You may want to think twice before taking the old saying cash is king too literally. Even though interest rates have risen in the last few years, over time, holding cash will yield a real negative return after inflation and taxes. Keeping cash is important, the key is finding the right amount. Here are a few ways to tell if you’re holding too much cash and how to put extra cash to work.

Do I have too much cash? How much should I have in savings?

Whether you have recently experienced a liquidity event from a windfall or have just been saving, holding too much cash can hurt you. But how much is too much? First, calculate your emergency cash reserves.

In general, one income households should have between 6-9 months of essential expenses in savings. Two income families usually need less, around 3-6 months in emergency funds. If you’re saving for a major purchase in a year or two, that money should be kept in a safe interest-bearing account or investment, such as a high-yield savings account or Treasury. Also, if you’re a business owner, you’ll also need more in savings. Take a look at your entire financial situation, or work with a fee-only financial advisor to determine exactly how much savings you should have.

The cash drag: opportunity cost of uninvested cash

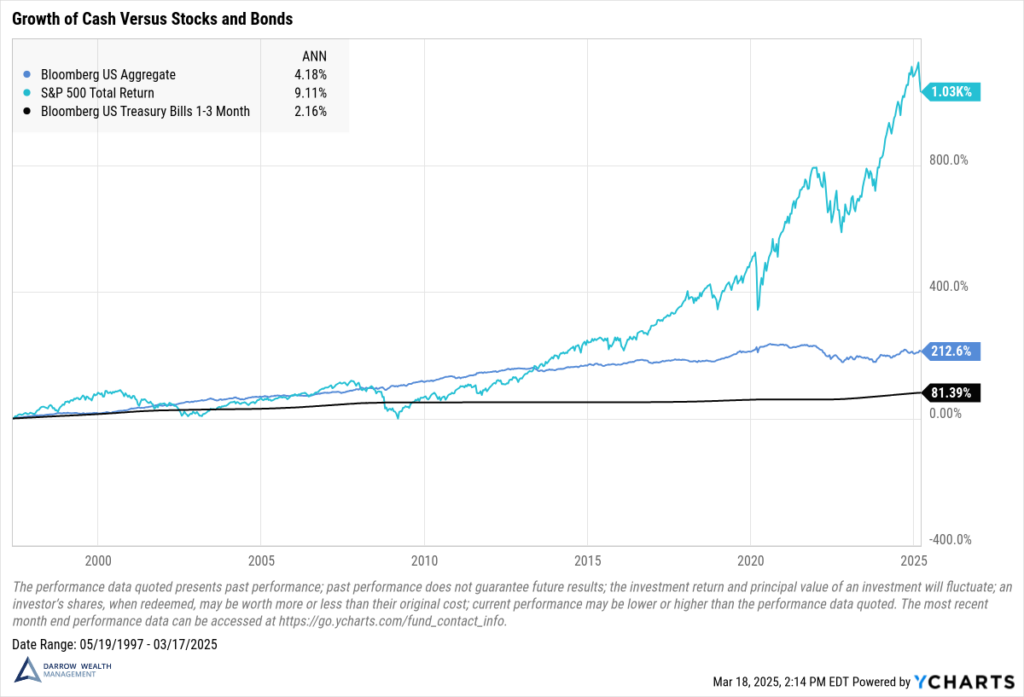

The biggest risk in keeping too much cash on hand is the opportunity cost. Even in periods of higher interest rates, the real return on cash after taxes and inflation can be negative. For long-term investors, only stocks have reliably outpaced inflation. That’s often the difference between having enough money to retire, and not.

Consider the chart below, illustrating the growth of the S&P 500, US bonds, and cash since 1997. The chart highlights the importance of holding the right amount of cash (stability), bonds (stability, income, some growth), and stocks (growth and some income).

Growth of Cash vs Stock and Bonds

What to do if you have too much money in savings

If your emergency fund is fully funded and your near-term major purchases are already covered (typically a combination of cash and leverage from a loan or mortgage), you’re probably holding too much cash. You will have several options to use your extra savings including debt management, saving for retirement, investing with a brokerage account, and paying off other debts.

5 ways to use extra savings

- Invest excess cash using a brokerage account

- Increase contributions to a 401(k), 403(b), or IRA

- Consider using the funds to pay the tax on a Roth IRA conversion

- Refinance your mortgage

- Pay off student loans or bad debt

Read more about ways to use extra savings.