Updated for 2024. There are lots of ways to spend an inheritance. But just because you have options, doesn’t mean they’re all good options. After receiving an inheritance from a loved one, heirs will often wonder: what’s the best thing to do with inherited money? As you consider what approach is right for your situation, consider these options for managing a large inheritance.

What to do with an inheritance

Depending on your financial situation and the type of asset you inherit, your options may differ. But in general, here are some of the best things to do with an inheritance.

Inherited cash, stocks, or a brokerage account

Inheriting money or taxable investment accounts has some big benefits. Assuming you inherit the funds outright (versus in a trust fund), you have total flexibility on when and how to use it. Further, many beneficiaries are eligible for a step-up in basis on eligible assets. This is a major advantage as assets can be sold/diversified right away without tax implications.

Some of the best things to do with this type of inheritance include:

Some of the best things to do with this type of inheritance include:

- Paying off high-cost debt, like credit card debt or student loans

- Jump-starting (or catching up on) retirement savings by investing the money in a brokerage account

- Shoring up college funds

- Topping off an emergency fund

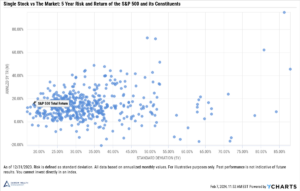

- Developing an asset allocation and investment plan that suits you, which may be different than who left you the inheritance. Concentrated holdings with an emotional attachment (often blue-chip stocks) can derail an investment plan

What not to do? After receiving a sudden windfall, individuals are often tempted to pay off their mortgage. But in comparison with the other ways to invest or utilize the funds, it usually isn’t the best option. Especially coming off of a prolonged period of ultra-low interest rates, many homeowners already refinanced into low fixed rate mortgages.

What to Do When a Parent Dies and You’re the Executor

Inherited IRA or retirement account

If you inherit an IRA, 401(k), or other type of retirement account from a parent who passed away after 2019, you must take the inheritance in 10 years. (There are a few exceptions). The IRS is also proposing changes that would require beneficiaries to take annual withdrawals during the 10-year window though if enacted, changes wouldn’t apply until 2025. Although options are limited, there are some strategies to maximize the benefits of inheriting a retirement account from a non-spouse.

Options after inheriting a retirement account from a parent

- Monitor changes in tax law in case annual required minimum distributions become law

- Consider doing an analysis to see if there’s a best year to accelerate distributions. Consider changes to state residency, scheduled tax rate increases in 2026, income changes, and other factors like college financial aid and Medicare premiums which use tax returns from two years ago.

- Prolong the benefits of tax-deferred growth as long as possible (all else equal)

- Make a plan to reinvest the money in a brokerage account. Without making a deliberate plan to save the money from your inheritance, it’ll easily get spent on lifestyle expenses

Options after inheriting a retirement from a spouse

Spouses have a lot more flexibility when they’re the sole beneficiary. While not an exhaustive list of options, for most spouses, these are some of the best things to do with an inherited IRA:

- Spousal rollover

- Inherited IRA

- Elect to be treated as the original account owner (your late spouse). This is a new option in 2024.

Again, there are other options after inheriting an IRA from your spouse. But typically, the above approaches enable the surviving spouse to have the most flexibility and extend the benefits of tax-deferred growth.

Inheriting a home

Inheriting a home can be emotional. Assuming you’re not already living in the house or want to move your primary residence, you may have some difficult decisions to make. Especially for individuals inheriting a family home or vacation house with siblings, everyone may not agree on what to do with the property.

Some of the best things to do after inheriting a home:

- Be realistic about the effort/cost in maintaining the property, how much you’ll use it, and the overall financial impact of keeping the house

- Consider whether the home is eligible for a step-up in basis and factor any tax savings into the analysis

- Objectively consider whether the decision is emotionally driven vs an investment. Keeping the home purely for sentimental value isn’t always a bad idea, but it depends on carrying costs and financial implications for the rest of your situation

- Formalize any agreements before agreeing to a co-ownership situation with family

Selling an inherited home is typically the cleanest way to go, but it’s not right for everyone. Depending on family dynamics, owning a home with relatives may not work out, and a buyout may not make financial sense. Discuss your situation with your financial advisor.

What’s the best thing to do with inherited money?

Deciding what to do with an inheritance is a big, often emotional, decision. Unfortunately, there are usually also time constraints to be aware of. Further, any action (or inaction) taken may not be reversible. As tempting as it may be to use an inheritance to buy a home or buy a car, it’s important to consider the alternatives for a sudden, one-time windfall.

Darrow Wealth Management is a fee-only wealth management firm and fiduciary specializing in helping individuals who experience a large windfall from an inheritance.

If you need help managing sudden wealth from an inheritance, please contact us today to schedule a consultation.

Last reviewed May 2024