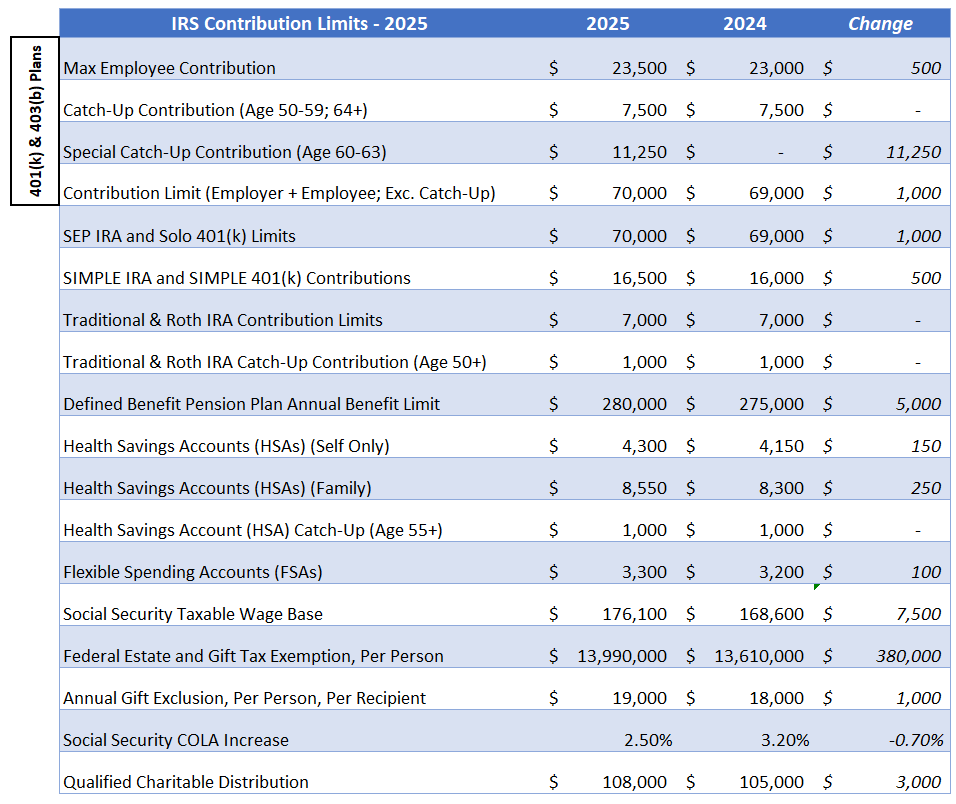

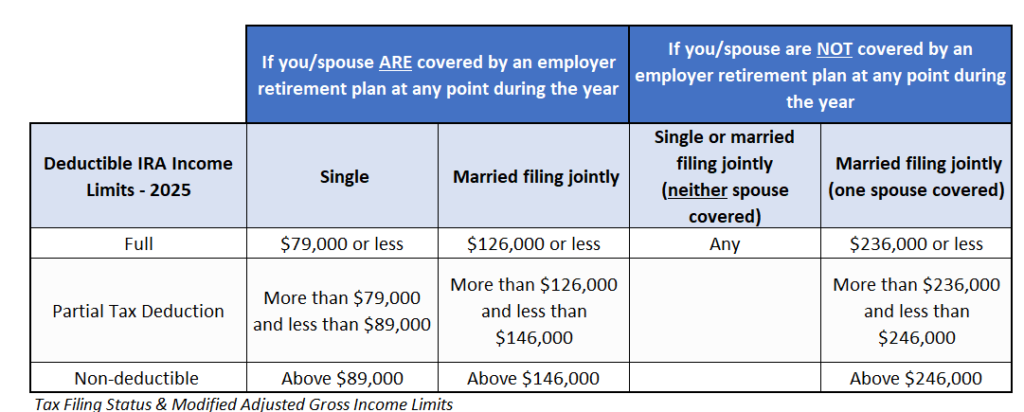

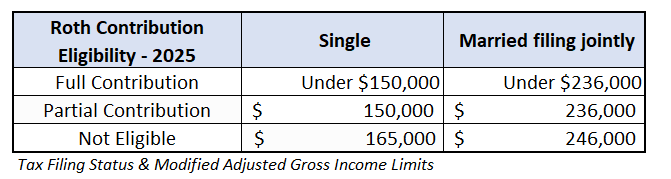

The IRS released the 2025 401(k), 403(b), and SEP IRA contribution limits, including a new special catch-up contribution for workers age 60 to 63. The IRA and Roth IRA contribution limits are unchanged but income eligibility for tax-deductible IRA contributions and Roth IRA contributions have changed.

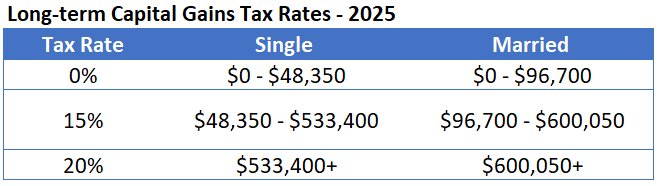

Also updated: health savings accounts, flexible spending accounts, estate and gifting limits, qualified charitable distributions and other cost-of-living adjustments. The 2025 income tax brackets and long-term capital gains tax rates are also updated.

Contribution Limits for 401(k)s, IRAs and More in 2025

Income Limits for Tax-Deductible IRA Contributions

Roth IRA Contribution Eligibility

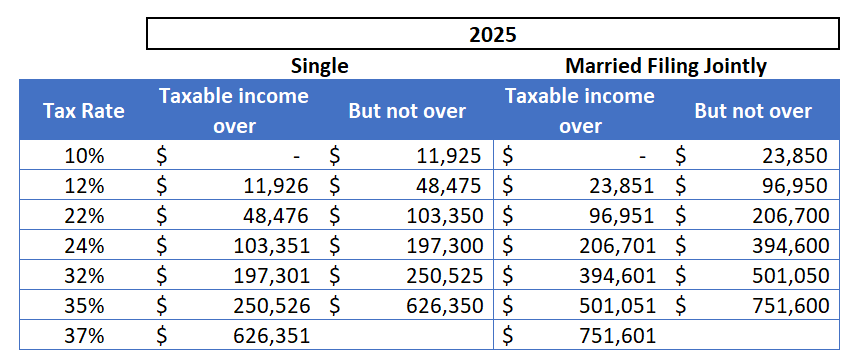

2025 Income Tax Brackets

Long-Term Capital Gains Tax Rates

Standard Exemptions

-

- Married filing jointly: $30,000 ($33,200 if age 65+ or blind)

- Single: $15,000 ($17,000 if age 65+ or blind)

AMT Exemptions

-

- Married filing jointly: $137,000

- Single: $88,100

- Exemption phase out: beginning with alternative minimum taxable income over $1,252,700 (married filing jointly) and $626,350 (single filers)

- AMT tax rates: AMT ordinary income rate increases from 26% to 28% for alternative minimum taxable income over $239,100 (single and married filing jointly)