The S&P 500 Is Up 97% Since 2019. What’s The Market Outlook In 2022 And Beyond?

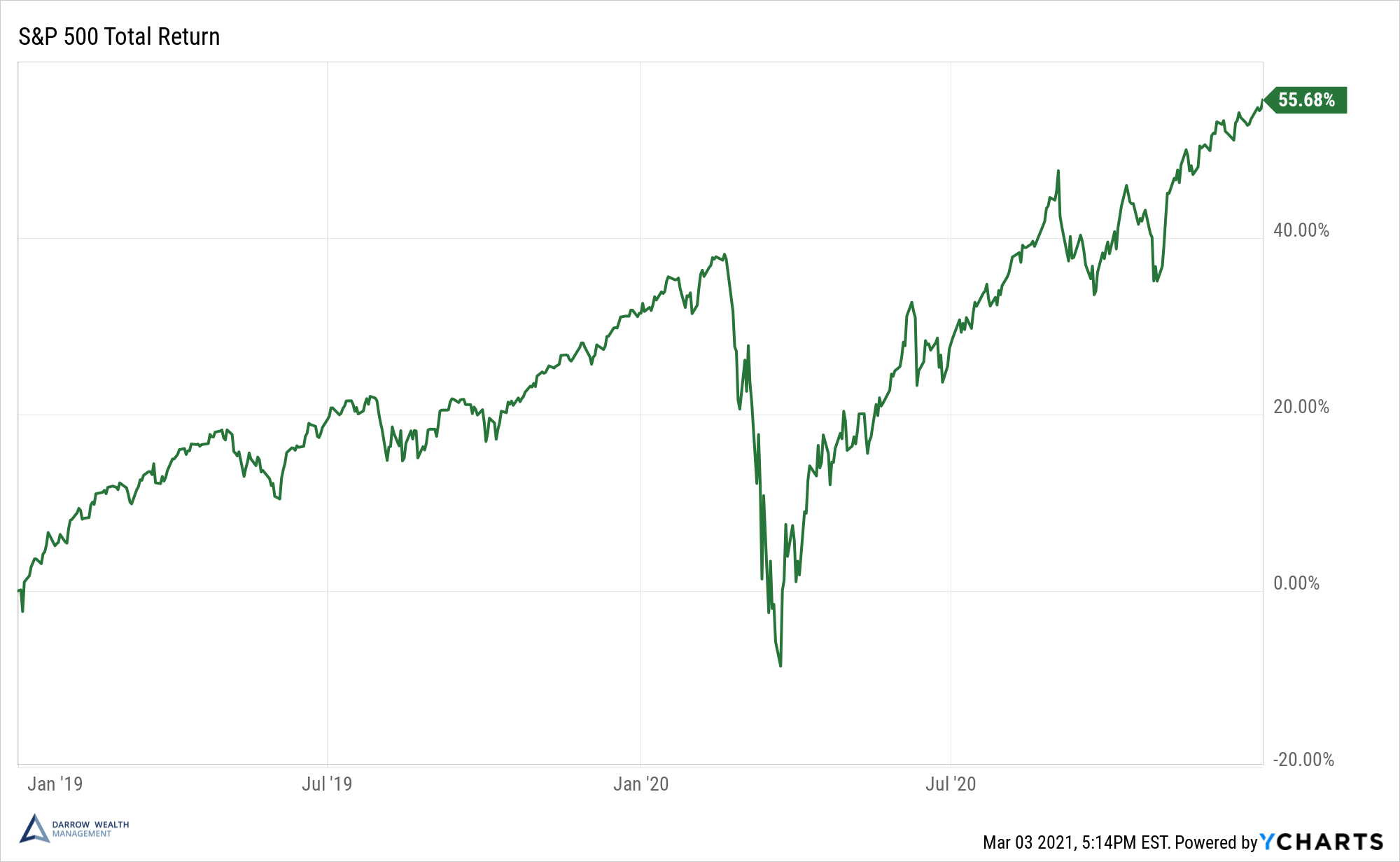

Since 2019, the total return on the S&P 500 is nearly 97% (almost 27% on an average annualized basis).¹ This outperformance is leaving many investors

Investing trends, topics, and money management strategies from professional money managers. The Darrow Wealth blog covers a wide range of topics, such as rebalancing your portfolio, setting your asset allocation, when to consider buying Treasuries, ways to diversify a concentrated stock position, and reasons to diversify globally.

Since 2019, the total return on the S&P 500 is nearly 97% (almost 27% on an average annualized basis).¹ This outperformance is leaving many investors

The idea of living off dividends in retirement sounds nice, but it’s challenging. What investors don’t always realize is how much money they’ll need invested

If you recently retired or are planning to, you likely have questions about how to position your investments going forward. Conventional wisdom suggests investors should

