Returns of Stocks and Bonds Before, During, and After Interest Rate Hikes (Charts)

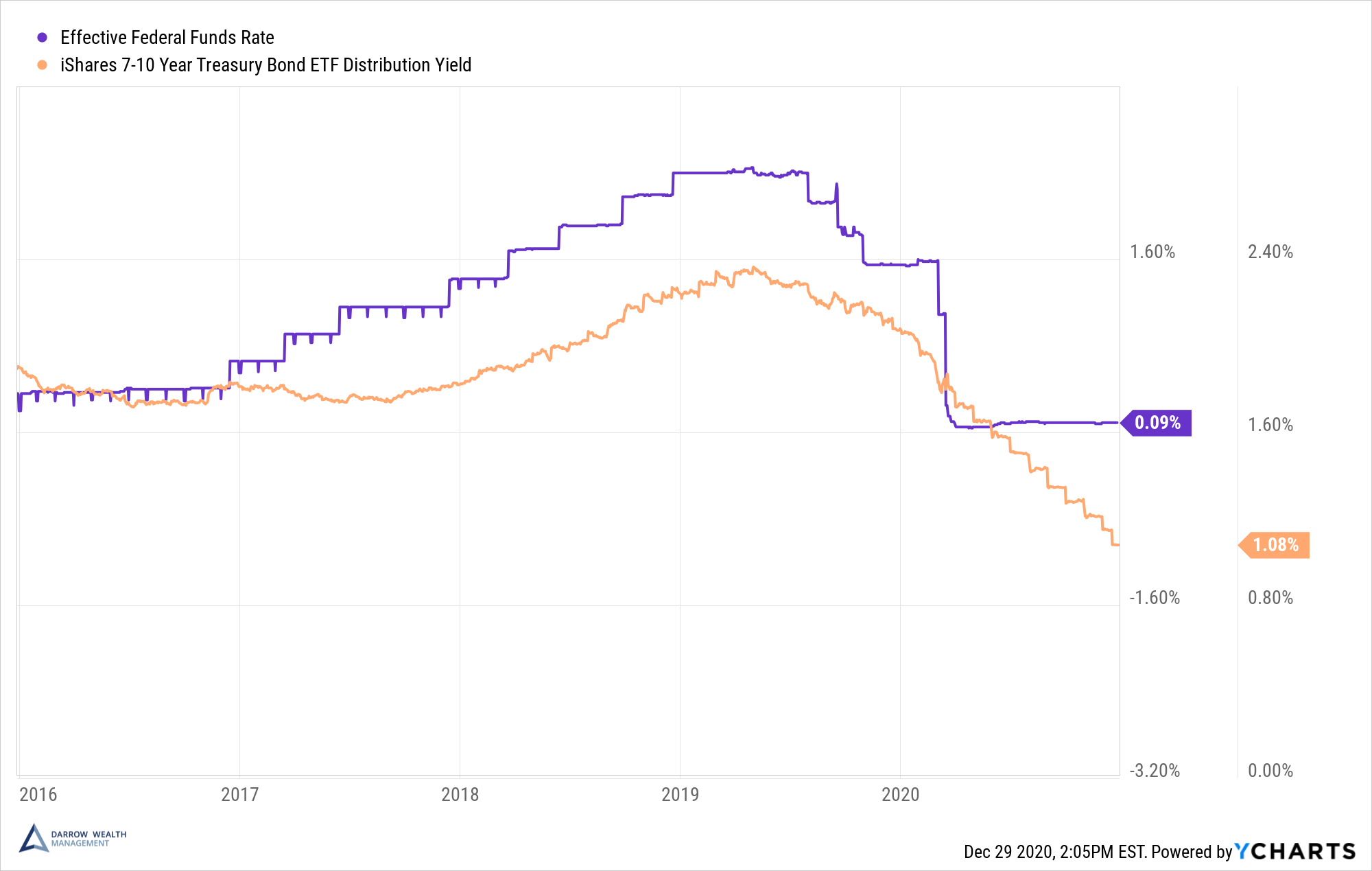

The Federal Reserve is going to be raising interest rates (via the target Federal Funds rate). This is likely to happen next month. Rising interest

The Federal Reserve is going to be raising interest rates (via the target Federal Funds rate). This is likely to happen next month. Rising interest

