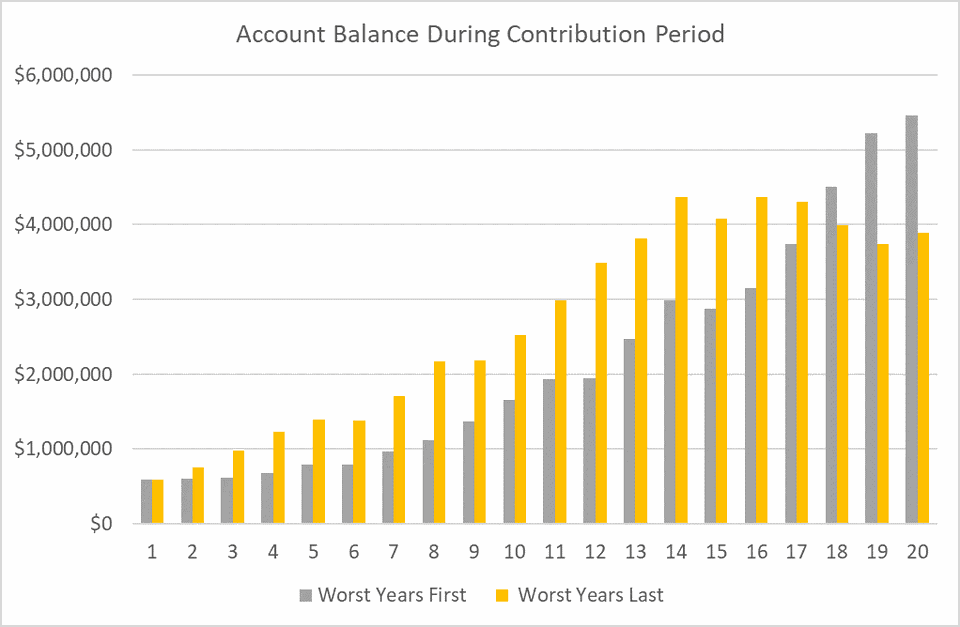

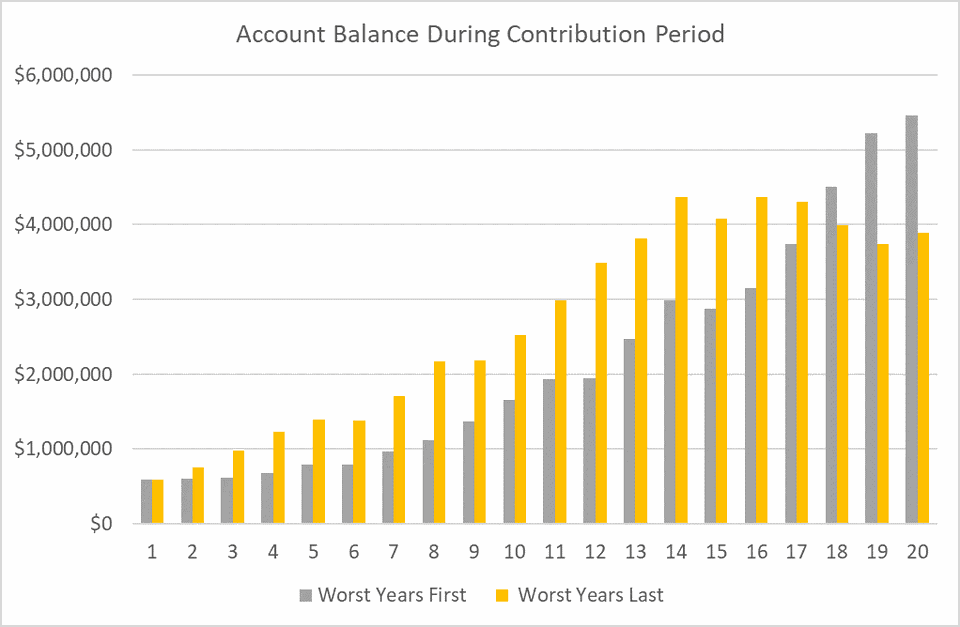

How the Timing of a Stock Market Crash Can Impact a Retirement Plan

There’s plenty for investors to worry about when their financial livelihood is on the line. When planning for major financial decisions such as retirement, individuals

Investing trends, topics, and money management strategies from professional money managers. The Darrow Wealth blog covers a wide range of topics, such as rebalancing your portfolio, setting your asset allocation, when to consider buying Treasuries, ways to diversify a concentrated stock position, and reasons to diversify globally.

There’s plenty for investors to worry about when their financial livelihood is on the line. When planning for major financial decisions such as retirement, individuals

If you’ve ever heard excerpts from the latest Apple earnings report, you may have thought, ‘so what?’ Well, for many investors, Apple’s relative performance could

What are the best strategies to build wealth and a comfortable lifestyle for you and your loved ones? The answer isn’t sexy or complicated. The

Like many things in life, managing your own investments becomes more complex as you get older. For young professionals just starting out, it makes sense

Investing your 401(k) in company stock can be quite risky. Although companies are scaling back on the practice, there are still many big U.S. firms