Should You Pay Off Your Mortgage Early or Invest Extra Cash?

It’s true: the idea of living without a mortgage payment sounds enticing. On the surface, it may also seem like a no-brainer financially…paying off debts is typically considered a positive thing. Unfortunately, many homeowners get so wrapped up in the debt-free dream, they never run the numbers. Or worse, admit paying off a mortgage is a poor use of cash, but still give into desires to live mortgage-free and do it anyways. Here’s why prepaying your mortgage is a mistake.

As with nearly everything in life, there’s an opportunity cost that comes with each decision we make. Whether you share the urge to live without a mortgage or simply aren’t sure where else to put extra cash, realize prepaying your mortgage isn’t always a good idea.

With ultra-low rates, prepaying your mortgage is probably a mistake

Using extra cash to pay off your mortgage early is probably a mistake, especially with rates so low. There is no one factor that will definitively indicate whether a homeowner should prepay their mortgage. The decision must be considered in the context of one’s entire financial and personal situation, including mortgage interest rates, free cash flow, other goals, length of time in the home, taxes, and risk tolerance. Even when it is advantageous to prepay a mortgage, the savings may be marginal for some homeowners.

Using leverage to build your wealth

Using leverage to build your wealth

If an investor’s cost of borrowing is less than their expected rate of return, that’s an opportunity for leverage. For example: a homebuyer gets a mortgage for 3% and assumes they’ll earn 6% in the market over the long-term. They’re using leverage to achieve a better financial outcome.

Here’s a simple example of leverage:

Assume you buy a house for $1M and put 20% down, $200,000.

Your mortgage is $800,000.

The market value of the home increases 20%, so you sell the house for $1.2M.

The return on your initial cash investment – the down payment – is 100%. (Sale price $1.2M – mortgage $800,000 = $400,000 profit.)

This simplistic example excludes taxes, selling costs, mortgage interest expense, opportunity cost for other investments. There’s always a risk that the value of the house declines, too.

Interest rates are central to mortgage decisions

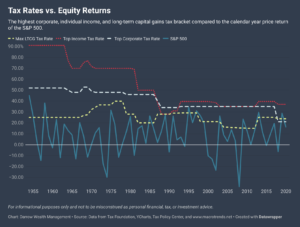

Rates are historically low right now, which boosts the case to invest instead of prepaying your loan.

As interest rates rise, it may be more difficult for buyers to take advantage of the leverage spread. The opposite is also true: the lower the interest rate on the loan, the more advantageous it can be to get a mortgage and invest cash in the market.

The analysis gets more complex with balloon payments, interest only loans, home equity lines, or adjustable rate mortgages, as both the potential investment returns and the future interest rates are mostly unknown. It’s always important to consider your whole financial picture before making changes to your mortgage payment plan.

For example, assume you have a home equity line of credit (HELOC) with 2 years left on the interest only period and a high variable rate. It may be worthwhile to start principal payments early if you’re confident you’ll stay in the home for a while. But if you plan to move before the principal payments start, why prepay?

Is It Worth It To Refinance? Here’s How Much You Can Save By Refinancing Your Mortgage

5 considerations when deciding if you should pay off your mortgage early or invest extra money

- Will you stay in the house long enough to live mortgage-free?

- Would you rather have the flexibility of keeping the cash in a liquid investment in case you need it?

- What’s the goal? If you’re thinking about putting a lump sum towards paying down – but not paying off – your mortgage, it won’t change your monthly payment.

- Will you still be able to itemize tax deductions if you don’t have a mortgage?

- What’s your interest rate? Can you refinance? Can you earn more by interest savings or investment growth in the stock market?

We’ll discuss these considerations in detail below.

Will you really live in your home long enough to pay off your mortgage?

Whether or not prepaying a mortgage is a good idea also depends on how long you own the home. Homebuyers typically feel each home is a forever home, but circumstances often change after a few years. According to a 2017 study by the National Association of Realtors, the average seller lives in their home for 10 years before moving on. That’s 20 years shy of the term of a conventional 30-year mortgage! The longer homeowners remain in their home the greater the benefits of paying off a mortgage early.