The idea of living off dividends in retirement sounds nice, but it’s challenging. What investors don’t always realize is how much money they’ll need invested

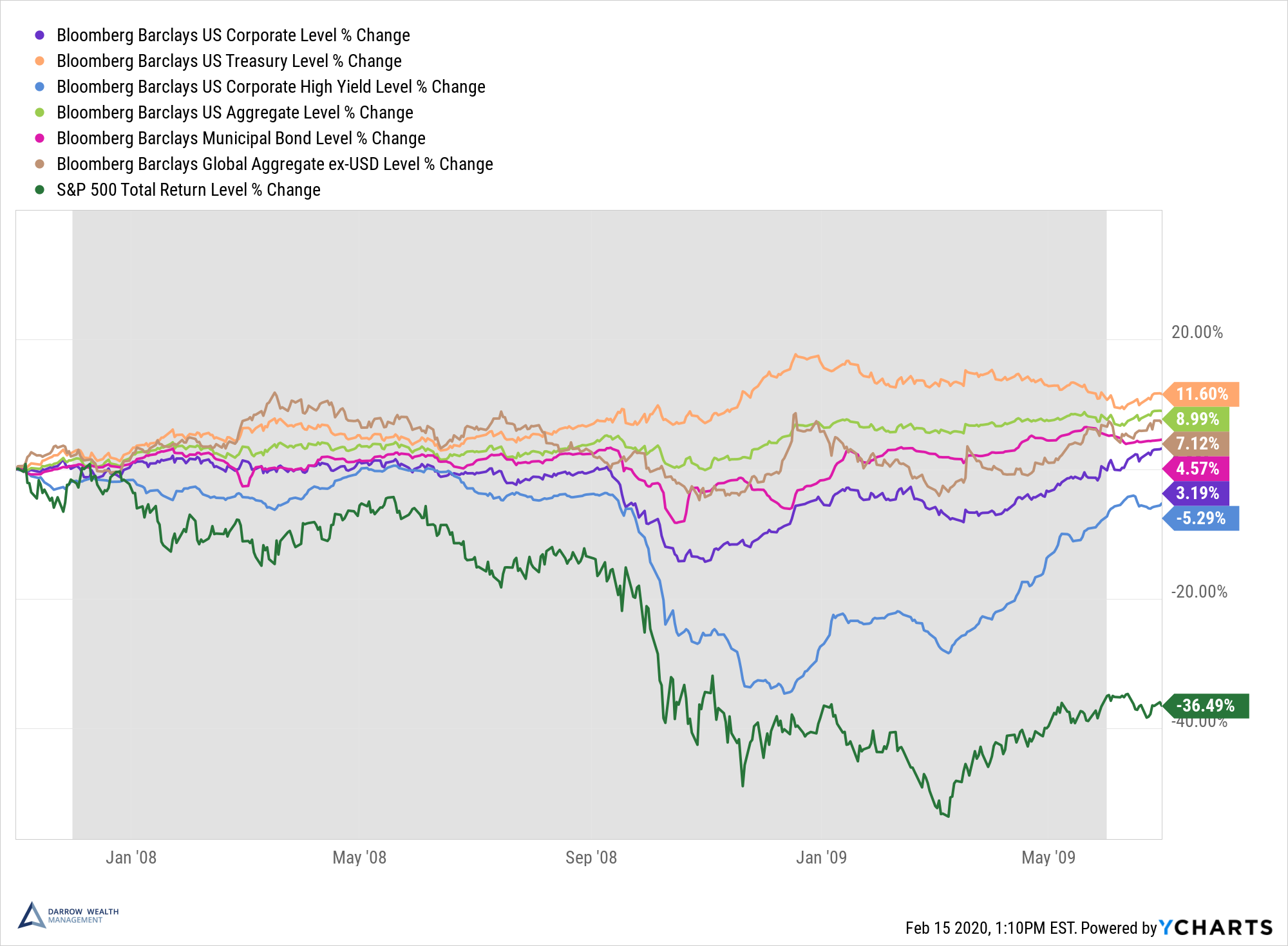

How do bonds work and why buy them in your investment accounts? There are several benefits of investing in bonds. Most notably, bonds provide investors

