and funded.

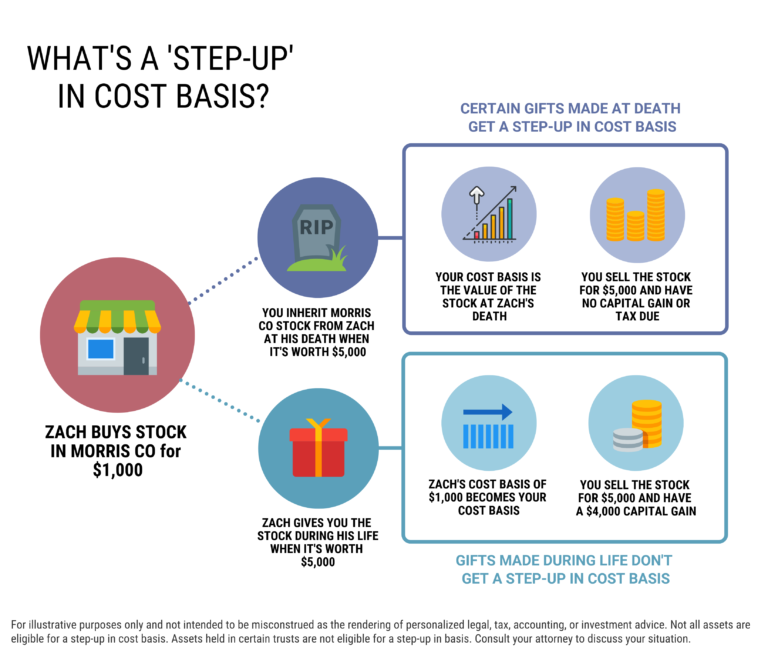

This is critically important in a post-Secure Act landscape. Further, perhaps the most significant tax benefit of certain inherited assets – the step-up in basis – isn’t always automatic. As wealth advisors experienced in managing inherited wealth, we have the knowledge and resources to help ensure you’re taking advantage of the planning opportunities available to you.

Investing and Planning After Receiving an Inheritance

A large inheritance can transform your financial life. But depending on what type of asset you inherited, you may have certain distribution rules or requirements to follow. For example, money in a trust fund may not be at your full disposal. And recent changes to inherited retirement accounts require most non-spouses to take the money within 10 years. We’re here to help you understand your options and develop a plan that best suits your needs and goals.

Our team of Financial Advisors can work to help you:

- Decide on a strategy to best use the inheritance, including funding multiple goals and investment management services to help you invest inherited money

- Understand the tax implications of distributions and assist in developing tax-efficient strategies for retirement account withdrawals

- Provide logistical support in opening new accounts and transferring funds for investment in coordination with your tax and legal advisors

- Quarterback a multi-step process to help ensure your new financial picture is aligned with what you’ve set up previously (insurance, estate plan, etc.)

- Provide ongoing financial planning and investment support through an ongoing wealth management advisory relationship

Meet the Advisory Team

Our team of advisors have broad and deep experience and education in the fields of investment management and financial planning. Our advisors include a CERTIFIED FINANCIAL PLANNER™ professional, Certified Public Accountant (CPA) and Chartered Financial Analyst® (CFA) designations. Learn more about the Darrow team of financial advisors.

Putting New Wealth to Work

Your planning needs will depend on the nature of your windfall and your overall financial situation. Darrow Wealth Management is a fee-only financial advisory firm and full-time fiduciary. We regularly work with individuals after a sudden wealth event from an IPO, selling a company, or inheriting a trust fund.

By integrating financial planning with investment management, our goal is to help you build and grow your wealth. Learn more about our Wealth Management Services and how we may be able to help you.

Managing Inherited Wealth Related Articles

Inheriting an IRA from Your Spouse

Losing a spouse is a difficult time, and navigating the complexities of inherited assets can feel overwhelming. If your spouse named you as the sole

What is a Stepped Up Basis? Cost Basis of Inherited Stock and Other Assets

A step-up in basis is a tax advantage for individuals who inherit stocks or other assets, like a home. A stepped up basis can apply

What’s The Best Thing To Do With A Large Inheritance?

After receiving a large inheritance from a loved one, you may wonder: what’s the best thing to do with it? As you consider what approach