As an example:

Assume Brian has a $400,000 30-year fixed mortgage at 4.5%. He lives in the home for 10 years. Brian expects his long-term rate of return is 6% for his investment accounts. Excluding potential tax benefits, if Brian prepays his mortgage by $500/month, he’ll save $7,368 over 10 years, or $737 per year, compared to if Brian had not prepaid his mortgage and instead invested $6,000 annually (the amount he prepaid).

If Brian’s interest rate was 3% instead of 4.5%, he would have been better off making regular payments, excluding taxes. Or, if Brian decided to move out after 5 years, the benefits of prepaying would drop to $1,294…only $258 per year.

As discussed below, it’s important to note that because Brian prepaid his mortgage, the extra cash isn’t readily available to help him transition to the next property or for other goals. As you consider the best approach for your situation, weigh whether the anticipated annual savings are enough to offset the reduced financial flexibility.

Related: Is it Better to Buy a Home with Cash or a Mortgage?

Liquidity is flexibility, and flexibility pays

The decision to pay down a mortgage early cannot be made in a vacuum. Depending on your entire financial situation, including other debts, income, and extra savings, prepaying your mortgage could be a bad idea financially. Real estate is a very illiquid asset, and this is particularly true when it’s your primary residence.

Cash used to accelerate mortgage repayments cannot be reclaimed if you need it later on for another goal (such as college or a down payment on a new house) or in the event of an emergency.

While it is possible for some homeowners with a lot of equity in their house to pull cash out through a refinance or a home equity line of credit (HELOC), the costs of doing so would likely fully negate the benefits of prepaying the mortgage in the first place.

Particularly for homeowners during certain periods of their life, such as first time buyers, new parents, empty-nesters, or couples nearing retirement, lifestyle preferences and needs can change quickly.

Prepaying your mortgage doesn’t change your monthly payment

Homeowners with conventional fixed mortgages sometimes think pre-paying their mortgage will change their monthly payment. This is not the case, even if your extra payment is tens of thousands of dollars. Paying down a mortgage early will reduce the life of the loan, which will save you money on interest expenses. However, it won’t change your monthly mortgage payment.

To change a monthly payment, you must ask your lender to recast your mortgage to change the amortization schedule on your loan using the new principal balance and the remaining terms of the original mortgage. Recasting a mortgage isn’t in the lender’s best interest, so they may not agree to it.

A mortgage can provide big tax benefits

Interest on mortgages may be tax deductible for taxpayers who can itemize their deductions. The 2017 tax law changed to the tax code which impacts many homeowners. State and local tax deductions (including property tax) are capped at $10,000. Interest paid on home equity loans may still be tax deductible, if proceeds are used to “buy, build or substantially improve the taxpayer’s home that secures the loan.” Further, starting in 2018, mortgage interest and qualified home equity debt interest may only be tax deductible on new home loans up to $750,000. Before 2018, the limit was $1,000,000.

The new tax code also nearly doubled the standard deduction, making it harder for homeowners to benefit from itemizing. In 2021, the standard deduction is $12,550 for single filers, double if married filing jointly. However, for homeowners who can still itemize, prepaying your mortgage could jeopardize that in the future. Especially for high-income households in a high tax bracket, consider working with your CPA to discuss the impact on your tax situation ahead of time.

Investing extra cash instead of prepaying a mortgage

Instead of plowing extra savings into a home or bank account and assuming you’ve already maxed out your 401(k), consider opening a brokerage account. Unlike retirement accounts which offer tax benefits in exchange for restrictions and possible penalties, a brokerage account has no funding limits or regulations governing when you can tap the account or for what purpose. This infographic has more ways to use extra cash. Having surplus cash flow each month is a great problem to have, but you’ll want to fully consider your options and personal circumstances before putting your savings to work.

Established in 1987, Darrow Wealth Management has been serving a diverse client base of individuals and families for over 30 years. To learn more about our Private Wealth Management Program or to discuss the benefits of working with an independent, fee-only financial advisor, please contact us today.

Using leverage to build your wealth

Using leverage to build your wealth