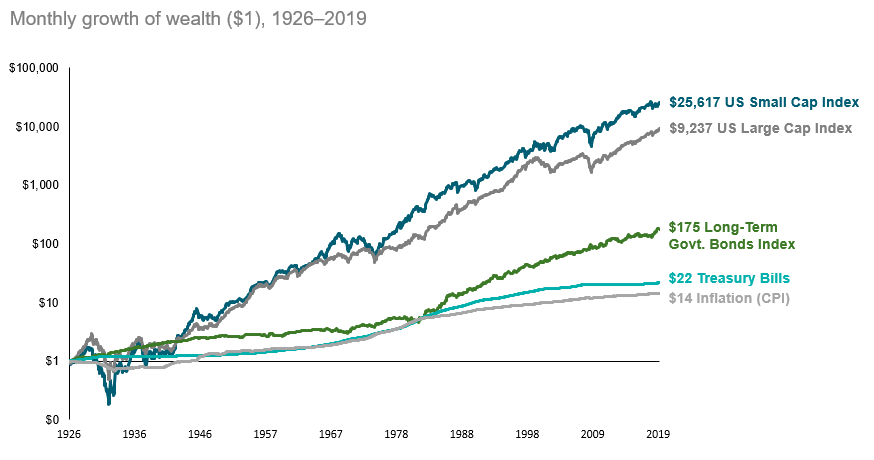

Stocks and bonds differ in many aspects, including the risk and return investors can expect. Because of these differences, stocks and bonds accomplish different things

One of the most important things to know about bonds is how changes in interest rates affect bond prices, and therefore yields (unless held to

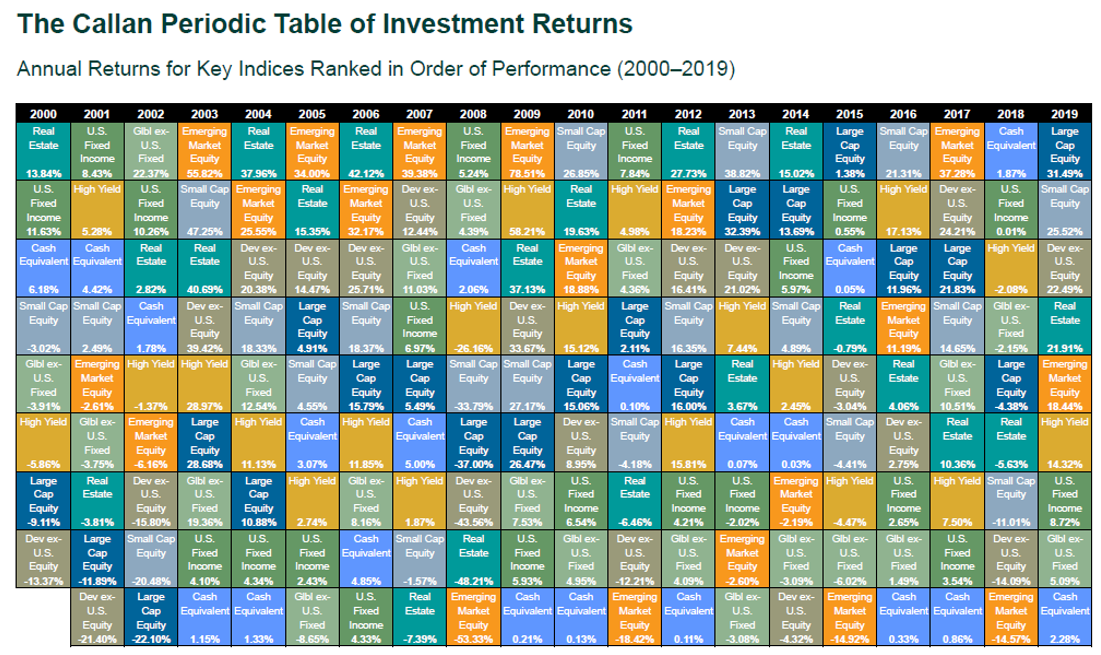

Amidst the vast uncertainty in the markets right now, it’s more important than ever for investors to understand the benefits—and limitations—of diversification. Having the right

The globalized nature of the world economy makes diversification a tall task. Although past performance is not indicative of future results, history is a helpful