How to Apply an Asset Allocation to Multiple Investment Accounts

Whether you’re managing your own investments or working with a financial advisor, setting the right asset allocation is key. But what’s the best way to

Investing trends, topics, and money management strategies from professional money managers. The Darrow Wealth blog covers a wide range of topics, such as rebalancing your portfolio, setting your asset allocation, when to consider buying Treasuries, ways to diversify a concentrated stock position, and reasons to diversify globally.

Whether you’re managing your own investments or working with a financial advisor, setting the right asset allocation is key. But what’s the best way to

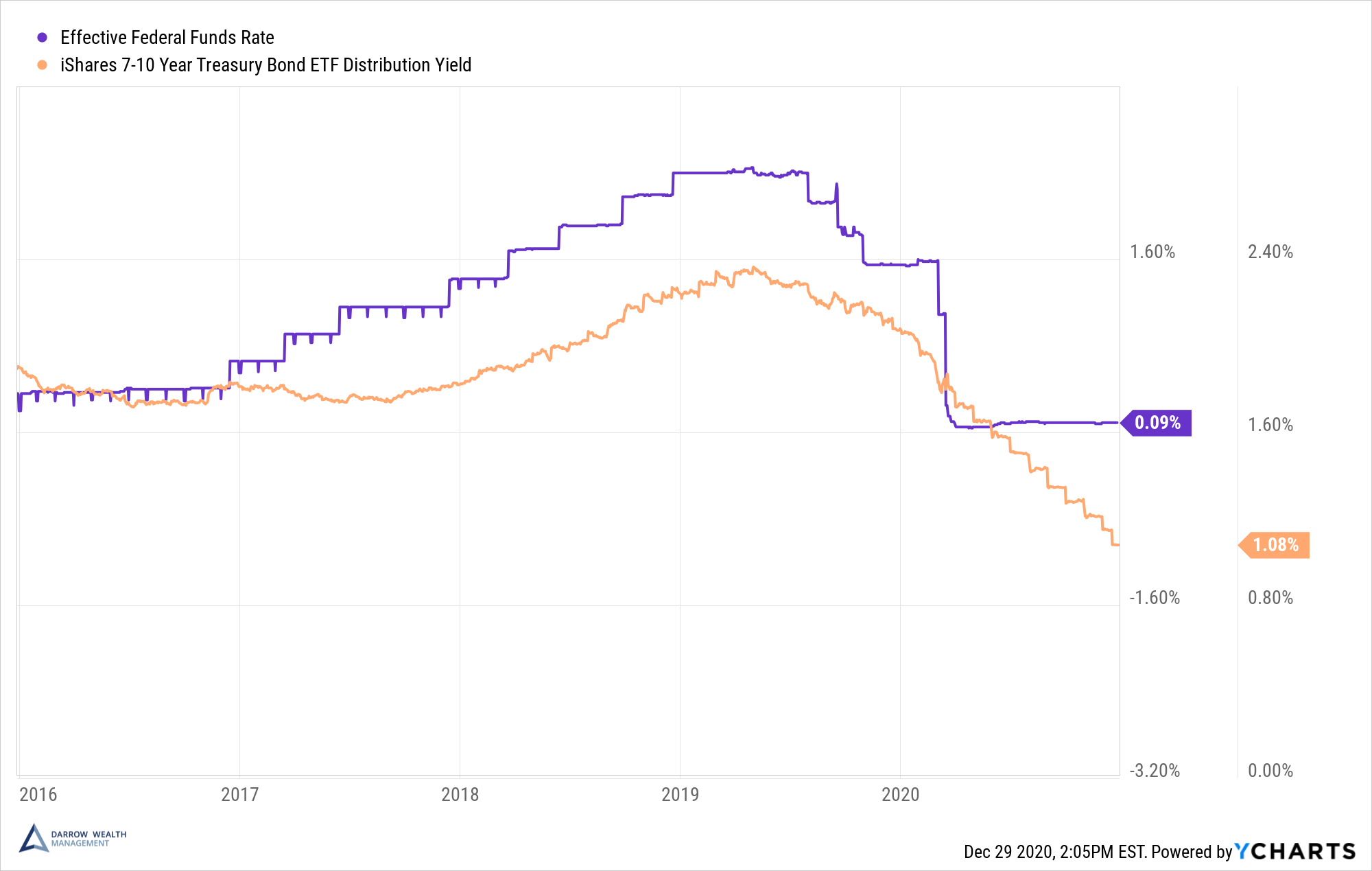

How do bonds work and why buy them in your investment accounts? There are several benefits of investing in bonds. Most notably, bonds provide investors

One of the most important things to know about bonds is how changes in interest rates affect bond prices, and therefore yields (unless held to

What is a brokerage account? Updated in 2025. A brokerage account is a non-retirement investment account. Essentially, a brokerage account is the opposite of a

Updated for 2025. What should you do with excess cash? If you are holding too much cash, consider how to use the extra money to

