After receiving a large inheritance from a loved one, you may wonder: what’s the best thing to do with it? As you consider what approach is right for your situation, it’s important to understand the complexities of managing a financial windfall and the various ways an inheritance can be taxed. Consider these options for making informed decisions that can significantly impact your financial future.

One of the best things to do with inherited money is consult a financial advisor

When someone receives a large inheritance, it’s not uncommon for inherited assets to come through a trust or taxable brokerage account. Ultimately, the best thing to do after receiving an inheritance is to take your time and work with your financial, tax, and legal advisors to fully understand the implications and your options with the inherited money. Then, depending on your current financial situation, goals, and the type of assets you inherit, you can develop a plan for the financial windfall.

This article is simply an overview of the tax treatment and primary options after inheriting significant wealth. Please contact us to discuss how we may be able to help you with financial planning and investing.

How is an inheritance taxed?

There are several ways an inheritance can be taxed depending on the situation. Whether the estate pays or the end beneficiaries, it still means less inheritance money is left for family members.

Federal estate tax

Large estates may be subject to federal estate tax to the extent they exceed the exemption. The current estate tax rate is 40%. Although the estate must pay, it can leave less money left for heirs.

State estate tax

A handful of states impose their own estate tax and exemption amounts. The tax rate is much lower than the federal system, but the exemption amounts are also smaller. Again, the estate pays, but it also means less is leftover for beneficiaries. In all, 12 states (Connecticut, Hawaii, Illinois, Maine, Maryland, Massachusetts, Minnesota, New York, Oregon, Rhode Island, Vermont, Washington, as well as Washington D.C.) have their own estate taxes.

State inheritance tax

Only a few states have an inheritance tax, which is usually paid by the beneficiary: Kentucky, Nebraska, Pennsylvania, New Jersey, and Maryland (Iowa will discontinue it after 2024). The exemption amounts vary by state, and whether a tax is imposed at all may also depend on your relation to the decedent.

Personal income taxes and capital gains

You may pay taxes multiple times on the same accounts. Retirement accounts like inherited IRAs are included in the taxable estate and non-Roth withdrawals are also subject to personal income taxes. Similarly, capital gains taxes also apply on sales of an inherited family home or taxable investment account.

What to do with a large inheritance of cash, stocks, or an investment account

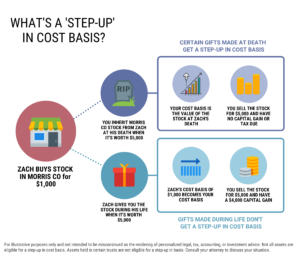

Inheriting stocks or cash in a brokerage account gives heirs a lot of flexibility. If you inherit the money directly (versus in a trust fund), you have total flexibility on when and how to use it. Further, many beneficiaries are eligible for a step-up in basis on eligible assets.

This is a major advantage as the cost basis of stocks or other assets are ‘stepped up’ to the value on the date of death and can be sold right away without incurring significant capital gains taxes. In practice, if an inheritance goes through the probate process, it may take a few months or more to access.

Some of the best things to do after inheriting stocks or a lump sum include:

- Paying off high-cost debt, like high interest debt such as credit card debt or student loans

- Jump-starting (or catching up on) retirement savings by investing the money in a brokerage account

- Shoring up college funds

- Topping off an emergency fund

- Developing an asset allocation and investment plan that suits you, which may be different than who left you the inheritance. Concentrated holdings with an emotional attachment can derail an investment plan

What isn’t the best thing to do with inherited money? After receiving a sudden windfall, individuals are often tempted to pay off their mortgage. But in comparison with the other ways to invest or utilize the funds, paying off a mortgage usually isn’t the best option. Especially after a prolonged period of ultra-low interest rates, many homeowners already refinanced into low fixed rate mortgages.

What to Do When a Parent Dies and You’re the Executor

Inherited IRA or retirement account

If you inherit a traditional IRA, 401(k), or other types of tax advantaged retirement accounts from a parent who passed away after 2019, you must take the money in 10 years or less. (There are a few exceptions). Depending on the age of the original owner, some beneficiaries also need to take annual withdrawals during the 10-year period starting in 2025. Although options are limited, there are some strategies to maximize the benefits of inheriting a retirement account from a non-spouse.

Options after inheriting a retirement account from a parent

- Run an analysis to optimize distributions for income tax purposes. Consider changes to state residency, income changes, and other factors like college financial aid and Medicare premiums (which use tax returns from two years ago)

- Prolong the benefits of tax-deferred growth in a tax-deferred account as long as possible (all else equal)

- Make a plan to reinvest the money in a brokerage account. Without making a deliberate plan to save the money from your inheritance, it’s easy to spend it

Options after inheriting a retirement from a spouse

Spouses have a lot more flexibility when they’re the sole beneficiary of an inherited IRA or 401(k). While not an exhaustive list of options, for most spouses, these are some of the best things to do with an inherited IRA:

- Spousal rollover

- Inherited IRA

- Elect to be treated as the original account owner (your late spouse). This is a new option starting in 2024

Again, there are other options after inheriting an IRA from your spouse. But typically, the above approaches enable the surviving spouse to have the most flexibility and extend the benefits of tax-deferred growth.

Inheriting the family home

Inheriting a home can be emotional. Assuming you’re not already living in the house or want to move your primary residence, you may have some difficult decisions to make, including understanding the tax implications of keeping or selling the house. Especially for individuals inheriting a family home or vacation house with siblings, everyone may not agree on what to do with the property.

Some of the best things to do after inheriting real estate:

- Be realistic about the effort/cost in maintaining the property, how much you’ll use it, and the overall financial impact of keeping the house

- Consider whether the home is eligible for a step-up in basis and factor any tax savings into the analysis

- Objectively consider whether the decision is emotionally driven vs an investment. Keeping the home purely for sentimental value isn’t always a bad idea, but it depends on carrying costs and financial implications for the rest of your situation

- Formalize any agreements before agreeing to a co-ownership situation with family

Selling an inherited home is typically the cleanest way to go, but it’s not right for everyone. Depending on family dynamics, owning a home with relatives may not work out, and a buyout may not make financial sense. Discuss your situation with your wealth management advisor.

Avoiding common mistakes with inheritance money

Don’t assume it’s yours until it is

One of the most common mistakes people make when it comes to inheritances is assuming that they will receive a certain amount of money or assets. There are many factors that can affect how much you inherit, including the deceased person’s debts, taxes, and other financial obligations.

Unless you’re the executor (and possibly trustee) you may not have visibility on who-gets-what. So even if you’re expecting to receive an inheritance, consider waiting until you actually do before making any personal finance changes.

Make decisions slowly

When you receive an inheritance, take your time and don’t make impulsive decisions, especially to your lifestyle expenses. One of the biggest mistakes people make is spending the money too quickly or making impulsive investments. Seek professional guidance from a financial advisor and create a plan for using the inheritance that aligns with your financial goals and values.

What’s the best thing to do with a large inheritance?

Deciding what to do with an inheritance is a big, often emotional, decision. Unfortunately, there are usually also time constraints to be aware of. Further, any action (or inaction) taken may not be reversible. As tempting as it may be to use a lump sum to buy a home or buy a car, it’s important to consider the alternatives for a sudden, one-time windfall.

Darrow Wealth Management is a fee-only wealth management firm and fiduciary specializing in helping individuals who experience a large windfall from an inheritance. Consulting with a tax and financial planner can provide significant tax advantages, enhancing your overall approach to wealth management.

If you need help managing sudden wealth from an inheritance, please contact us today to schedule a consultation.

Last reviewed December 2024