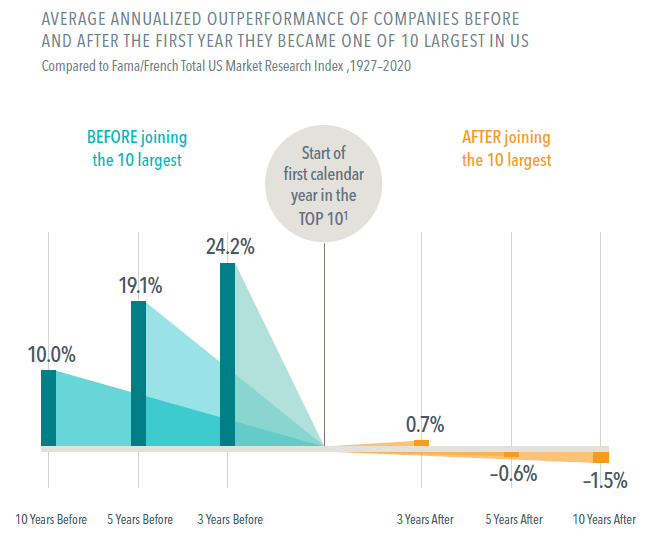

With the dominance of the largest U.S. stocks often occupying headlines, it’s worth remembering that the biggest companies don’t always produce the best returns. In

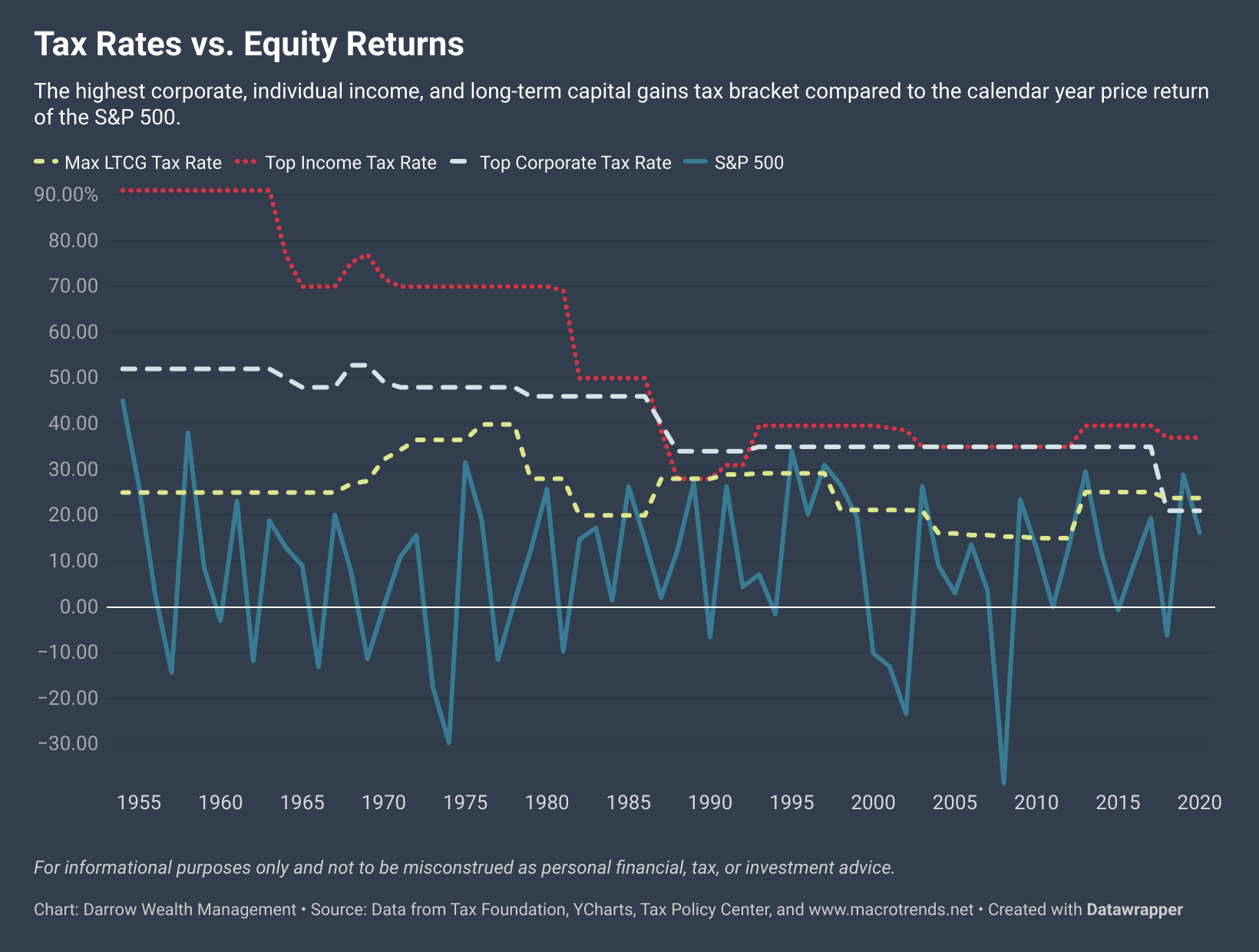

Between the Biden tax plans and other bills already before Congress, it’s likely that some level of tax legislation will make its way into law

Tesla, GameStop, Hertz, Dogecoin: retail traders continue to dominate headlines in the financial news media. Some individuals may be wondering, how is trading different from

After selling your business, you may receive a lump sum in cash. Deciding how to allocate and invest the proceeds after selling your business is

According to a recent survey of U.S. households by Schroders, only 27% of respondents who were still working reported ‘very good’ and ‘fully on track’

It was almost a year ago when the Covid-19 induced selloff in the financial markets reached a bottom. The S&P 500 fell from its February

We’re all ready to put 2020 behind us. But before closing the books, it’s worth reflecting on what was a crazy year in the stock