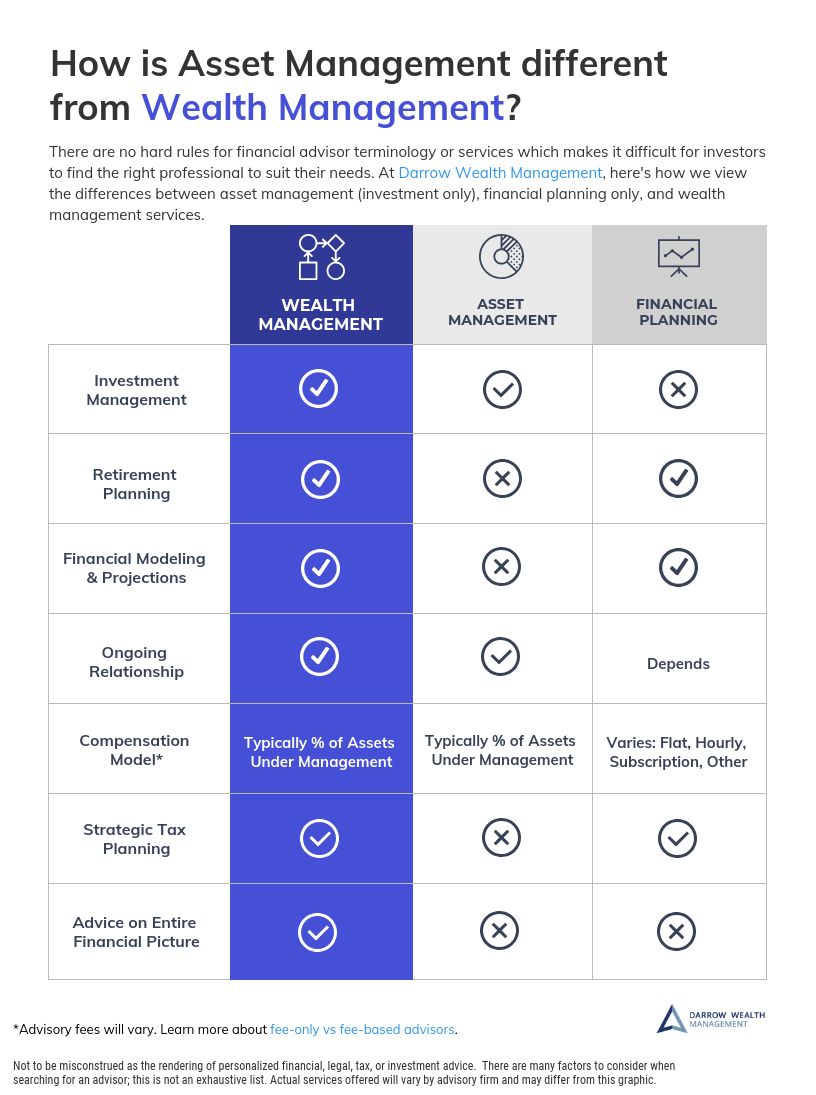

Asset Management vs Wealth Management When searching for a financial professional, you may wonder whether you need asset management vs wealth management. How are they

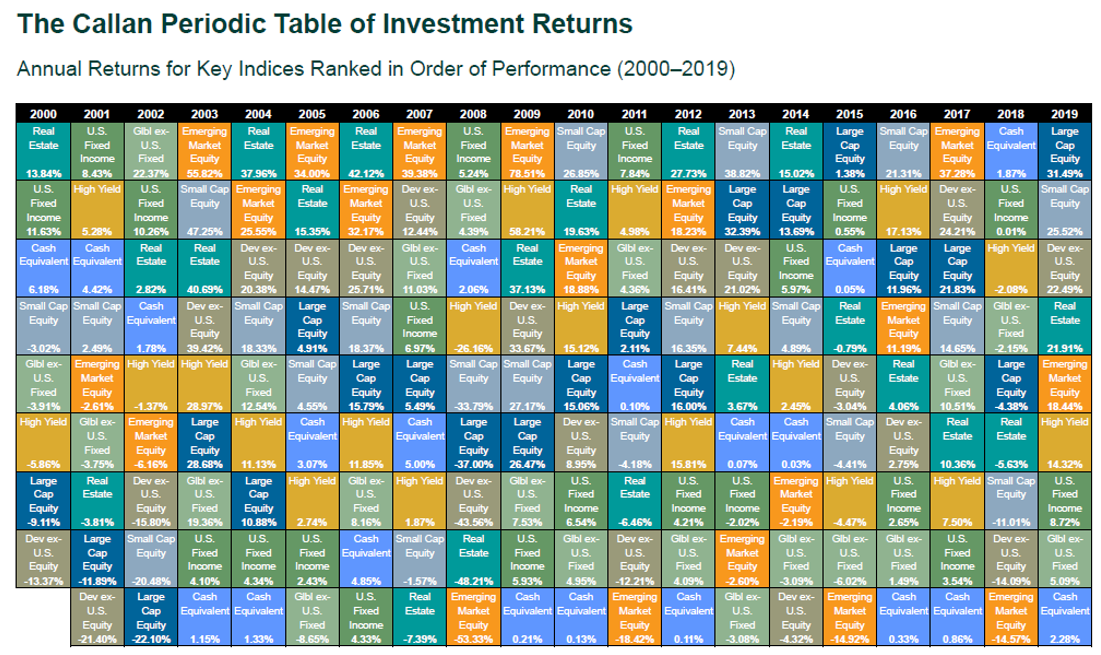

Amidst the vast uncertainty in the markets right now, it’s more important than ever for investors to understand the benefits—and limitations—of diversification. Having the right

This article was written by Darrow advisor Kristin McKenna, CFP® and originally published by Forbes.

Tax-loss harvesting is the process of selling an investment that has lost value in your portfolio to ‘realize’ the loss for tax purposes. Investors can

Setting your asset allocation is like drafting architectural plans when building a home; it provides a map to guide the construction of your investment portfolio.