Inheriting a home, such as the family home or a vacation home can be emotional. As you begin to sort through the emotional and practical issues, you may initially be left with more questions than answers. As an added complexity, you may have inherited a house with siblings. Varying wishes for the property can test family relationships and prompt unwise financial decisions. So what happens after inheriting a house?

What should you do after inheriting a home?

After inheriting a house, begin to assemble the objective facts of the inherited property. The executor of the estate should have access to any questions you cannot answer. This checklist will help you organize your thoughts by providing a clear factual basis for you to come back to as needed.

Taxes on the sale of an inherited home

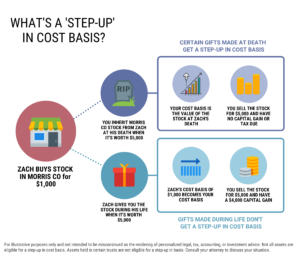

In receiving an inheritance following the passing of a parent or relative, the home or vacation home often receives a “stepped-up” basis for tax purposes. This stepped-up cost basis is usually the market value of the property at the date of death.

In receiving an inheritance following the passing of a parent or relative, the home or vacation home often receives a “stepped-up” basis for tax purposes. This stepped-up cost basis is usually the market value of the property at the date of death.

Stepped up value is always given a long term holding period for capital gains taxes. If you sell the property for more than the cost basis, the gain will be taxed at long term capital gains rates.

If the property is sold for less than your stepped-up basis, it will likely be considered a capital loss. Only $3,000 in capital losses may be deducted against your income each year. However, the balance may be carried forward to future years. These calculations can be complex; consulting a tax professional for specific advice is advisable.

Note: federal and state estate tax implications are different and may still apply, both of which can impact the remaining liquidity and assets available for beneficiaries. This discussion is outside the scope of this article. Discuss your situation with the trust and estate attorney for the estate.

Inheriting a house in a trust

If you inherit a home in a trust, you’ll need to work with the executor of the estate to find out the details. A trust gives people the ability to control their assets after they die, so you might not own the home free-and-clear.

Generally, if the home was in a living trust when the owner passes away, the tax treatment will be the same as explained above. However, if the home was inherited in an irrevocable trust, you probably won’t be eligible for a step-up in basis. Further, the estate may have to pay the tax due at the highest rates.

If you inherit a house in a trust, work with the attorney who is settling the estate and your financial advisor to understand your options.

Selling an inherited house

Each family will have different reasons for deciding to keep or sell inherited property. Many decide to sell the house for the following reasons:

- Financial reasons. Put simply, the sudden ownership of a home (whether a first, second, or even third home) is not financially feasible for most families. Even without a mortgage on the property, insurance, taxes, and maintenance costs can be significant on some homes. If the home does have a mortgage the analysis becomes more complex. Although relatives are allowed to keep the existing mortgage for a time while affairs are being sorted out, the loan will ultimately need to be refinanced and re-qualified with the new owner’s credit, debts, etc.

- Limit taxable gains. Due to the favorable step-up basis for tax purposes, you can limit your tax exposure with a quick sale. Real estate markets can be volatile, so it may make sense to sell after consulting a real estate agent if the market is up.

- Other competing goals. With finite resources, it may not be possible to own an inherited property given your other goals and financial obligations. Selling the home and using the proceeds to develop an investment management strategy to help fund other goals, such as retirement, education, or a bucket list vacation, eliminates the market risk of holding real estate.

- Inheriting a home with siblings. Even plans that begin with the best intentions can end with disastrous outcomes. Different financial situations, lifestyles, and personalities often create conflict. Compromising over use of the home during desired vacation times and deciding who will bear the primary burden of managing the property are also common sources of tension.

What to do with an inherited IRA or 401(k)

Keeping an inherited house, renting it, or moving in

It is often difficult to part with a family home. For those with greater financial means, the good news is that keeping the home may be an option. The following are some common reasons beneficiaries keep an inherited home:

- Financially feasible. First and foremost, you have to be able to afford the home’s upkeep or be willing to make any necessary lifestyle adjustments to do so. Certainly your loved one would not want to put you in a precarious financial situation by leaving you the property, so it is important to keep things in perspective.

- Nostalgic reasons. After the passing of a loved one, it is difficult to deal with the inevitable changes. Whether you decide to keep the property for a trial period at first or move forward with long-term plans is up to you.

- Real estate investment opportunity. The local real estate market will determine the strength of this strategy. Perhaps the property is located in a year-round vacation destination. Alternatively, if there are plans for development, it may increase the value of the home. You will owe capital gains taxes on the gain when you sell, but the stepped-up basis will help to limit the tax liability.

- Legacy. Some homes have been in the family for generations. Continuing the tradition may be an important estate planning goal.

Donating inherited property

A less common option for the inherited property is to donate it to a qualified charity for a tax deduction. Although the specifics of how this strategy may benefit you should be discussed with a tax professional, common reasons for donating the home are:

- Charitably inclined. Whether you have a particular organization in mind or plan to donate in memory of your loved one, the desire to give is often the main objective.

- Tax deduction. Although it depends on the specifics of the property and your situation, you may be able to deduct a portion of the value of the property against your income. The remaining value that cannot be deducted in the current year can be carried over for five years.

After inheriting a home, try not to rush into a decision, particularly if there are other beneficiaries. Your financial advisor can help you with the affordability aspect, but you and your family will need to make sense of the emotional side of the decision, undoubtedly the hardest part.

Last reviewed October 2023