Losing a parent is emotional. It can also be overwhelming for adult children when they’re the executor of the estate. Settling an estate is a process that takes time — months not days. When a parent dies and you’re the executor, make sure you understand your duties. Here’s a checklist to help you manage the process as executor of your parents estate.

What to do when a parent dies and you’re the executor

The executor (also called personal representative) is responsible for settling the estate. If your parent had a trust, the individual(s) named in the trust documents as successor trustee will control the distribution of the trust assets. You might also be the successor trustee or co-trustee.

Checklist for executors of their parent’s estate

Get organized

- Where are the original estate planning documents located? Typically, the attorney who drafted the documents will keep originals in a vault. But your parents may have kept them at home or in a bank security deposit box.

- Who is the attorney who drafted the estate plan? Inform them of your parents passing and discuss options for support in settling the estate.

- Get death certificates. Some institutions will require originals, consider getting 10 copies.

- Have mail forwarded to you.

If your parent or parents’ are still living and you’re trying to learn more about the role of an executor, take this opportunity to discuss the key elements of their estate plan and wishes.

Create a financial inventory

After the death of a parent, you’ll need to gather a lot of financial documents and statements, including:

- Bank statements

- Investment account statements (brokerage and/or trust accounts)

- Retirement account statements and beneficiary designations

- Life insurance policies and beneficiaries

- Pension details

- Estate planning documents

- Tangible assets and personal property

- Outstanding debts or liabilities, including any mortgage or loan balances, credit card balances, and unpaid bills

- Check for abandoned property in the state your parent was located

Also determine how the bills are being paid. For help finding all the accounts, ask the credit bureaus for a report and notify them of your parent’s passing. The funeral home typically notifies the Social Security Administration. Later in the process you’ll work with the attorney to discuss what assets may potentially need a valuation. If your parent had a financial advisor, ask them to share relevant documents with you to help you get up to speed.

Find out if the estate will go through probate

The estate planning attorney is going to be critical here. Hopefully, your parent did some advance planning. Assets owned by your parent individually, that don’t pass through a beneficiary designation like on a retirement account or life insurance policy, or through a transfer-on-death or payable-on-death arrangement, will likely go through probate. It may be helpful to familiarize yourself with concepts like how a trust differs from a will.

A copy of the will may still need to go on file with the probate court. If your parent had a vacation home or assets in another state, you could have multiple probate estates. Consult your attorney to find out.

As the executor, you’ll need to open an estate account

An estate account is a bank account that’s set up to pay expenses and receive income owed to your deceased parent while the estate is settled. The estate account will need to get a separate Employer Identification Number (EIN). The attorney typically does this.

If your parent hasn’t yet taken their required minimum distribution (RMD) from retirement accounts for the year, it can go into the estate account. Make sure to do that before the end of the year.

Make notifications and keep up with bills and expenses

When your parent passes away, you’ll need to ensure their bills will be paid until it’s time to close everything out. After someone dies, their individual bank account shouldn’t be used. Transition payments to the estate account and make notifications. Consult the attorney for guidance as needed. It’s important that things like mortgage and insurance payments are kept current.

Deciding What to Do When You Inherit A House Published in Forbes by Kristin McKenna, CFP®

Real estate considerations

If your parent was still in their home and living alone, notify the insurance company. Insurers need to know if the property is vacant or they might not cover losses. If you plan to sell the home, discuss nuances in the process with a real estate attorney. A real estate tax lien can delay closing. Discuss eligibility for a federal capital gain exclusion on the sale of the home with your CPA.

File and pay taxes

You may need to file an individual tax return for your parent which follows regular deadlines. Depending on the income earned by the estate, it may need to file state and/or federal returns as well. Depending on your state, there may be state estate and/or inheritance tax due. If a federal estate tax return is necessary, it’s due nine months from the date of death. Gather tax documents and consult a CPA for help. The attorney might complete the estate tax return.

If your parent had property or assets in other states, you’ll want to consult an attorney to understand the laws in that state.

Get help with valuation and stepped-up basis

An estate’s value is determined as of a point in time, typically the date of death. If the estate is federally taxable, the executor can choose an alternate valuation date which is six months from the date of death. There are rules for this and it can only be done if the alternate valuation date reduces the federal estate tax liability.

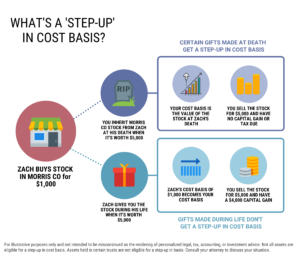

Certain non-retirement assets owned by your parent or money in a revocable trust can be eligible for a step-up in basis to the fair market value at the date of death (or alternate valuation date, if applicable). In most states, the step-up portion will be 100% of eligible individual assets including revocable trusts.

This isn’t done automatically, but doing so can drastically reduce tax for the beneficiary. A financial advisor can help with brokerage and trust accounts, but also consider other property. If you don’t plan to sell an inherited home right away, you’ll want to get a valuation done.

Notify beneficiaries and distribute assets

The distribution of assets is the last step in settling an estate. Sometimes the executor may decide to do a partial distribution earlier, but there’s a risk when still subject to creditor’s claims. Once the estate’s assets have been valued and/or sold and all expenses and taxes paid, the remaining estate is distributed.

Retirement accounts

Retirement accounts typically pass directly to heirs via beneficiary designation. Your distribution requirements will depend on the age of your parent, type of retirement account, and other factors. Most beneficiaries will need to empty an inherited retirement account within 10 years and annual RMDs may be required. Beneficiaries will need to set up their own inherited IRA accounts.

Trusts

Trusts can be distributed in many ways. Assets might go to heirs outright once the estate is settled but funds can also be held in trust. Beneficiaries of a trust have the right to ask for certain information from the trustee.

Depending on how the estate is set up, assets in retirement accounts may go into a trust if it’s the beneficiary. Similarly, real property such as a home, could also be in the trust. And a pour-over will is common, where other assets not held in trust during life are to go into trust at death. As the executor of your parent’s estate, you may also be the successor trustee. But if you’re not, that person will be responsible for overseeing trust assets.

Specific distributions

The estate plan may include specific distributions of tangible property or cash to relatives or charity.

Figuring out what it means for you after the dust settles

When the estate is nearing completion, you’ll be able to focus on what an inheritance means for you financially. Depending on how complex the estate is and level of pre-death planning/communication/organization, you might not be able to consider your own finances until the end. Don’t rush into important financial decisions and consult with financial and legal professionals who can help you make informed decisions.

Darrow Wealth Management specializes in helping individuals manage sudden wealth from an inheritance. To discuss your situation and how we may be able to help, please schedule a consultation.

Last reviewed May 2024