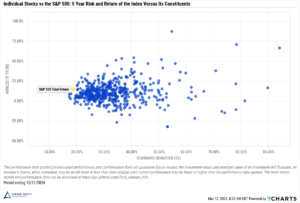

If you’ve ever heard excerpts from the latest Apple earnings report, you may have thought, ‘so what?’ Well, for many investors, Apple’s relative performance could impact your own bottom line. As of December 31st, 2020, the 5 largest publicly traded companies (Apple, Microsoft, Amazon, Facebook, and Google) in the world were all from the US – and they represented roughly 11% of the global stock market.

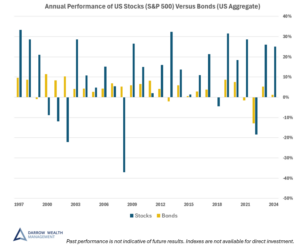

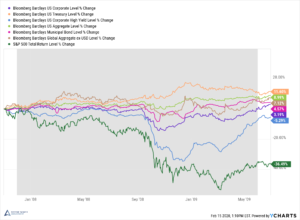

Diversification is the best way to reduce market risk and volatility, but given the size and market share of the largest companies, investors must take deliberate steps to diversify their investments in a meaningful way. Utilizing different asset classes (e.g. small cap, midcap, REITs, and international equity) is a great way to accomplish this. To learn more about investment management at Darrow Wealth Management, please contact us today.

Also read:

What History Can Teach Us About Asset Class Diversification

Taking a Closer Look at the S&P 500