What the 4% Rule Gets Wrong About Retirement Income

The 4% rule is one of the most well-known rules of thumb in personal finance. The premise is simple: retirees can withdraw 4% of their

The 4% rule is one of the most well-known rules of thumb in personal finance. The premise is simple: retirees can withdraw 4% of their

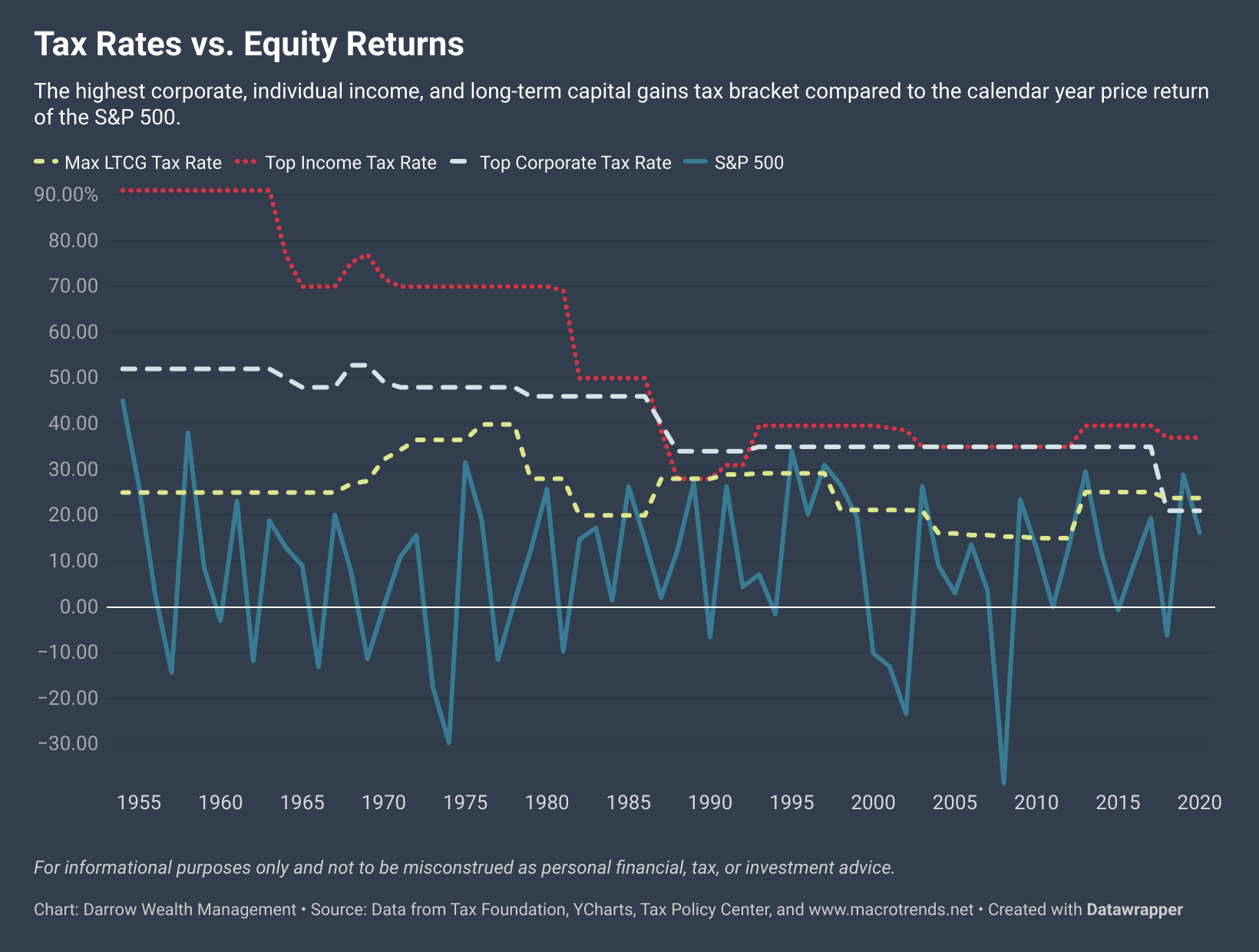

Between the Biden tax plans and other bills already before Congress, it’s likely that some level of tax legislation will make its way into law

Should You Take a Pension or a Lump Sum? Deciding between a lump sum or receiving pension benefits monthly requires careful planning and consideration. Though

Should You Pay Off Your Mortgage Early or Invest Extra Cash? It’s true: the idea of living without a mortgage payment sounds enticing. On the

Setting your asset allocation is like drafting architectural plans when building a home; it provides a map to guide the construction of your investment portfolio.

How should couples file for Social Security benefits if they have unequal incomes? It isn’t always advantageous to wait until age 70 to file for

Is it always a good idea to max out your 401(k)? For wealthier retirees or individuals with a sizeable pension, you might not want to

Moving and wondering whether you should sell or rent your house? It’s common for homeowners to wonder if they should rent or sell their home

Updated for 2021. One of the most common ways Americans save for retirement is through a 401(k) plan offered at work. As 401(k) plan assets